Washington Raises Stakes in War on Chinese Technology

New U.S. sanctions are in some ways more restrictive than Cold-War era controls.

Originally published at Foreign Policy

The United States is not looking for a new Cold War with China, U.S. Secretary of State Antony Blinken said in a major speech on foreign policy in May. “We don’t seek to block China from its role as a major power, nor to stop China—or any country—from growing their economy or advancing the interests of their people.”

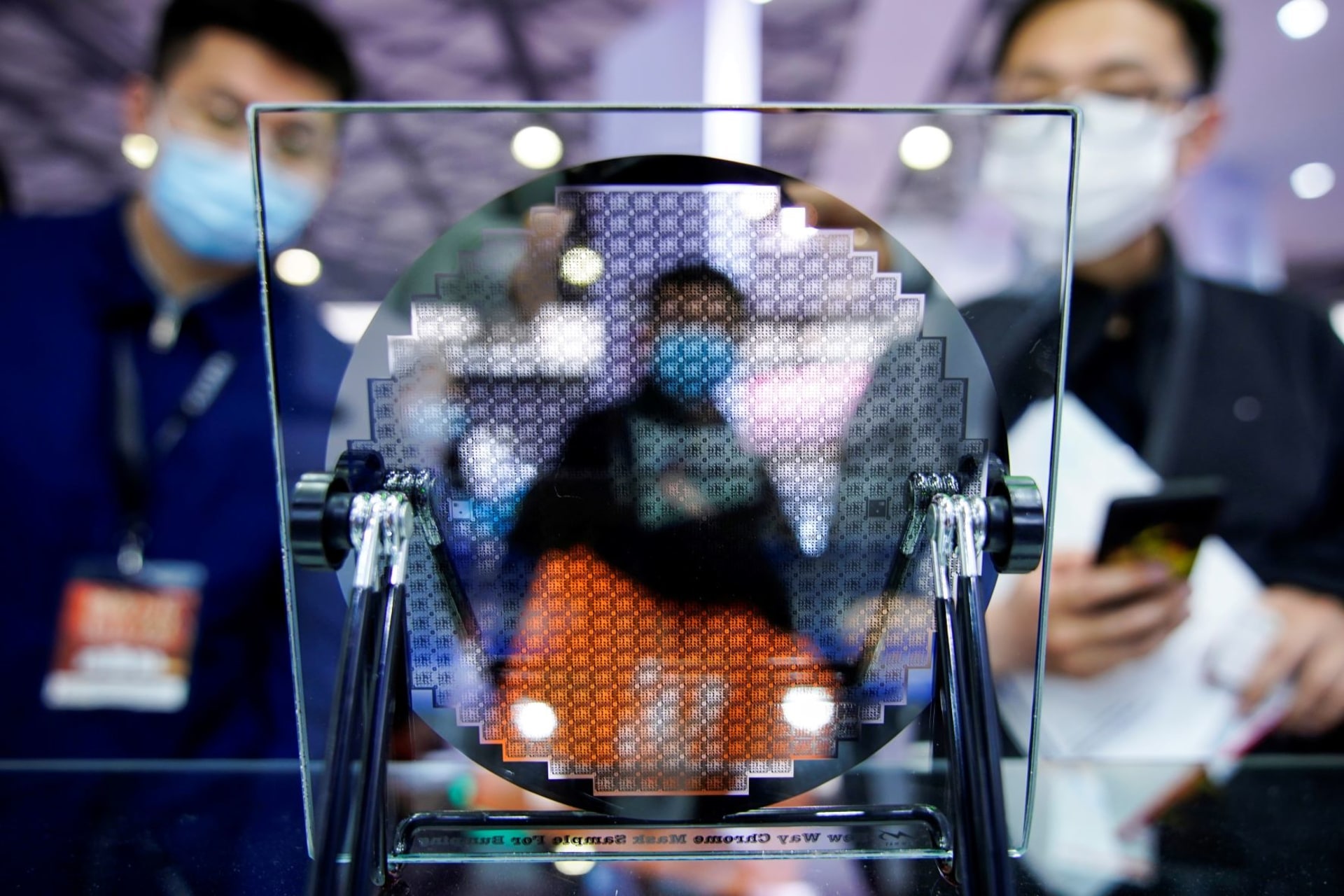

That was then. With last week’s announcement of sweeping new controls on sales of semiconductors to China, the Biden administration’s approach to Beijing now looks increasingly drawn from the Cold War playbook. The U.S. Commerce Department said it will vastly expand its campaign to deny advanced semiconductors and other critical technologies to China. The new restrictions, which will be fully implemented as soon as Oct. 21, go well beyond any previous measures by seeking to freeze China at a backward state of semiconductor development and cut Chinese companies off from U.S. industry expertise. “To put it mildly, [Chinese companies] are basically going back to the Stone Age,” Szeho Ng, managing director at China Renaissance, told the Financial Times.

The new measures will block sales of semiconductors vital for the development of artificial intelligence, supercomputers, and other critical technologies as well as expand prohibitions on the sale to China of equipment needed for making its own advanced chips. Such chips not only are vital to the latest weaponry but also have broad commercial applications, from health care to autonomous vehicles. And in a novel move, the actions also forbid U.S. companies and citizens from working with Chinese entities on advanced semiconductor design, research, or fabrication. “That is a bigger bombshell than stopping us from buying equipment,” said one official at a Chinese state-owned company, noting that Americans—mostly Chinese or Taiwanese dual citizens—work “in some of the most important positions.”

With China so integral to the global electronics supply chain—and to the profits of Western technology companies—Washington has been trying to find a balance between treating Beijing as an economic partner and a geopolitical rival. But a choice has now been made: For the first time in a generation, weakening China is now more important to the United States than working with China.

