The Japanese Bid for Foreign Bonds After the End of Yield Curve Control

The Bank of Japan (BoJ) is widely expected to end yield curve control. But Japanese yields will remain low, and foreign bonds will remain attractive to those Japanese investors who don’t have to hedge.

This is a joint blog post with Alex Etra of Exante Data

The Bank of Japan (BoJ) seems set to exit its negative interest rate policy (NIRP) this week and allow its target interest rate to rise to just above zero.

It also may also take further gradual steps to allow the yield on 10-year Japanese government bonds (JGBs) to fluctuate more freely, continuing its two-year long process of backing away from yield curve control.

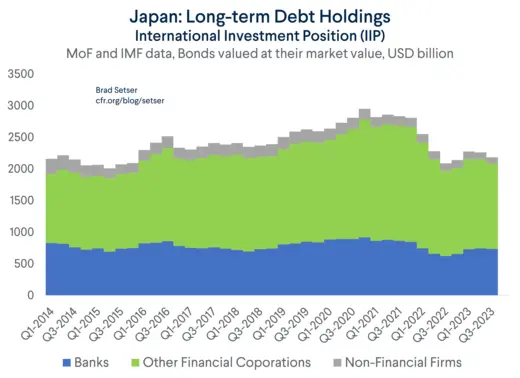

Japanese investors own about as many bonds around the world as China’s central bank and its big state banks. Shifts in Japanese monetary policy – even if widely telegraphed – are of global interest. There are always fears that Japanese investors will lose interest in foreign paper.

Analysis of Japan’s impact on global markets is oversimplified, however.

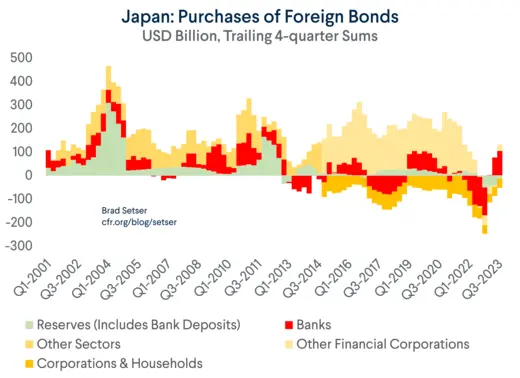

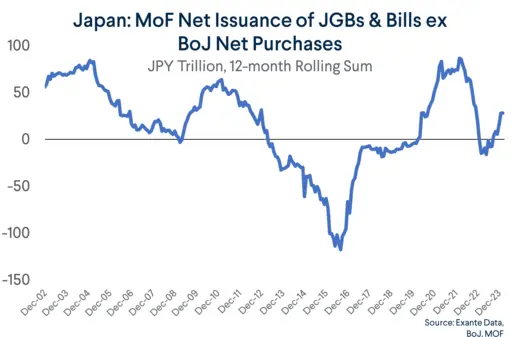

There is no doubt that the Bank of Japan’s policies have pushed Japanese investors to seek yield around the world. For the eight years before the COVID shock, the Bank of Japan’s purchases were so large that the stock of bonds available for Japanese investors to buy was actually falling – and many Japanese investors had no real choice but to look abroad for yield.

And now Japanese yields are poised to increase a bit, creating fear that Japanese investors will start selling foreign bonds and returning home.

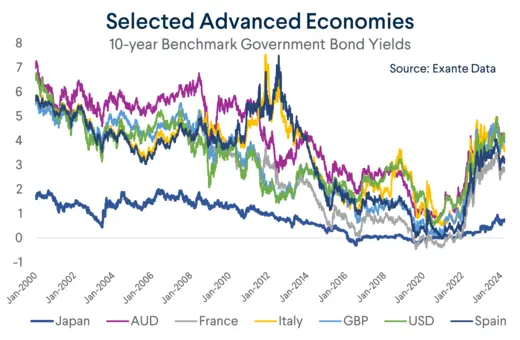

But the impact of the end of yield curve control also should not be exaggerated. There is also a lot more yield available globally now than there was back in 2014. U.S., Australian, British, Italian, Spanish, and French 10-year government bonds all currently yield considerably more than 10-year JGBs.

