The World Needs a Second Channel for Using SDRs

The multilateral development banks need to develop a second channel for mobilizing the world’s under-utilized special drawing rights (SDRs).

The World Bank, along with the other multilateral development banks (MDBs), was set up to provide long-term financing for development projects – including in the basic infrastructure needed for economic progress. Today that includes investing in the clean energy transition and pandemic preparedness, among many other things.

The IMF, by contrast, is supposed to be the source of emergency foreign exchange for distressed countries. Access to foreign exchange more than fiscal financing – so funding for imports and even foreign currency debt payments more than fiscal deficits. It isn’t really supposed to be a source of long-term financing, though it sometimes becomes one.

That is an important role. For now, the IMF has the resources it needs to do its job. It has access to $1.3 trillion between quotas, New Arrangements to Borrow, and bilateral borrowing, and it has lent out just shy of $150 billion — with nearly one-third ($43 billion) going to Argentina. It also has commitments to lend if needed to some large Latin American economies (Mexico, Colombia, Peru).*

It doesn’t really need any of the world’s spare Special Drawing Rights (SDRs) to do its core job.

A bit of history. SDRs are created by the IMF and can only be exchanged for hard currency – either through the IMF’s Voluntary Trading Arrangements (VTAs) or bilaterally with other members. Once they have been exchanged for hard currency, the underlying funds can be used freely. The IMF created 456 billion of SDRs (about USD $650 billion) back in 2021 – and since SDRs are allocated according to voting shares at the IMF, most of those SDRs were provided to the world’s advanced economies and China. As a result, most of the SDRs did not go to the countries most in need of extra foreign exchange.

Efforts to rechannel those SDRs have focused on the IMF for a few reasons that are not particularly compelling. First and foremost, the IMF seems like the natural home for making use of IMF members’ spare SDRs. It’s of course not the only natural home for doing so, and the IMF Executive Board has approved of 20 additional “prescribed holders” — mostly multilateral development banks — to make use of members’ spare SDRs as well. Second, IMF leadership jumped at the opportunity to use its members’ new SDRs by establishing the Resilience & Sustainability Trust. It has taken the MDBs longer to roll out their proposals for what to do with SDRs, and as the MDBs continue to focus on using the SDRs as hybrid capital — which most countries have indicated they cannot actually purchase — the rechanneling conversation naturally gravitates towards the IMF.

A third reason for rechanneling to the IMF is that the IMF was already in the business of receiving SDRs. Countries can lend spare SDRs to the IMF’s facility for low-income countries — the Poverty Reduction & Growth Trust (PRGT). Yet today the PRGT isn’t constrained by a lack of SDRs to lend out, but rather by a lack of subsidy financing. As SDRs are lent to the PRGT at the SDR interest rate (currently 4.179 percent) countries need to provide budget resources to offset the SDR interest rate and allow the PRGT to lend at a zero rate. From the standpoint of SDR rechanneling, this means very simply that the PRGT cannot currently make use of more SDRs: it needs contributions to its subsidy account not its loan account (budget resources not SDRs). In order for it to eventually take in more SDRs, more countries will need to wrangle their legislatures to provide the necessary budget resources — which countries have been slow and unwilling to do. As the SDR interest rate continues to climb, the need for more offsetting subsidies climbs too, making it less and less likely that the PRGT can become a bigger conduit for SDR rechanneling.

More SDRs thus don’t address the real limit on the IMF’s ability to provide concessional financing — the limit is subsidy resources, and political unwillingness to provide them.

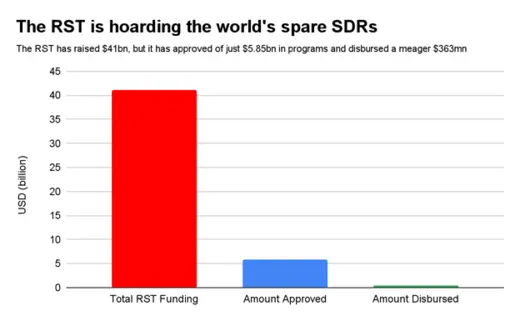

Yet, as we noted, the Fund also jumped at the opportunity to take in its members’ spare SDRs by opening a second channel for SDR rechanneling: the Resilience and Sustainability Trust (RST). This has become the main mechanism for SDR rechanneling. It has received commitments of 31.2 billion SDRs ($41.1 billion), with an initial aim to raise 33 billion SDR ($43.4 billion) in total. At France’s “New Financial Pact Summit” in June, IMF MD Kristalina Georgieva announced the intention to increase the RST’s fundraising goal by 50 percent, to 50 billion in SDRs.**

