Stephen C. Freidheim Symposium on Global Economics

The 2020 Stephen C. Freidheim Symposium on Global Economics discusses the implications of the coronavirus pandemic on global economic policy.

This symposium is presented by the Maurice R. Greenberg Center for Geoeconomic Studies and is made possible through the generous support of Council Board member Stephen C. Freidheim.

The full agenda is available here.

Mark Carney will discuss his perspective on how to rethink valuation within the market economy, as well as economic policies for a post-pandemic world.

STAFF: (Gives welcome remarks.)

FINK: Welcome to today's Council on Foreign Relations virtual Steven C. Freidheim Symposium on global economic[TT1] s...our keynote session with Mark Carney. I'm Larry Fink, Chairman and CEO of BlackRock and a member of the Board of Directors of CFR and I'll be presiding over today's discussion and taking questions. This symposium is presented by the Maurice R. Greenberg Center for Geopolitical Studies, it is made possible through the generous support of the council board member Stephen C. Freidheim. Mark Carney, a friend, is currently the Vice Chairman of Brookfield Asset Management, and head of ESG and impact fund investing. Mark served as governor of two countries, not just one—pretty amazing—of the Bank of England from 2013 to 2020 and prior to that as the governor of the Bank of Canada from 2008 to 2013. He was a chairman of the Financial Stability Board in 2011 to 2018 and he's currently the United Nations Special Envoy for climate action and finance. Nice resume mark.

CARNEY: Thanks, Larry (laughs)...

FINK: Really good, really impressive. Anyway with that background, let me just start off and ask, where are we, in terms of the global economy with COVID and with some of the de-globalization trends that we're seeing in the world today?

CARNEY: Yeah, well thank you and let me thank the CFR for inviting me, and you for doing this, Larry. Why don't I start with a few comments on your question, but can I also throw it back to you and get your perspective on it as well, because I'd like to...I think people would like to hear and I'd like to hear how you see these issues from your unique vantage point. I guess first thing is, in terms of the broad contours of where the economy is going—I'm more confident about that than any of the precise numbers—it's going to be for many of us a bleak winter, a difficult time with the virus renewed slowing. But followed by, you know—here's an insight from a central banker—followed by spring and potentially quite a strong summer, and reasonable confidence in terms of the bounce back.

And obviously I'm not an epidemiologist, I can't give any precision around vaccination timelines, but if we look at how economies performed, coming out of the second quarter into the third quarter, as de-lockdowns took place and economies re-opened up, pretty broad based strength across a number of our economies and we're seeing it as well in Asia where things have proceeded. We have a financial sector that is strong...in part because of steps taken prior to this crisis, and I think we should give full credit to that, but also by the very timely action of central banks and others to ensure that there wasn't the feedback loop through the financial sector.

And then thirdly, you've got pretty strong, given what's happened—and there's a caveat with that—but pretty strong consumer and household balance sheets. It's been drawn, they're being drawn down a bit in the U.S. Of course, that's a topic of...probably as we're speaking, it's a probably a topic in front of Congress in the U.S. about additional stimulus, but in general there has been a rebuild of consumer balance sheets as well. So all of that bodes, in the limited past history we have, all bodes well for a pickup, so, confident in terms of that contour...no particular insight about the orders of magnitude.

But I'll make two other points, one is that what's exceptionally important is that policy remains stimulative as the economy picks up—it was designed as a bridge, we will get this initial bounce back, but there is a lot of reallocation that still needs to happen. We're in a disinflationary environment in the near term so central banks have policies struck correctly. But fiscal policy, and this is sort of my last point, it will need to shift in 2021 and into 2022 from COVID to capital, if I could simplify it.

In other words, emergency type support spending towards the type of measures that are going to either invest or encourage business investment, setting the direction of the economy. And I'm sure we'll have a chance to talk about building a more sustainable economy and what's needed to do there because the handoff to the private sector is going to need to happen in...over course of next year if we're going to take that initial bounce and extend it. But that's kind of enough for me, I didn't touch on fragmentation, we should...maybe we'll come back to that. But can I throw it back to you and get your sense of how you're seeing things?

FINK: Well, I started off as being an optimist, an optimist that I do believe we are going to have multiple choices for the vaccinations. I happen to have conversations with a bunch of the pharmacy owners yesterday and, you know, we will have fully distributed vaccinations, at least in the United States and other countries. And obviously we need to make it broad and worldwide. We should assume by May/June, be fully distributed by then. And the Pfizer and the Moderna will be starting to be rolled out this month in December, in parts of the United States. One thing key is the rollout is going to be centered by every government, it's not going to be the private sectors decision how it's rolled out so we're all going to learn how it's rolled out. We're also going to have to learn about what is the better vaccination for somebody who's sixty versus somebody who's thirty, and so we have many unanswered questions.

That being said, I believe the industries that are being harmed....the industries of...the service industries that are focused on people, the aggregating of people, whether that's cultural events, or large business events, vacations, hospitality, those industries are still going to face some severe headwinds until you actually feel safe. And I think it's going to be longer than the June period of time where people are going to feel emotionally safe to do and go back to normal. So I would say A) we're not going to see a normalcy. I don't believe businesses are going to go back, and the reason why, getting back to your statement, Mark, related to U.S. balance sheets have improved a lot...I mean, think about the average worker in New York, who spends four hundred, five hundred, seven hundred dollars a month on commuting costs, they're not commuting, they're working from home, they're saving that money.

