This guest post is co-authored by Sarang Shidore, a visiting scholar at the LBJ School at the University of Texas at Austin, and Joshua Busby, associate professor of public affairs at the Robert S. Strauss Center for International Security and Law at the LBJ School at UT Austin.

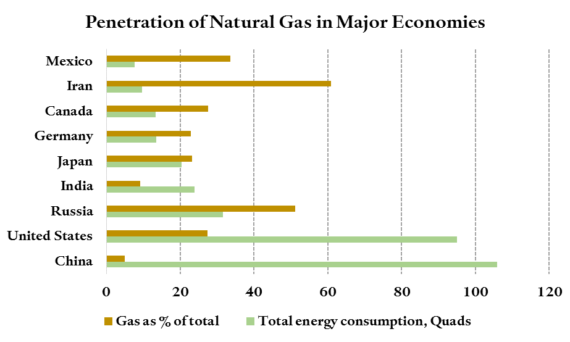

India is among the fastest-growing large energy consumers in the world. According to the IEA, India’s share of primary energy demand accounted for about 5.7% of the global total in 2013, and with its energy demand set to increase by 30%, India’s share of the global total could be nearly 7% by 2020. Reining in greenhouse gas emissions from its fast-growing economy will be crucial to combat global climate change. Though it has laid out an ambitious roadmap to scale up renewable energy over the next decade, the bulk of Indian electricity generation is still expected to come from burning coal, and oil is widely expected to remain the dominant source of transportation fuels for the foreseeable future. Natural gas penetration in India, however, is extremely low compared to that in many major economies (see figure), with the exception of China. This is concerning, since natural gas could bring substantial benefits to India and the world.

More on:

Compared with burning coal or oil, burning natural gas releases significantly lower greenhouse gas emissions per unit of energy (provided that methane leakage from natural gas production and delivery is limited). Natural gas power plants also produce lower levels of pollutants harmful to human health, compared with coal-fired power plants—this is particularly important given India’s high urban air pollution levels. And natural gas could be a bridge fuel in the transition to renewable energy because natural gas power plants can provide flexible, or peaking, power that makes it easier to integrate unpredictable wind and solar energy into the power grid. Indeed, in the United States a major revolution in producing low-cost shale gas has contributed to an electricity transition away from coal and toward renewable energy. So it is important to understand the barriers for natural gas adoption in India and examine public policy options to reduce them.

Natural Gas consumption in India compared with that in other major economies (Compiled by authors with data from EIA, 2012).

What’s Holding Natural Gas Back?

Increasing the production and consumption of natural gas has faced a number of barriers in the Indian market. Most evidently, India’s conventional gas reserves are estimated to be relatively modest at about 1.4 trillion cubic meters, only 0.7% of the global total. Moreover, exploration and exploitation activities have been sub-optimal at best, and producers have considered deep water reserves economically unviable until recently. Low production is largely due to Indian government regulations that limit the gas price that domestic producers can charge in the domestic market. Some analysts have argued forcefully for a higher domestic gas price to incentivize production and attract greater private investment in the upstream gas market. In addition to India’s limited conventional reserves, some unconventional gas reserves exist in the form of shale gas and coal-bed methane. Multiple barriers, such as water and land availability, have impeded shale gas production, though there is good potential for exploiting coal-bed methane.

Compounding the lack of domestic reserves, international pipelines have stalled. Projects such as the Iran-Pakistan-India, Myanmar-Bangladesh-India, Oman-India, and Bangladesh-India have stalled for a number of reasons related to cost, technology, and international and domestic politics. Prospects for the only viable pipeline currently on the drawing board, the Turkmenistan-Afghanistan-Pakistan-India (TAPI) pipeline, remain uncertain due to the deteriorating security situation in Afghanistan. In general, it is unlikely that international pipelines can deliver substantial gas supplies to India, at least over the next 10–15 years.

