China Sold Reserves in June, Just Not Very Many

Both of the key proxies for China’s actual intervention in June are out.

The PBOC’s balances sheet shows a $15 billion dollar fall in reserves.

More on:

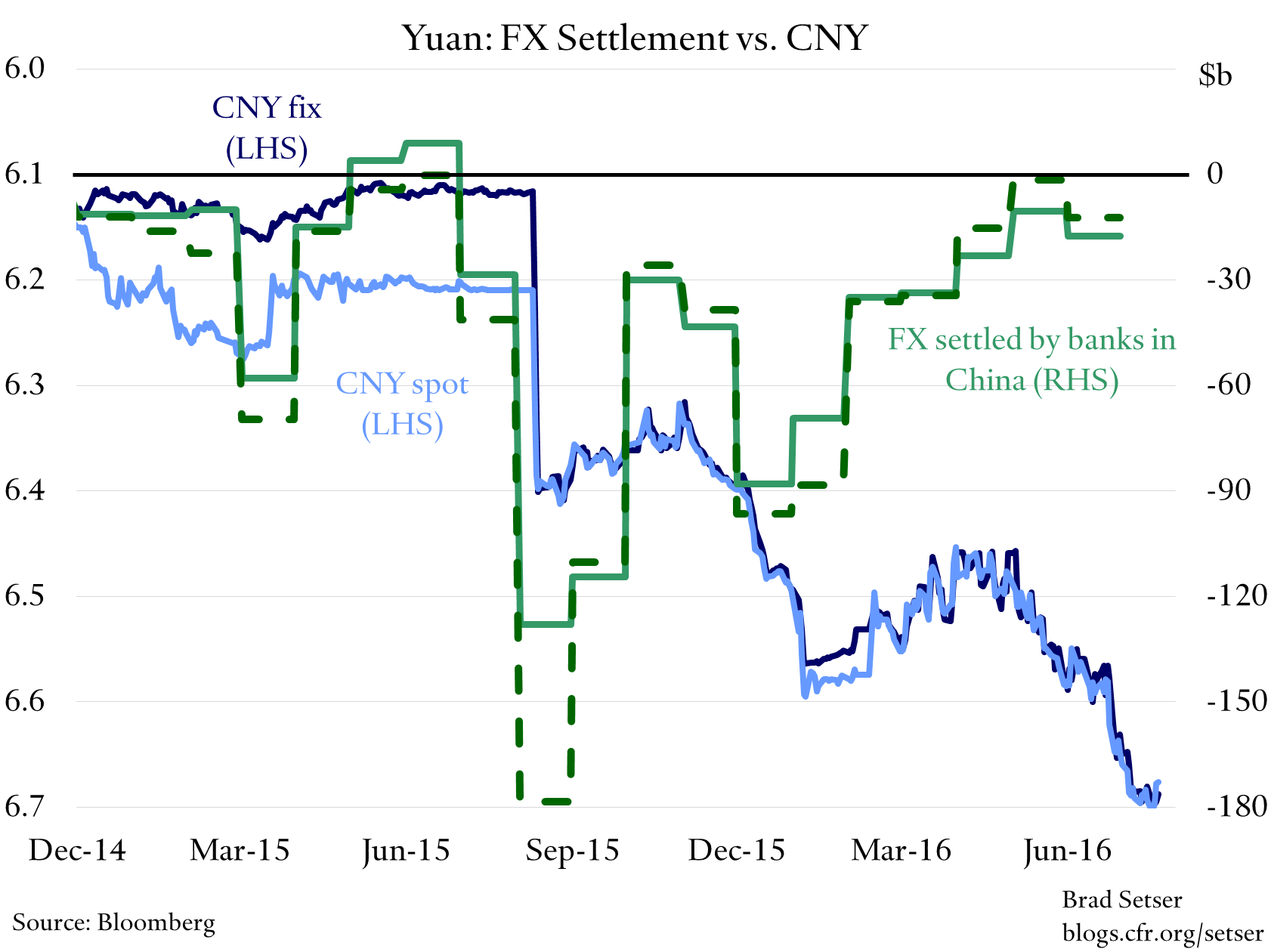

And the State Administration on Foreign Exchange (SAFE) data on foreign exchange settlement by the banking system (the PBOC is treated as part of the banks) shows $18 billion in sales from the banking system (using sales for clients, not net settlement).

They paint a consistent picture. The gap between the modest sales reported in the data and the rise in headline reserves ($13.4 billlion) is almost certainly from the mark-to-market gains on a portion of SAFE’s book. The portfolio of high quality bonds should have increased in value in June. Friends who read Chinese say SAFE has admitted as much on its website.

The more interesting thing to me is how modest the sales were, at least when compared to other periods of depreciation (against the dollar) in the last two years.