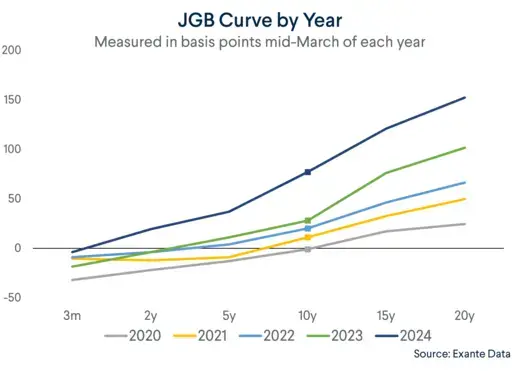

The famous (in some circles) kink in Japan’s curve that was obvious in March 2023 has largely disappeared. Japanese investors looking for yield no longer are forced to choose between chasing returns abroad or buying ultra-long dated JGBs.

So, understanding the likely impact of the BoJ forthcoming tightening requires understanding the Japanese bid for foreign bonds – and that requires understanding, well, a lot of different institutional flows. Japan’s commercial banks, Japanese policy/savings banks (Post Bank and Norinchukin), Japanese life insurers and Japan’s big government pension fund all have large foreign bond holdings, which they hold for related but subtly different reasons.

The good news? Japan matters, but not in quite the sensational way that some often posit. The potentially imminent end of negative rates and the possibility of higher 10-year JGB yields with the end of yield curve control isn’t going to radically change the incentives that have led Japanese investors to seek yield abroad between 2012 and 2021 – or the incentives that led that flow to reverse in 2022, well ahead of any shift in Japanese policy.

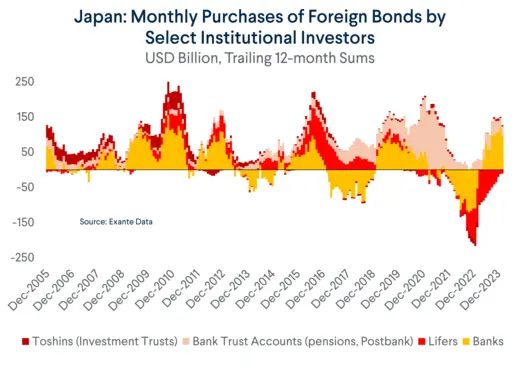

Our core thesis is simple: the Japanese bid for foreign bonds is best understood as the convergence of two distinct bids. There is a bid from large, hedged investors: banks, investment trusts managing funds for Post Bank and Norinchukin (Nochu), and the life insurance companies (“lifers”) – sometimes. And there is a separate bid from large, unhedged investors: the Ministry of Finance (MoF), the Government Pension Investment Fund (GPIF), the “private” pension funds, and the lifers – sometimes.

The economics of the two trades differ – as do regulations governing the large Japanese institutions that drive the overall Japanese bid for foreign bonds. The resulting tug of war determines net Japanese flows – which don’t always follow directly from changes in the absolute yield on safe Japanese assets.

One irony: the bid from private Japanese investors has mostly been a hedged bid; the bulk of the unhedged holdings are in the hands of Japan’s government (counting the MoF’s reserves, which are the largest unhedged holdings of foreign bonds). As a result, the bulk of the losses from hedged investments are in private hands (as those investors have seen the market value of their bonds fall without an offset from the rising yen value of their dollars or euros). See, for example, the large unrealized loss Norinchukin reports on its bond portfolio. Conversely, the big profits from the yen’s move from 100 to 150 have been enjoyed by the MoF and the GPIF.