But that doesn’t mean the IMF has any plausible path to actually making use of the initial 33 billion, let alone the full 50 billion, in SDRs any time soon. With its mandate limited to providing balance of payments support to sovereigns, the Fund cannot directly finance projects that would actually raise resilience or provide more sustainable sources of energy. That is, in fact, the role of the World Bank.

Instead, the Fund is meant to advise countries to undertake climate-related policy adjustments — which unfortunately, albeit understandably, is not something that the Fund’s macroeconomists are well equipped to advise on their own. As Mark Miller of ODI has noted, to draw up RST programs the IMF has relied on the World Bank to provide “Country Climate and Development Reports” (CCDRs) and “Climate Public Investment Management Assessments” (C-PIMAs), which have both delayed and complicated the development of RST programs.

As a result, of the $41 billion in SDRs that the RST has taken in, it has actually disbursed less than $400 million ($364 million to be precise) to just 3 countries — Rwanda, Barbados, and Costa Rica. The board has approved programs for another eight countries, totaling $5.85 billion, which is still less than 15 percent of the RST’s total funding.

To make matters worse, in some cases the programs will be less than meets the eye. Egypt is supposed to get money from the RST (perhaps one billion SDRs), but the funds will simply go to pay back the IMF, which has already lent out $16.28 billion to Egypt. Egypt will make $4.5 billion in payments to the IMF next year, and $16.6 over the next five years. A $1.3 billion RST program, as has been discussed between Egyptian authorities and the Fund, thus provides Egypt less than 30 percent of what is owed in 2024 and a meager 8 percent of what is owed through 2028. An RST for Argentina would have the same uninspiring effect.

The RST may technically fit within the Fund’s mandate, but it simply isn’t a viable mechanism for providing any meaningful net flow of resources to low-income and lower-middle-income countries to support their development and support investment in expanding their access to clean energy. Actual flows through this channel are going to remain a trickle of the headline total – and the headline total is only a fraction of the SDRs that are potentially available to be mobilized.

The MDBs are in fact much better institutions to make use of SDRs than the Fund once you step back and think about it. As Mark Plant and Bernat Adrogué note, mobilizing SDRs through the MDBs would not only ensure efficient utilization of SDRs, but would speed up the recycling process significantly. The MDBs were in fact set up to raise long-term funds by selling bonds that provide investors with liquid safe assets. The underlying funds are used to invest in projects with a long-term return, but the development bank – like China’s policy banks – acts as a true intermediary in the same way a commercial bank uses deposits to fund longer-term loans.

The MDBs thus are well-suited to creating a channel for using SDRs that actually can raise and disburse real funds for development. They take payment for SDR-linked bonds in SDRs. The new bond could actually be traded for hard currency cash. It is thus functionally more liquid than the SDR deposits that most advanced economies now hold given problems with the VTAs. More on that later. But the SDR-linked bond would settle in dollars or euros and thus could be sold directly in the commercial market.

Multilateral institutions other than the World Bank and the IMF also can make use of SDRs — the IMF has made 13 multilateral development banks “prescribed holders,” meaning they can receive and make payments in SDRs. When the IMF’s Executive Board expanded the set of prescribed holders of SDRs, it noted that it did so to “enlarge the choices of members to use their SDRs, including settling financial obligations and potentially channeling SDRs to them, thereby increasing the attractiveness of the SDR as a reserve asset.” Opening an SDR channel through the MDBs thus could both boost available financing to the MDBs and make the global stock of SDRs more liquid.*** It is a real two-fer.

There aren’t any real technical obstacles to doing this right now – the technical architecture for selling SDR-linked, dollar, euro, yen, and yuan settled bonds already exists. The only current obstacles are political ones. Moreover, there is no reason why an SDR-linked bond could not have a substantially longer maturity than the 5-year fixed rate bonds that make up most of the Bank’s current issuance. An SDR bond series thus would help the Bank term out its funding, and provide a better match for its long-term lending.

