By experts and staff

- Published

Experts

![]() By Benn SteilSenior Fellow and Director of International Economics

By Benn SteilSenior Fellow and Director of International Economics

By

- Elisabeth HardingAnalyst, Greenberg Center for Geoeconomic Studies

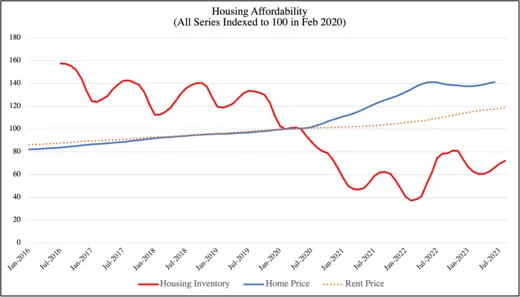

Notes: This figure depicts housing inventory (the number of active listings), the S&P/Case-Shiller U.S. National Home Price Index, and the Consumer Price Index for All Urban Consumers: Rent of Primary Residence in U.S. City Average. Source: FRED.

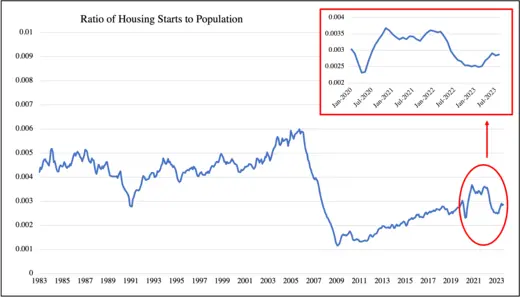

Notes: This figure depicts the number of new privately-owned, single-family home housing starts, a measure of residential construction projects, divided by the U.S. population over time as a three-month moving average. Sources: FRED, authors’ calculations.

While China’s government struggles with a glut of new homes and plunging prices, the U.S. faces the opposite problem: a large and growing housing shortage.

House prices are up 42 percent since January 2020, driven by low mortgage rates (until 2021), the rise of teleworking, the accompanying flight to suburbia, and pandemic-era home-buyer tax credit and FHA loan inducements. During the pandemic, loan forbearance and eviction moratoriums kept people in their homes, but also pushed more people into the market and prevented the fire sales that would otherwise have depressed prices. 2022 further saw the highest level of household formations in ten years. Meanwhile, housing supply growth has been restricted by the supply-chain problems which emerged in 2020. In consequence, the gap between single-family housing starts and household formations grew by one million over the course of 2022, reaching an enormous 6.5 million at the end of that year.

We illustrate the problem in the upper graphic, which shows the massive divergence which has emerged between home prices and inventory since 2020. The bottom graphic shows that whereas the ratio of housing starts to population, which plummeted during the Great Recession and early in the pandemic, recovered in the second half of 2020, it plunged again in 2022—before making a tepid recovery earlier this year.

Unfortunately, public policy is exacerbating the home shortage. Housing vouchers, subsidies, and tax credits, intended to ease the burden on home buyers, increase demand without generating additional supply, making housing on the whole less affordable. On the supply side, local zoning rules, which have been a costly barrier to home building for many decades, have of late emerged as a major issue of national contention. The Biden administration has taken a baby step toward mitigating the problem through its Pathways to Remove Obstacles to Housing (PRO), announced in July, which will direct $85 million to communities that remove barriers to housing production—in particular, ill-conceived zoning restrictions. But far more will need to be done to rid the landscape of minimum lot size requisites, minimum parking requirements, bans on multi-family units, and other obstacles to the creation of much-needed new housing.