More on:

Liquefied Natural Gas (LNG), which can be shipped around the world, is another major route for expanding gas supplies. LNG provides flexibility and shorter time horizons in contracting with active markets in both long-term and spot, or immediate, trading. However, high prices have traditionally made LNG unattractive for India. Historically, Asian countries have had difficulty procuring affordable LNG because of the so-called “Asian premium” in landed gas prices. Typical LNG prices were in the neighborhood of $16 per MMBtu [million British thermal units, a unit of energy] until recently. This was a cost far too high for the Indian electricity and other demand markets to bear—for example, gas-powered generation is competitive with generation from imported coal only at a gas price somewhere below $5 per MMBtu.

India also suffers from a deficiency of infrastructure for domestic deployment of natural gas. India has delayed constructing LNG infrastructure to receive supplies from abroad, and new builds are ongoing. Though key regasification facilities (that convert LNG to pipeline gas) at the ports of Dahej, Hazira, Dabhol, and Kochi are operational, they can handle only about 20 mmtpa (million metric tonnes)/year at the moment, which represents about 30% of current gas consumption. Given that domestic production increases will fall well short of demand even under optimistic scenarios, a major expansion of gas consumption will require a major expansion of LNG import capacity. India has ambitious expansion plans to raise its import capacity to 47.5 mmtpa/year by 2022, which will represent about 45% of IEA’s projected gas consumption for India in that year.

However, substantial delays in large infrastructure projects are the norm in India. Moreover, once LNG is received in Indian ports, it still needs to be transported to major demand centers that can be far away. In general, gas transport is more challenging than oil transport, and pipelines are the best solution for moving large quantities of gas across country as large as India. Southern and eastern India are poorly served by pipelines. Critical projects such as the Kochi-Mangalore-Bangalore pipeline have been delayed owing to land acquisition issues. And infrastructure (e.g. filling stations) for Compressed Natural Gas (CNG) for transportation and city gas for domestic use is limited and could be expanded to many more Indian cities.

Market Shifts Are Improving India’s Gas Prospects

Low prices are making gas more attractive. A major development in gas markets in Asia has been the recent crash in LNG prices, which are now trading in the neighborhood of $5/MMBtu. It is undoubtedly risky to plan long-term energy transition strategies based on short-term market vagaries. However, there is good reason to believe that low LNG prices in Asia will persist, given new sources of gas supply. The United States recently began shipping LNG to India, and Australian gas will be delivered beginning late 2016. If the US-Iran nuclear deal continues to facilitate Iran’s entry into global markets, then Iran’s LNG supplies, expected on the global market post-2020, would further increase global supply. And East Africa is an additional major future source for LNG on the horizon.

Furthermore, structural factors are putting downward pressure on prices. Two major developments in LNG markets are now well underway that could reduce LNG prices moving forward. One is the steady decline of traditional LNG contracts that index natural gas pricing to oil prices, which could erode the “Asian Premium." The other is a simultaneous dynamic of slowing demand growth in key countries like Japan and South Korea and accelerating supply from new sources such as the US and Australia. Both factors are exerting downward pressure on medium-term LNG prices which could persist for the longer term, shifting deals toward shorter-term, more flexible transactions.

India has been quick to react to these changes, having renegotiated an earlier deal with Qatar to bring its contracted price from $12-13 per MMBtu to $6-7 per MMBtu—a reduction of about half. The Modi government is in talks to import LNG from the Chevron-led Gorgon project in Australia. India is also in preliminary talks with other Asian countries to create a buyers’ alliance that can jointly negotiate an extended regime of lower prices with key suppliers.

India has also achieved some domestic pricing reform. As of 2016, India now incentivizes production from deepwater wells at a higher price than before of $6.61 per MMBtu. This has helped close the gap between regulations and the position of Indian producers such as Reliance, which recently withdrew a key arbitration proceeding against the Indian government on stalled production at a major gas field. Finally, given citizens’ increasing anger over worsening air quality in New Delhi and elsewhere, recent court rulings in India have banned diesel vehicles in a few cities, providing new market opportunities for CNG use in the transportation sector.

Regulatory Reform can HELP Gas Turn Around

The government’s recent Hydrocarbon Exploration Licensing Policy (HELP) attempts to reform the previously unwieldy system by streamlining license procedures, allowing developers to define acreage of exploration fields, moving from a profit-sharing to a revenue-sharing model, and allowing “pricing freedom” to new gas finds subject to a cap determined by a complex formula. This cap turns out to be quite low in an era of low fossil fuel prices.