The Hedged Investors

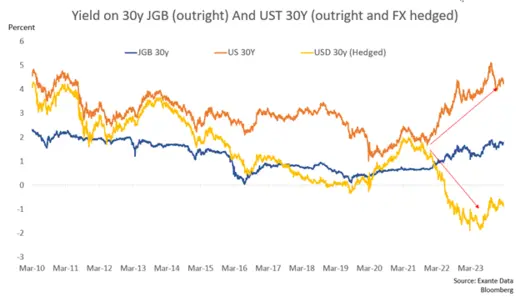

The underlying economics of hedged purchases are actually easy, but they aren’t intuitive. A hedged Japanese investor in U.S. bonds is typically borrowing U.S. dollars short-term to buy long-term U.S. Treasuries. The profitability of that trade is clearly a function of the shape of the U.S. curve (it makes sense if the curve is steep, but not if the curve is inverted). In practice, a hedged Japanese investor is paying the difference between short-term Japanese rates and short-term U.S. rates to borrow the dollars with which to purchase long-term U.S. debt.

So long as short-term Japanese rates are close to zero (as they have been for decades), the logic of the trade depended in large part on the shape of the U.S. curve. Or to be technically precise, the economics of the trade were driven by the shape of the U.S. curve relative to the shape of the Japanese curve.

If, for example, Japanese short-term rates were at zero, U.S. short term rates were 0.5 percent, and U.S. long-term rates were 2.5 percent, a hedged Japanese investor could earn about 200 basis points borrowing dollars (paying the difference between short-term Japanese and U.S. interest rates) and investing in U.S. Treasuries – at a time when 10-year JGBs yielded ~10 basis points and 15-year JGBs yielded ~25 basis points.

But now, with short-term U.S. rates of 5.5 percent and long-term U.S. Treasury rates of between 4.0 and 4.5 percent, Japanese investors buying Treasuries unhedged are losing money – and clearly would be better off holding JGBs currently yielding ~75 basis points.

Now, sophisticated observers would note two things.

First, what really matters for an investment in a 10-year bond that will be held to maturity on a hedged basis isn’t the current difference in short-term interest rates but the expected path of short-term interest rates. For example, a Japanese investor who bought a 10-year Treasury last fall at a 5 percent yield on a currency hedged basis would make money relative to a 10-year JGB if the average U.S. short-term interest rate over the next 10 years is below 4 percent (or to be technically correct, if the difference between U.S. and Japanese short-term rates – net of the extra premium paid to borrow dollars through the swap market – is less than 4 percent on average).

Second, a hedged investor can also collect credit and liquidity premium in addition to the spread on theoretically riskless safe assets such as sovereign bonds. A Japanese investor today buying U.S. Agency mortgage-backed securities or U.S. investment-grade corporate bonds can still make around 25 basis points or more on a hedged basis right now – with the prospect of additional returns should U.S. short-term rates fall and/or Japanese short-term rates rise.

