How COVID-19 Is Harming State and City Budgets

- State and local governments are responsible for the bulk of U.S. education and infrastructure spending.

- Many are facing severe budget shortfalls as a result of the coronavirus pandemic.

- Subnational governments have few options for dealing with budget crises, and the federal government has stepped in to provide aid.

Many U.S. state and local governments, on the front lines of the response to the coronavirus pandemic, are facing severe budget shortfalls. A distressing combination of dwindling tax revenues, record unemployment, and rising health costs have pushed them to cut back on spending for infrastructure and education—of which states and cities are by far the primary funders. Some still bear the scars of the 2008 financial crisis, which forced painful spending cuts to public services.

Even before the pandemic, subnational governments were grappling with ballooning costs, including health care and pensions for public employees. Some had already sought bankruptcy protection.

More on:

In response to COVID-19, states and municipalities have made cuts, frozen spending and hiring, laid off workers, and drawn down rainy day funds. Some states have seen revenues rise due to the uneven nature of this recession, but by and large the pandemic has drained state and local coffers. The federal government has stepped in to provide substantial aid.

How do state and local governments budget?

Most state and local governments keep two budgets. The operating budget, often simply referred to as “the budget,” funds ongoing outlays such as employee salaries, payments for services, and interest on long-term debt. The capital budget—which is used to fund major infrastructure projects such as bridges, roads, or waterworks—issues long-term debt, such as bonds.

Unlike the federal government, states cannot run operating budget deficits. Every state in the union, with the exception of Vermont, has some type of balanced budget requirement—though many states have in the past used gimmicks, such as selling assets and then leasing them back, to circumvent the law. Under state laws, most municipalities must also keep balanced books. The cost of borrowing is also greater for subnational governments, as their bonds typically carry higher interest rates than U.S. Treasuries.

Some federal lawmakers have expressed concerns about mounting municipal debt, but aggregate levels as a percentage of gross domestic product (GDP) have remained within historical parameters. According to the U.S. Census Bureau, state and local governments had a little more than $3 trillion in total outstanding debt in 2017, of which nearly 99 percent was long term. Interest payments on this debt were roughly 3.3 percent of total expenditures—no more than in the 1970s. In contrast, the U.S. national debt has risen dramatically over the same time period, and is projected to soon exceed GDP.

Why are state and local budgets relevant?

The U.S. national economy is composed of a vast collection of local and regional economies, where state and local policies play a significant role. Collectively, state and local governments outspend Washington on direct goods and services, employ more workers than the domestic manufacturing sector, and are responsible for about 15 percent of national GDP.

More on:

States and cities supply nearly 80 percent of the $441 billion spent nationally on transportation and water infrastructure, according to the Congressional Budget Office’s most recent data. These investments help fuel the economy directly by creating jobs in sectors such as construction, experts say, and are also essential for improving long-term economic efficiency and international competitiveness. (For example, less congestion lowers business costs.) The 2019 Global Competitiveness Report from the World Economic Forum (WEF) ranked the United States second overall in economic competitiveness, but thirteenth in quality of infrastructure. The American Society of Civil Engineers gave the United States a D+ in its 2017 Infrastructure Report Card—the same grade it gave in 2013.

State and local governments contribute more than 90 percent of the money spent nationally on K–12 education, as well as provide substantial financing for the public university system, which graduates the majority of U.S. college students. While education has typically been the largest budget category of total state spending, Medicaid’s share has been growing over the past decade.

At a more basic level, states and cities are where life is lived and economic decisions are made. While budget austerity at the federal level can seem removed to many families and businesses, the effects of cutbacks in their home states and localities are tangible. Cuts to police and fire departments, for instance, mean some neighborhoods are less safe. Fewer teachers and more students per classroom erode the quality of education, making U.S. workers less competitive in the long run. Crumbling roads and bridges discourage businesses from investing.

What are the policy options for dealing with budget crises?

On their own, state and local governments have few options for dealing with budget shortfalls of great magnitude. Some states’ laws prohibit borrowing to fund day-to-day operations, while others’ require voter approval, which is generally difficult to obtain quickly. Most states have to pay back any debt within the fiscal year. States can, however, borrow from the federal government to pay out unemployment benefits.

That effectively leaves two options: raise revenue or cut spending. States have historically chosen the latter during recessions. Education and Medicaid, the two biggest budget items, cannot usually escape cuts; nor can state payrolls, another big expense. Mental health services, courts, law enforcement, and other public services can also face trims.

How did the Great Recession affect state and local budgets?

The deep economic recession of December 2007 to June 2009 and slow recovery put many subnational budgets in unusually dire straits. Depressed tax revenues, elevated spending on social welfare programs such as unemployment insurance and Medicaid, and, in many cases, rising personnel costs squeezed public purses. The situation was particularly bleak at the local level, where many balance sheets were battered by the collapse of home values and property tax revenues.

