- RealEcon

- Israel-Hamas

-

Topics

FeaturedIntroduction Over the last several decades, governments have collectively pledged to slow global warming. But despite intensified diplomacy, the world is already facing the consequences of climate…

-

Regions

FeaturedIntroduction Throughout its decades of independence, Myanmar has struggled with military rule, civil war, poor governance, and widespread poverty. A military coup in February 2021 dashed hopes for…

Backgrounder by Lindsay Maizland January 31, 2022

-

Explainers

FeaturedDuring the 2020 presidential campaign, Joe Biden promised that his administration would make a “historic effort” to reduce long-running racial inequities in health. Tobacco use—the leading cause of p…

Interactive by Olivia Angelino, Thomas J. Bollyky, Elle Ruggiero and Isabella Turilli February 1, 2023 Global Health Program

-

Research & Analysis

FeaturedFollowing a long series of catastrophic misadventures in the Middle East over the last two decades, the American foreign policy community has tried to understand what went wrong. After weighing the e…

Book by Steven A. Cook June 3, 2024

-

Communities

Featured

Webinar with Carolyn Kissane and Irina A. Faskianos April 12, 2023

-

Events

FeaturedJohn Kerry discusses his work as U.S. special presidential envoy for climate, the challenges the United States faces, and the Biden administration’s priorities as it continues to address climate chan…

Virtual Event with John F. Kerry and Michael Froman March 1, 2024

- Related Sites

- More

July 18, 2016

RussiaSteven A. Tananbaum Senior Fellow for International Economics Robert Kahn argues that summer has seemingly brought a new optimism about the Russian economy. Russia’s economic downturn is coming to an end, and markets have outperformed amidst global turbulence. But the coming recovery is likely to be tepid, constrained by deficits and poor structural policies, and sanctions will continue to bite. Brexit-related concerns are also likely to weigh on oil prices and demand. All this suggests that Russia’s economy will have a limited capacity to respond to future shocks.

May 2, 2012

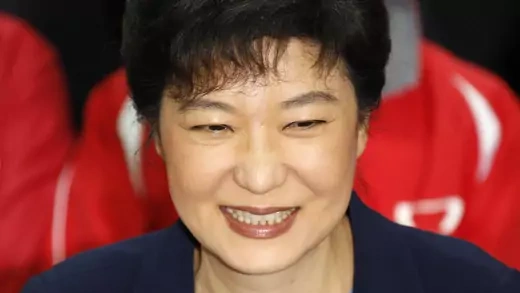

South KoreaThe ruling Saenuri Party won a surprise majority in South Korea's National Assembly elections last month. This victory went against all expectations. Prior to the election, experts unanimously predic…

December 1, 1999

Emerging MarketsOverview The export-led growth model for emerging economies is driven by their need to service external debt and build foreign exchange reserves. It has foundered in the aftermath of financial cri…

September 1, 2000

Budget, Debt, and DeficitsOverview Though threats to American security have changed dramatically in the last decade, U.S. defense policy and military forces look a lot like they did during the closing days of the Cold War…

March 15, 2017

GreeceSteven A. Tananbaum Senior Fellow for International Economics Robert Kahn writes that Greece and its creditors are again locked in a showdown over reforms, cash, and debt relief. Another cliff-hanger ahead of heavy July debt payments looks likely. Extend-and-pretend is a dead end for Greece and an increasingly populist Europe, and a more ambitious agreement seems ruled out by bailout fatigue in creditor countries. Markets are once again underestimating the risks of “Grexit.”

Online Store

Online Store