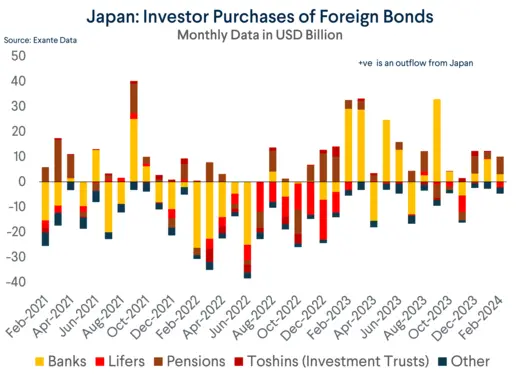

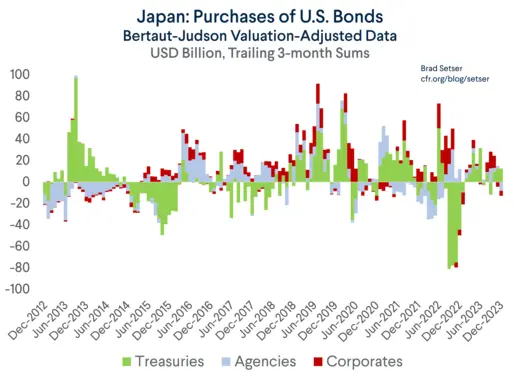

All this matters because Japanese hedged investors – by all appearances – returned to the U.S. bond market in 2023 (even as 10-year JGB yields moved from less than 25 basis points to 90 basis points). Japanese banks were the first to sell U.S. securities – selling in early 2022, as the Fed started its hiking cycle. But Japanese banks clearly bought foreign bonds over the course of 2023, even as the U.S. curve remained inverted. They were likely either betting that U.S. short-term rates had peaked or betting that they could make money by taking a bit more credit risk (or perhaps maxing out their ability to take unhedged risk, as buying U.S. bonds unhedged yielded big returns). For example, Norinchukin Bank – the savings cooperative of fishers, farmers, and foresters – returned to the collateralized loan (CLO) market to get a big hedged yield according to its February 2024 investor report. It isn’t alone.

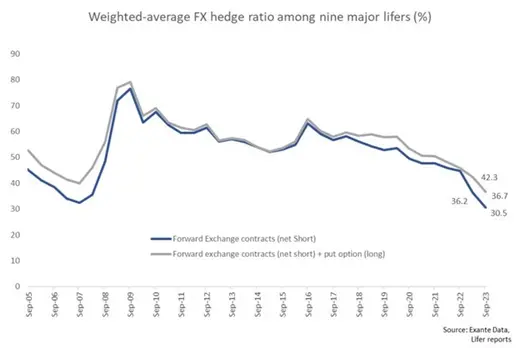

The other response to a rise in hedging costs is simply to stop hedging. Japanese lifers historically have hedged about 60 percent of their foreign bond portfolio. But that hedge ratio, according to data tracked by Exante Data, fell to under 40 percent.

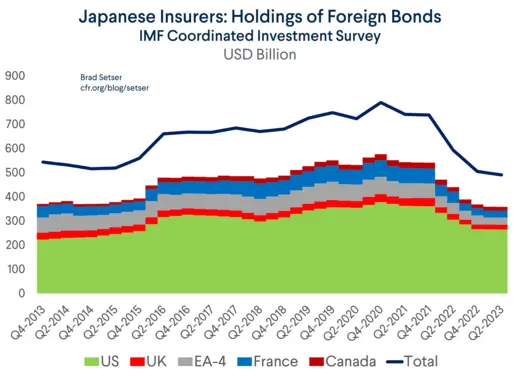

The lifers also have been unwinding a portion of their big bet on foreign bonds, as they are the one major set of Japanese institutional investors who continued to sell foreign bonds in 2023.* See Appendix A for detailed data on their holdings through June 2023.

The Financial Systems Report released by the Bank of Japan provides additional detail about the strategies that Japanese investors have deployed to limit losses on their legacy foreign bond portfolio. The Bank of Japan notes that hedged Japanese investors with a strong capital position sold low-yielding securities bought before 2022 (taking a hit to their capital via market-to-market losses) and bought new, high-yielding securities:

“Banks’ investment behavior has become more diverse since the start of 2023 compared to 2022, when banks were cautious about taking risks. Banks in the fourth quartile have restored some of their foreign bond positions that they had reduced in 2022 ... In addition, as a result of rebalancing since last year, banks have reconfigured their portfolios, increasing their holdings of bonds with higher yields and shorter average durations (Charts IV-2-4 and IV-2-5). The improvement in bond yields and shorter durations is particularly pronounced at banks in the third and fourth quartiles ... As mentioned earlier, a large part of the increase in foreign bond positions since the start of 2023 consists of foreign bond investment trusts. These invest in a wide range of products, including credit products ... Most of the foreign credit products held by banks have been investment-grade bonds.”