Despite federal aid, states were compelled to slash spending by $290 billion and hike taxes by $100 billion to try to close the budget gap, according to the Center on Budget and Policy Priorities (CBPP). States continued to lay off workers for years after the recession and cut back on infrastructure and education spending. State support for public higher education dropped by 13 percent, on average, in constant dollars between fiscal years 2006 and 2011. California, with the largest state budget in the country, cut its transportation spending by 31 percent from 2007 to 2009; Texas shrank its funding by 8 percent.

Spending recovered slowly. By 2017, some states’ education funding was still more than 10 percent below prerecession levels. Total public infrastructure spending, meanwhile, fell in real terms by nearly $10 billion between 2007 and 2017, according to the Brookings Institution, and a larger share now goes toward maintenance than toward new projects.

Other headwinds that hit state budgets include: the disproportionate growth of Medicaid spending; a decline in aid due to federal deficit reduction; shrinking tax bases and unstable revenues; and the fiscal plight of local governments. The recession also widened the hole in state pension funding. In 2017, states collectively could cover only 69 percent of their pension liabilities, down from 86 percent before the recession, according to a 2019 Pew report, though levels varied widely by state.

Unlike states, municipalities—of which there are more than eighty-seven thousand, including cities, towns, counties, school districts, and other public entities—can file for federal bankruptcy protection, known as Chapter 9 under the U.S. bankruptcy code. Though they are historically rare, there have been some high-profile cases, such as Detroit’s in 2013.

Bankruptcies in the wake of the recession came about for various reasons. The experiences of Harrisburg, Pennsylvania, and Jefferson County, Alabama, both of which filed in late 2011, were largely the result of poor infrastructure investments and political dysfunction. The challenges faced by many cities in California, such as Stockton and San Bernardino, largely stemmed from a precipitous drop in home values. In other cities, such as Vallejo, California, and Central Falls, Rhode Island, the main problem was escalating personnel costs.

How will the COVID-19 pandemic shape state and local budgets?

The fiscal shock from the pandemic is expected to be comparable to that of the last recession. Before the pandemic’s start, state budgets had mostly recovered from the 2007–2009 crisis, and many had built up rainy day funds to draw from during downturns. But the cushion is nowhere near sufficient to prevent the pandemic from wreaking considerable economic damage.

States ended the 2020 fiscal year in better shape than was initially forecast because of hundreds of billions of dollars in federal aid and the unusual nature of the pandemic recession. Low-wage earners in the service industries, who pay less in taxes, were devastated by job losses, while the stock market boomed and high-wage workers were relatively unscathed. But states were still projected to see huge shortfalls in the years ahead, even before the surge of COVID-19 cases in late 2020. The situation varies significantly across states, depending on the structure of their economies and their prepandemic fiscal health: for example, California has seen record revenues, fueled by the stock market and income gains among its wealthiest residents. But the majority of states have seen tax revenues shrink, according to an analysis by the Washington Post; five states, including Alaska and Florida, suffered double-digit percentage declines.