Bottom line: until there is recognition that the IMF isn’t the right channel to mobilize trapped SDRs, no real money will flow to countries in need. And conversely, as soon as a channel is opened up through the MDBs and the MDBs can scale up their pipeline, big sums can flow.

There is a related technical issue. The IMF’s VTAs don’t actually work all that well. The IMF won’t say that of course, but it is the truth, and finance ministries and central banks have grown increasingly vocal about it.

The VTAs are set up to allow low-income countries to exchange SDRs for hard currency, with an expectation that the advanced economies will be suppliers of hard currency against SDRs. The IMF doesn’t provide clear data on the VTAs, but it appears that the U.S. has been by far the biggest buyer of SDRs through this arrangement: its SDR holdings amount to $162 billion, whereas its SDR allocation is just $151 billion, meaning that it has supplied $11 billion in hard currency. That is a peculiar burden to fall upon the U.S., because the U.S. reserve fund — the Exchange Stabilization Fund — is small by global standards, holding just $214 billion, or just 3 percent of China’s official and shadow reserves. Moreover, the Exchange Stabilization Fund appears to be running precariously low on dollars, with its dollar balance hovering just north of $16 billion, which limits its operational flexibility. Yet insiders say privately that the system would gum up and freeze if any large advanced economy — particularly the United States — ever stopped supplying currency, let alone sought a role reversal of selling its own SDRs for much-needed dollars.

An SDR bond that mobilized real funds for development would require some technical reforms to make the VTA work better – as the MDBs might be exchanging $20 billion a year in SDRs for hard currency to support an ambitious balance sheet expansion.

The world has $12 trillion in official reserves (more really, as some countries hide their true reserves), so IMF members can easily supply liquidity against $20 billion of SDRs. Coupon payments on the world’s dollar and euro reserves ($10 trillion) will soon top $300 billion.

But there needs to be an expectation that all the large reserve holders participate in the VTA market much more actively – the big buyers of SDRs should be China and Japan, but also Singapore, Saudi Arabia, and Switzerland. Countries with so many reserves that they are shifting massive sums over to their sovereign wealth funds clearly have capacity to supply liquidity to support the provision of global public goods. A smart way to do this would be to change the queuing formula that the VTA uses: rather than having countries top up their SDR balance (i.e, supply more currency for SDRs to buy back SDRs) in the event that they have rechanneled funds elsewhere, the SDR Department should pin VTA participation to total external reserves. After all, the productive use of global reserves strikes at the purpose of the SDR system, and it is not the scarce reserves of the Exchange Stabilization Fund that are in need of productive reallocation — it is the trillion dollar stockpiles of the East Asian and oil exporting countries.

Making a new SDR channel work – and really work, not just allowing countries to claim that they are meeting their G20 commitments in communiques – requires real global cooperation. But it isn’t technically all that difficult …

* The U.S. is proposing to shift funds from the New Arrangement to Borrow to quota.

** Germany has provided it with euros in lieu of SDRs, as Bundesbank apparently objects to any actual use of SDRs. The U.S. also promised to provide dollars instead of SDRs to the RST because some parts of the Hill share the Bundesbank’s dislike for SDRs.

*** There is a perception that since SDRs are created by the IMF they also need to be mobilized through the IMF. The EU has enshrined this prejudice in a directive that says, more or less, that most uses of reserve assets through the IMF aren’t monetary financing. That directive doesn’t say that other uses of reserve assets (SDRs) are necessarily monetary financing, only that SDRs channeled through the IMF are deemed to be consistent with the EU’s rules. The actual binding constraints are the requirement that any use of the SDR has to preserve their reserve asset character and protect their role as a monetary asset on the balance sheet of a Eurosystem central bank, and thus they shouldn’t be used to substitute for budgetary financing). Shifting from what effectively is an SDR deposit at the IMF to an SDR bond paying the SDR interest rate issued by the World Bank would be a standard reserve transaction, akin from shifting dollars from the Fed’s reserve repo facility (a de facto deposit) into a U.S. Treasury note held in the Fed’s custodial accounts.