Today, the Cold War is remembered primarily for its specter of nuclear annihilation, which perhaps looms again in the current conflict between Russia and the West over Ukraine. But at its heart, the Cold War was an economic struggle. The United States and its allies developed a comprehensive—though far from airtight—export control system aimed at restricting the sale of advanced technologies—such as computers, telecommunications gear, and machine tools—to the Soviet Union and its allies. In particular, machine tools—used for making everything from simple automotive parts to advanced aerospace components—were as central to the 20th-century industrial economy as semiconductor fabrication equipment is to today’s: the building blocks of the most sophisticated technologies. The stated Cold War goal was to restrict Soviet access to dual-use technologies with both commercial and military applications, but in practice, export controls were a broader form of economic warfare. Their purpose was not just to keep the Soviet Union from developing its military capacity but to slow its growth as an advanced industrial economy.

Blinken’s claims notwithstanding, a growing raft of U.S. measures now aim at slowing China’s development as a high-technology economy. On top of a series of restrictions imposed over the last several years, including U.S. efforts to deny the latest generation of chips to Chinese telecommunications giant Huawei and its affiliates, the United States is adopting the sort of sweeping technology exports that were a central feature of the Cold War. (Russia currently faces even broader restrictions since its invasion of Ukraine.) “The stunning thing about this move is that they have assembled a whole array of tools,” an unnamed U.S. chip industry executive told the Financial Times. “They are not just targeting military applications. They are trying to block the development of China’s technology power by any means.”

The administration has been explicit about its concerns. Although the United States and its allies in Europe and East Asia maintain a significant edge in the most sophisticated computing-related technologies, running faster is no longer enough to stay ahead. In a speech last month, U.S. National Security Advisor Jake Sullivan said the United States must “revisit the long-standing premise of maintaining ‘relative’ advantages over competitors in certain key technologies.” He called that approach a “sliding scale,” in which the United States had tried to ensure that it stayed a couple of generations ahead of its rivals. “That is not the strategic environment we are in today,” he added. “Given the foundational nature of certain technologies, such as advanced logic and memory chips, we must maintain as large of a lead as possible.” That aim has led to a two-pronged strategy of ramping up U.S. investments in scientific research and the production of critical goods—the goal of the recently passed CHIPS and Science Act—while denying China the Western technologies it currently needs for its own technological advancement.

There are some ways in which the evolving export control regime toward China is even more expansive than what the West devised during the Cold War. The old Cold War’s controls were aimed solely at slowing Soviet and Chinese military capabilities, but the new actions have broader goals. A senior U.S. Commerce Department official cited concerns not just over China’s military modernization but also that China “is using these capabilities to monitor, track, and surveil their own citizens.” The new restrictions, the official said, “will protect U.S. national security and foreign-policy interests while also sending a clear message that U.S. technological leadership is about values as well as innovation.”

So far, the Biden administration—like the Trump administration before it—has seen only modest pushback from U.S. high-technology firms. But the more the control regime expands, the more acute the conflict will become between the administration and U.S. companies. Shares in U.S. chipmakers plunged following the announcement; the stocks of the most affected companies, such as Nvidia and Advanced Micro Devices, are down almost 60 percent this year. China is the most important global market for semiconductor exports, and the commercial success of U.S. chip companies depends in no small part on access to China’s market. In 2021, despite restrictions on Huawei and other companies, U.S. chip sales to China surged as demand for Chinese-made laptop computers, video games, and other home technology soared with consumers staying at home during the COVID-19 pandemic. Chinese firms also stocked up on chips in anticipation of future U.S. export restrictions. But in 2022, U.S. sales have been plummeting, likely from a combination of expanded controls and a weakening Chinese economy; chip sales to China are down 25 percent so far this year, and semiconductor equipment sales have fallen 15 percent. Boston Consulting Group has estimated that a complete ban on U.S. chip sales to China would cost U.S. semiconductor firms 18 percent of their global market share and 37 percent of their revenues.

The Biden administration is well aware of these dilemmas, but the new measures are a significant ratcheting up, nonetheless. The goal appears to be to freeze China’s ability to make or acquire logic chips below the 14-nanometer node, well above the current leading-edge capabilities of 5 nanometers or less. (The smaller the node, the more advanced the chip.) U.S. companies like Nvidia and Advanced Micro Devices that produce the higher capability chips and other companies that make the equipment for fabricating such chips were notified in advance of the coming restrictions.

A big question remains on how effective even expanded controls will be in slowing China’s efforts to develop its own advanced chip-making capabilities, where it has made surprising domestic progress. The Semiconductor Manufacturing International Corporation (SMIC), China’s largest chipmaker, announced in August that it had started shipping 7-nanometer semiconductors, just one generation behind the most advanced chips fabricated in Taiwan and South Korea. But it has done so using production techniques that are significantly less efficient than the current standard, since U.S. controls have blocked the SMIC from acquiring the most advanced lithography equipment. And the latest controls will make further progress far more challenging.

The Cold War experience showed that export controls are far from perfect, and they may do less than their advocates hope to slow China’s technological development. Such restrictions are inherently leaky, and countries can often find a way around them through smuggling, espionage, or by routing deliveries through third countries. The Soviet Union still developed advanced nuclear and other weaponry despite all the technology restrictions. But in another sense, Western export controls probably succeeded: The Soviet Union, right up to its demise, lagged behind the United States and its allies in technological innovation, opening up an ever large gap in both economic and military capabilities with its Western rivals.

With the more integrated supply chains of the 21st century, the United States has more capacity to harm Chinese efforts at the highest ends of technology development, which will weaken both its commercial competitiveness and its military capabilities. Blinken’s diplomatic niceties about not wanting a Cold War with China aside, U.S. actions now seem very much intended to block China’s rise as a major power.