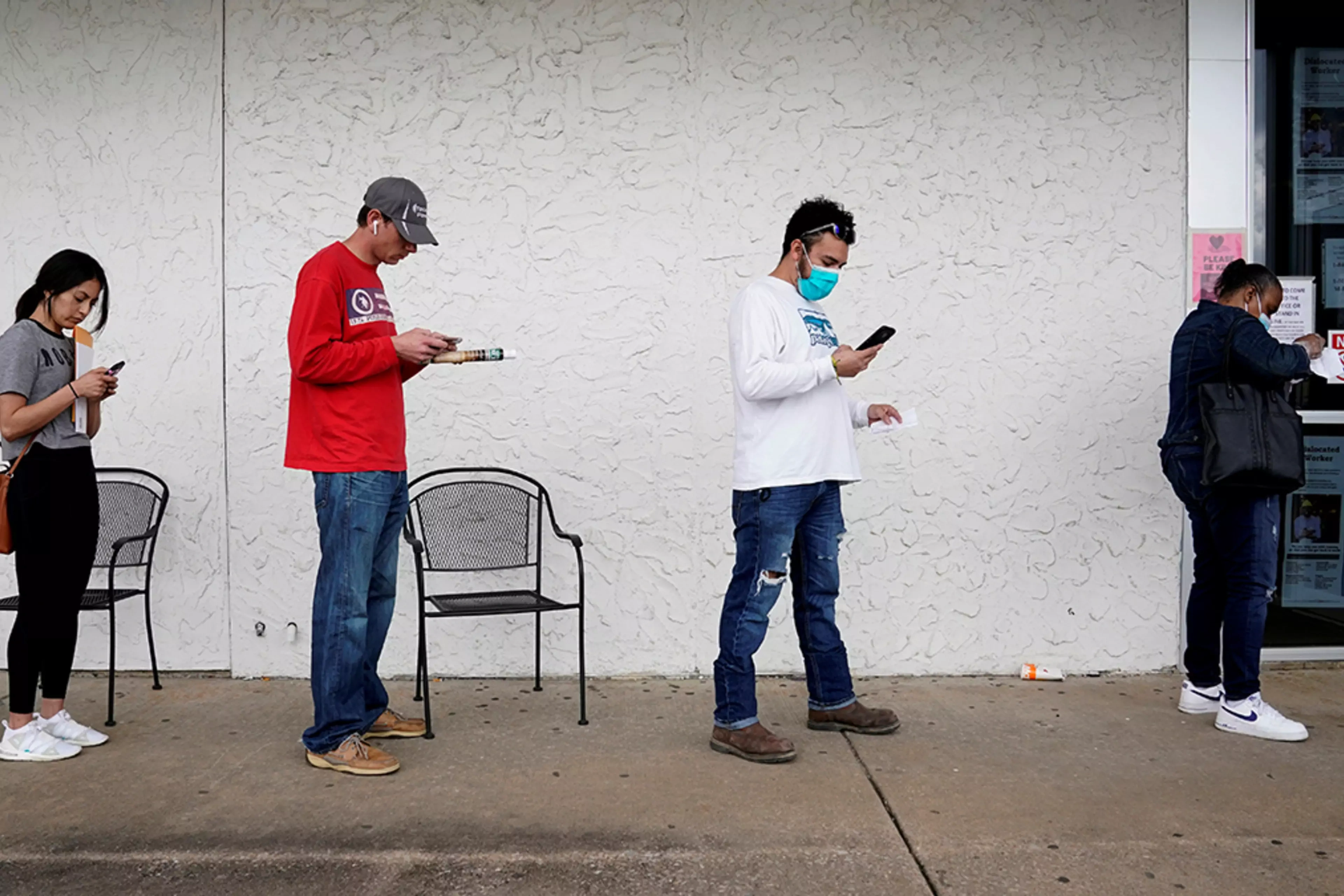

Tax revenues have fallen sharply as states faced record unemployment claims and rising public health costs. Though the economy is slowly adding jobs, nearly ten million of them have been lost since the pandemic began, with restaurants and hotels among the hardest-hit businesses. As people lose jobs, more qualify for Medicaid, the costs for which are shared by states and the federal government. Moreover, in the first quarter of 2020, state pension funding levels fell to their lowest point in three decades, as the pandemic caused the value of pension fund assets to plummet. Though the stock market later recovered, there are still concerns about its performance, as well as the effect of low interest rates from bonds on pension funds.

The pandemic has also starved state governments of sales taxes, one of their largest sources of revenue, as social-distancing measures curtailed activities such as shopping and dining out. Municipalities are being hit just as hard: a December 2020 survey by the National League of Cities found that revenues had declined by more than one-fifth.

To make ends meet, state and local governments have rolled out austerity measures. In the second quarter of 2020, state and local spending fell by 6 percent on an annual basis, the biggest drop since 1952, and in the third quarter it declined an additional 4 percent. By the end of the year, state and local governments had shed 1.3 million jobs, the overwhelming majority of those in education.

Many states have cut funding for K–12 and higher education. The pandemic has also contributed to a precipitous drop in enrollment by international students, who typically pay higher tuition than the average U.S. resident at public schools. A survey of U.S. colleges found that enrollment of new international students fell by 43 percent in fall 2020. Infrastructure spending is also on the chopping block. By August, state and local governments had delayed or canceled almost $10 billion in infrastructure projects due to the pandemic, according to the American Road & Transportation Builders Association.

The federal government has stepped in to help states manage the pandemic response. The Coronavirus Aid, Relief, and Economic Security (CARES) Act, passed at the start of the crisis, set aside roughly $150 billion for state, local, and tribal governments. The law also expanded unemployment benefits and created the Paycheck Protection Program (PPP), which helped lessen the economic blow. An earlier measure, the Families First Coronavirus Response Act, increased the federal government’s contributions to Medicaid.

In December 2020, Congress approved an additional stimulus package. This law extended unemployment benefits and PPP funds, and allocated some money that state and local governments can use, including for education and health programs such as vaccine distribution, but it did not include direct aid.

A few months later, with Democrats in control, Congress approved another massive stimulus bill, which set aside $350 billion in aid for states, cities, counties, and tribal governments, and an additional $10 billion specifically for infrastructure projects. That money is on top of funds the law provides for schools, coronavirus testing, and vaccine distribution.

With the new influx of cash, state and local officials say they will be able to prevent additional layoffs; improve government services; and revive delayed or canceled projects, such as broadband internet expansion. But some experts, along with many Republican lawmakers, say the federal funds are excessive; in some cases, the money that state and local governments will receive exceeds their projected deficits.

Recommended Resources

Experts discuss the fiscal plight of state and local governments at this CFR Virtual Meeting in December 2020.

The New York Times examines the effect of the pandemic on public services and jobs.

The National Conference of State Legislatures tracks the measures states have taken to close budget gaps caused by the pandemic.

Online Store

Online Store