By experts and staff

- Published

Experts

![]() By Benn SteilSenior Fellow and Director of International Economics

By Benn SteilSenior Fellow and Director of International Economics

By

- Benjamin Della RoccaAnalyst, Center for Geoeconomic Studies

“Tariffs are working far better than anyone ever anticipated,” President Trump tweeted on August 4. “China market has dropped 27% in last 4 months.”

The president’s numbers are off—China’s stock market was down 14 percent over those four months (or 24 percent since its peak on January 24). More importantly, the assumption that this fall has spurred trade-talk progress is dubious.

But putting those quibbles aside, we question the president’s bigger premise: that the Chinese market is down because of his tariffs.

Here is why we question it.

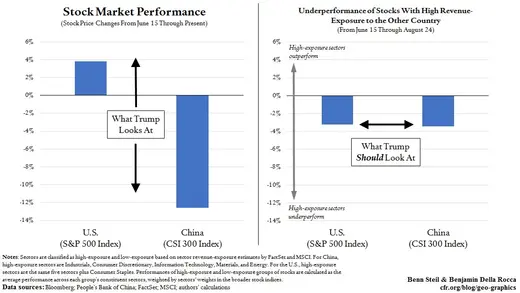

Since both countries unveiled the product lists and roll-out dates for their first waves of tariffs on June 15, China’s CSI 300 index has fallen by 13 percent. The U.S. S&P 500 index, meanwhile, has risen 4 percent. This would, at first glance, appear to back the president’s view that tariffs are hitting China harder than the United States. Yet if we want to isolate the impact of tariffs, we need to do at least two things.

The first is to establish the parameters of the time period such that we are not capturing the impact of other trade-related factors. By starting the analysis on June 15, we exclude the market effects of earlier U.S. steel and aluminum tariffs. And since the U.S market rallied on August 27, after progress was announced on NAFTA negotiations between the United States and Mexico, the most logical cut-off date is the previous trading day, August 24.

Second, we need to focus on stocks of companies that are highly exposed to the two countries’ tariffs, and to measure their underperformance relative to the rest of the market. The Chinese market, for example, has been slammed by non-trade factors such as Beijing’s crackdown on shadow-bank lending, which has curbed credit growth—as shown below.

In short, we don’t want to ascribe to Trump’s China-import tariffs falls in stock prices caused by other factors. We also don’t want to ignore the impact of China’s U.S.-import tariffs on U.S. stocks.

We have, therefore, calculated the performance, from June 15 to August 24, of U.S. stocks with high revenue-exposure to China, and that of Chinese stocks with high revenue-exposure to the United States. Comparing the results tells a very different story from President Trump’s.

Trump’s story is illustrated in the left-hand figure above. Yet the correct story is the right-hand one. As we show, China-sensitive U.S. stocks underperformed the rest of the U.S. market by 3.2 percent between June 15 and August 24, while U.S.-sensitive Chinese stocks underperformed the rest of the Chinese market by 3.4 percent. The market impact of tariffs is therefore almost identical in the two countries.

Broadly speaking, the president is wrong: his trade war has damaged U.S. stocks as much as it has Chinese stocks.