That meant that they could look forward to future profits rather than just bleeding income every year. Conversely, weaker institutions without enough capital to absorb mark-to-market losses on low-yielding foreign bonds were forced to hold onto to their low-yielding securities and lose money on the hedge.**

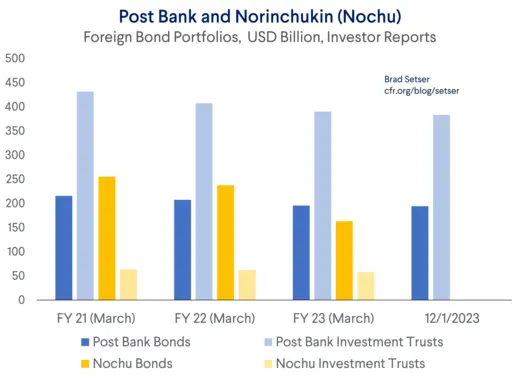

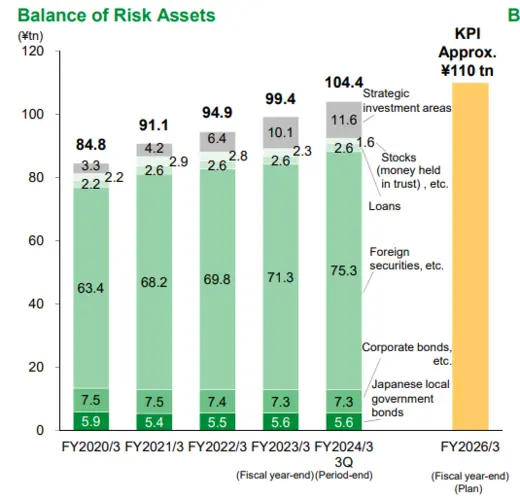

Interestingly, Post Bank has largely maintained its foreign bond holdings (mostly held through investment trusts), while Norinchukin looks to have significantly scaled back its bond investments between March 2022 and March 2023, consistent with the net selling observed by Japanese banks over that period.*** The net result is that Japan’s banks, who mostly hedge, clearly added to their total foreign bond portfolio over the course of 2023 – and the market value of their total holdings also increased.

The Unhedged Flow

The biggest unhedged investor by far is the MoF itself. But it invests for currency management purposes, not for profit. The MoF is sitting on enormous capital gains – but those will remain unrealized absent new dollar selling intervention.

It also has significant income flows (it still raises at interest rates that are close to zero and holds a foreign bond portfolio that is likely heavy in 2- and 3-year Treasuries). As it typically reinvests its interest income, the MoF has recently been a small net buyer of global fixed income as its 2022 intervention fades into the background.

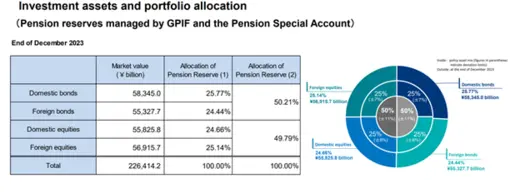

The second biggest unhedged holder of foreign bonds is the Government Pension Investment Fund (GPIF). Half of its portfolio is now invested internationally, and half of that is in bonds – so it currently holds close to $400 billion in foreign bonds, But the GPIF generally only generates big flows when it significantly alters its overall asset allocation targets, and it hasn’t done that for a while.

However, it is a net buyer of foreign bonds when its foreign equity portfolio goes up significantly, and it has to sell equities and buy bonds to keep about half its international portfolio in bonds.