However, more regulatory reforms are needed to incentivize domestic production. Most analysts have argued for greater pricing freedom, in the range of $6-$14 per MMBtu, depending on the type of gas field in question. However, it is also clear that gas at these prices cannot compete with coal for electricity generation. They will also greatly increase fertilizer subsidies. There are major political barriers to reducing or eliminating the fertilizer subsidy regime, which directly benefits farmers, who compose more than half of India’s voters.

Thus, India has three policy choices. The first is to prioritize domestic production through an across-the-board pricing reform, reflecting domestic market dynamics. This has the advantage of increasing energy independence and building in greater price predictability. However, this option will substantially increase the fertilizer subsidy burden, though higher government royalties that would accrue in a higher price regime could offset some of this increase. Barring politically difficult power tariff increases, this also means compromising gas-fired grid-based electricity expansion, which in turn would have a negative effect on renewables growth.

A second choice has emerged in the wake of the recent dramatic drop in LNG prices in Asia. India could bet on a sustained low price LNG environment and focus almost entirely on increasing gas imports to meet future demand rise. This option requires more aggressive gas port and pipeline infrastructure goals and their on-time completion and energizing pipeline projects such as TAPI. It however carries the risk that Asian gas prices could sharply increase at some point in the future due to geopolitical or other factors endangering Indian energy security.

The third option, and the one we recommend, is to seek the middle ground—undertake selective but deeper pricing reform, perhaps for the more challenging ultra-deepwater fields and coal-bed methane, but also pull out all stops to ensure that ambitious LNG and pipeline infrastructure plans meet stated deadlines to enable accelerated imports. Existing subsidy regimes would largely remain intact, but deregulated markets in piped gas, CNG, captive power plants, and industrial sectors could absorb much of the price increase, especially if the state acts to facilitate large demand volumes for gas in the domestic and transport sectors. This will require a major build-out of gas infrastructure (such as pipelines to homes and CNG filling stations) to generate the requisite demand at these prices. It will also require strong domestic regulations to limit methane leaks from production and transport sites, lest the climate benefits of methane over coal disappear. Additionally, the government should consider including the steel sector within the “Tier 1” list of sectors to which domestic gas is released first. Steel manufacturing is a major source of India’s carbon emissions, and there are substantial climate and air quality benefits in encouraging it to use natural gas rather than coal.

Additional Policies and International Coordination Are Also Important

The diesel vehicle ban promulgated by the National Green Tribunal, India’s top environmental court, must be supported strongly. Not only should the government abandon its current opposition to extending the ban to other cities, but it should also proactively support its extension. This will not only have major air quality benefits, but will also enable demand for natural gas in the transportation sector to take off, a critical condition for the regulatory reforms listed above to become viable.

The buyers’ alliance initiative from the Modi government is an excellent idea. Major consumers such as South Korea, Japan, Thailand, and even China could be included in these discussions. If Asian LNG prices converge strongly with landed prices in Europe, there is also the future possibility of including EU states in this conversation.

The United States can significantly promote greater adoption of natural gas in India. It can participate in plurilateral talks on coordination of gas buyers and continue to publicly disseminate information on air quality as a public health issue. The US can also leverage some of its recent experience on quantifying and regulating methane leakage to help India establish an effective policy framework. And quiet U.S. diplomacy can pay off when pursued appropriately, exemplified by India’s shift in stance on bringing HFCs [hydrofluorocarbons, potent greenhouse gases] under the Montreal framework.

Though enhancing India’s consumption of natural gas will inevitably mean greater imports, compared with domestically abundant coal, there are enormous benefits from increasing adoption of natural gas that can aid India’s development and public health as well as global efforts to combat climate change.

Some might question whether expensive investments in natural gas will come at the expense of a renewable energy revolution. In fact, the reality is quite the opposite—barring a low-cost, grid-scale storage technology breakthrough, a major revolution in wind and solar energy cannot be achieved without adequate flexible power sources to meet peak load power demand. Natural gas and hydropower provide by far the best source of peaking power. With major constraints to hydropower’s expansion in India, gas-fired plants are essential to India’s achievement of the ambitious renewables targets it committed to in the Paris climate agreement last year.