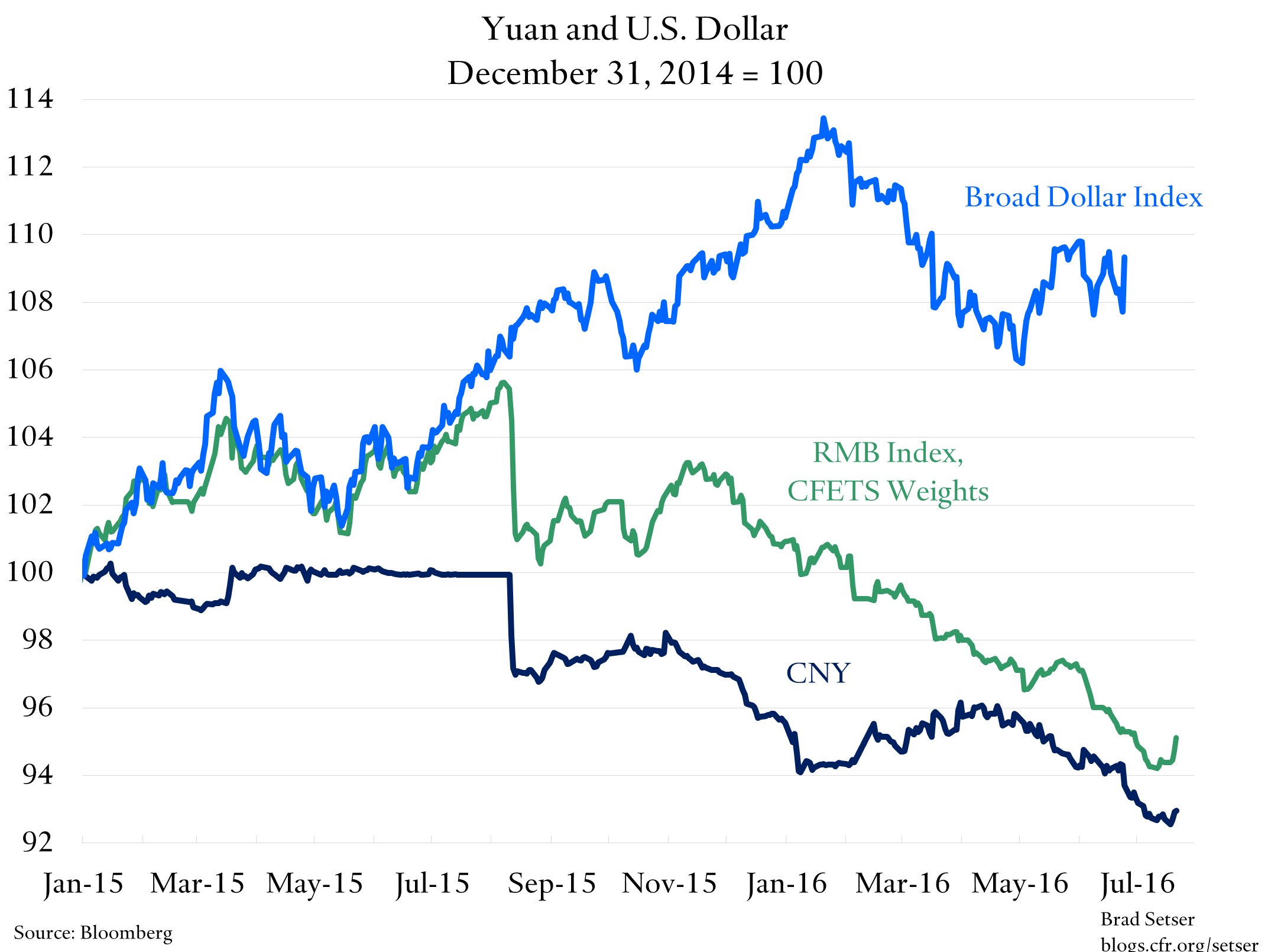

Either the carry trade unwind is over or the controls work. Or somehow this most recent depreciation hasn’t produced expectations for further depreciation, even though the crawl down against the basket has been pretty stable.

More on:

It is a puzzle, at least to me.

For the conspiratorially minded, the banks do look to have sold foreign exchange from their own accounts in June, as they did last August and this January. But the sales from their own account were modest—$5 billion versus $85 billion last August and $15 billion in January. And the settlement data for forwards also shows a modest reduction in the net forward book of the banks in June. Net of the change in forwards, total sales in the settlement data look to be just under $15 billion.

Not much, in other words.

But there is at least a suggestion that expectations started to build over the course of July in a way that worried the PBOC. The need to break the cycle of expectations is one explanation for the decision to appreciate the yuan in the middle of the week back to about 6.7 to the dollar, even though such appreciation against the dollar meant appreciation against a basket.

"The yuan advanced the most in two weeks, with the central bank’s daily fixing adding to signs that China’s authorities are prepared to overrule the market to control the currency’s moves.The People’s Bank of China strengthened its reference rate, which restricts onshore yuan moves to 2 percent on either side, even as the dollar advanced the most since July 5. This spurred speculation that the central bank isn’t sticking to its stated policy of following the direction of the market, which would have resulted in a weaker fixing."

The mystery of the PBOC’s actual exchange rate policy rule remains. Perhaps intentionally.

All this matters, of course, because the exchange rate is the mechanism that most powerfully transmits any weakness in Chinese domestic demand to other manufacturing economies. Commodity exporters are, of course, impacted more directly by changes in commodity prices. The cumulative depreciation against the dollar over the last 12-plus months has reached 7-8 percent—enough that it would reasonably be expected to start having an impact on trade flows going forward.

Online Store

Online Store