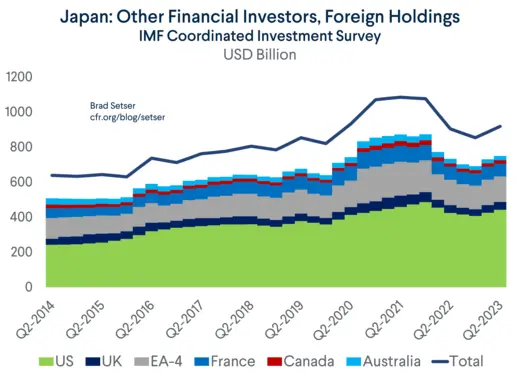

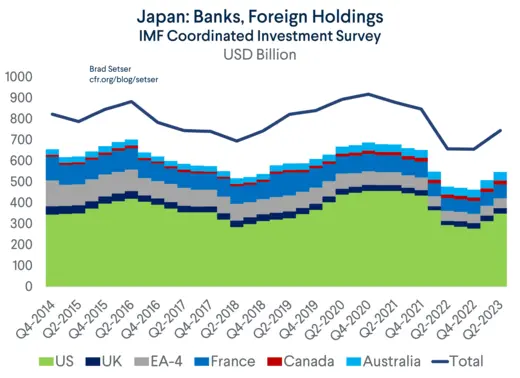

And then there are the smaller pension funds – and the lifers who have always invested a portion of their funds unhedged and can change their hedge ratio as the times shift. They clearly have been net buyers over the last year. These flows, together with Post Bank’s ongoing use of (mostly hedged) investment trusts drove the increase in the holdings of “other” investors (heavily investment trusts) in the coordinated survey of portfolio investment (See Appendix A).

But, guess what: for unhedged investors, their incentives don’t radically shift if JGB yields increase by twenty-five basis points. With U.S. Treasuries yielding 4.3 percent and U.S. Agency mortgage-backed securities yielding over 5 percent, investors looking for strategic diversification and who are willing to take currency risk can get an absolute yield pickup even if 10-year JGBs go to 1 or even 1.5 percent. That shows up in the US flows data, as Japanese investors returned to the U.S. market over the course of 2023.

In fact, the hedged investors are more sensitive to the absolute yield on JGBs, as that is what they would get if they unwound their hedged investments (both JGBs and hedged investments are free from currency risk). The unhedged investors, by contrast, should care much more about the yield differential than the absolute yield on JGBs.

This is all both complicated and straightforward. Japanese fixed income flows are actually somewhat predictable – as they reflect the incentives created by the JGB curve and the constraints faced by a set of very large institutional investors.

Of course, there is a risk that something unexpected could go wrong. Yields on JGBs could rise in an unconstrained way, generating large paper losses for Japanese institutions or, more likely, more volatility in the Yen and the 10-year JGB impacts certain leveraged bets.

But the odds that the Bank of Japan will lose control of the JGB market are small. And the big Japanese institutional investors with hundreds of billions invested abroad don’t necessarily mark those positions to market (Post Bank, Norinchukin) or don’t use leverage (GPIF) and thus are less impacted by market volatility than most foreign investors playing the yen.

At the end of the day, the ongoing evolution in Japanese monetary policy settings isn’t likely to change all that much. Both short-term and long-term Japanese rates will remain well below rates in the U.S. and Europe. And so long as the U.S. curve is inverted, hedged flows into U.S. Treasuries will only appeal to a small subset of investors convinced that the Fed is certain to start cutting.

Thus, the best bet is that Japan will continue to be a modest net buyer of foreign bonds, as it was in 2023. A bit dull really – but still of great importance to global markets.

* See also Chart III-2-4 of the October Financial Systems Report.

** The Financial System Report: “Banks that rebalanced significantly in 2022 were those that, to start with, had high loss-absorbing capacity, such as high capital adequacy ratios and ample room for realizing gains. For details, see Section C of Chapter IV in the April 2023 issue of the Report”

*** Post Bank reports that it still wants to add – in yen terms – to its foreign exposure over time. Relative to Nochu it also makes far more use of investment trusts. Its foreign bond holdings are currently two times its JGB holdings, a rather strange allocation for what fundamentally is government savings bank with yen liabilities.

Appendix A:Foreign Holdings of Japanese Banks and Financial Institutions from the Coordinated Portfolio Investment Survey