Now, obviously, that's harming parts of the economy, but they're saving that. In many cases, people move back to their families’ homes and so they're saving rent and so there's actually quite a buildup of savings. And you know, some of that savings is being used right now in investing, that's why we're seeing some very large, I would say retail activity in the global equity markets. But I would say, the consumers are alive and well in many cases. We're building, we're spending money on our homes, we're refurbishing our homes, we're building home offices. So the one beautiful thing about, I would say, the written human response to COVID is we're responding, we're adapting, we're growing, we learn we could do business like this remotely now.

And I do believe some of these changes are wonderful for society, but it's going to leave society in a very large imbalance. Segments of the society are going to be still harmed, big cities are going to have many more years, it's going to take for them to adapt, because I think more and more people are looking...they're enjoying the fact that they're working from home. Even though people cohabitate and humans are social animals, they could find that social connection somewhere else, maybe back at a restaurant or at a vacation ultimately, but I would say, because of the strength of the fiscal policy—which I want to talk to you over the next question about, more fiscal policy—the strength of a global response for monetary policy, I think all things considered, and when you think about this virus and the impact of society, we're in a pretty good position.

I mean, that is not to say...society has more imbalances, there's more inequalities than ever because of the imbalance of the economy and it's going to take years to rebalance people's jobs from one sector to another. But I believe overall, we can feel pretty confident that we have medical solutions on the way. As you framed it, though, December and January going to be pretty dark, we're going to have much rising infections. And so you know, markets are good about looking beyond the problem and we'll see. Corporate earnings are very strong and so I'll leave it at that. I'm probably a little more optimistic than most on these issues.

CARNEY: Just one thing, if I can reemphasize from what you said, which is, you know, this is a terrible situation we've all been through and unfortunately it's going to endure for a while, but some of the response has been incredible— and leave aside policymakers—but of individuals, of people in their communities, companies with their suppliers and their clients etc. And what we need to do is build on that response, the best of that response, as we come out of it. And you know, part of it will be, and as you rightly say, look, the decisions about the vaccine rollouts and the sequencing of that, those will rightly be decided by governments.

And hey, here's a newsflash for those of us on zoom, who've been conducting our life on zoom, we're going to be at the end of the queue for that because we've been able to function effectively through this process. It's the essential workers, it's those most at risk, who need it to get back in. I remember, very early on Bill Gates said—we don't need to hold him to it—but he felt he would be almost the last person to be vaccinated. Now, no person on the planet has done more to ensure that we have these vaccines than Bill Gates, but it gives you a sense of the sequencing. So anyways, building on the best and moving forward it's not just good economic policies, it's good social policy.

FINK: I agree. Any word on greater/more need of fiscal policy? Any commentary about the over reliance on monetary policy from a perspective of a central banker?

CARNEY: Yeah, I think...well I think two things. One is that there's the fiscal policy, I think we should distinguish between fiscal policy which is a pure bridge, which is replacing for the parts of the economy that had been shut down, and you alluded to that earlier, that will fall away, or most of that will fall away as the economy restarts. Now, unfortunately, not every restaurant, hospitality, will come back, retail shop will come back. So there will be a bit of a gap, but you get a drop.

If you look at the UK, UK deficit, nineteen percent of GDP is the projection that the Chancellor put out last week and let's say almost half of that falls away as the economy restarts. But then you have a choice in terms of what's left, do you immediately move towards some consolidation or reduction of that deficit? Or do you provide the support needed as the economy comes out? My bias would be towards the latter, but with the caveat that—and let's say, just to keep the numbers simple, that you're running a nine or ten percent deficit at that point, once it's been cut in half—the question is, is that money being spent well, is it being spent in a way that's going to regenerate and build the economy? And the answer is, if it's just exactly the way you were spending beforehand it's not being spent well, it needs to be repurposed.

And one of the things we've emphasized, and I'm thinking from a COP perspective, is that actually this is a time—it wasn't the case in 2008, but it is the time now—we're pointing the direction towards a more sustainable economy, building on renewables, retrofitting houses so they're not leaking heat, and moving towards a sustainable vehicle fleets. All of these things, actually are capital intensive, big multipliers for GDP, and their job heavy and so that's the mindset. Now, we've seen that in Europe with the German budget, the French budget, UK ten point plan is in that direction.

We see it in the incoming administration's priority in the United States, we saw it a bit yesterday in Canada in terms of what they were saying, and if we can come out on the sustainable side and the digital side—actually is the other point, which is to pick up on some of these changes in our economy, reinforce those in a way that are going to generate jobs—again, the handoff from that initial bounce we'll get as we come out to more sustained growth is much more feasible.

FINK: I want to move to sustainability and also want to talk about Janet Yellen in a second. But let me ask you a question from your history as a banker, are you worried about the deficits at all? Are you worried about rising potential inflation? Where should...because the markets are not worried either at the moment...can you talk about that?

CARNEY: I think, again I'd like your take on this as well, my view is that if you wait until the markets are worried it's too late. Your responsibility as a manager, whether you're a finance minister or chancellor or whatever, as we come out of this is to set a path, reasonable path for fiscal policy and some discipline around it. And that is going to be important and that doesn't mean moving to a balanced budget overnight. We all know we're in a low interest rate environment, which is likely to persist for a period of time, but you don't want to be solely reliant on the goodwill of markets and low interest rates because after all, our objective is not to have interest rates rise for their own sake, but our objective is to grow jobs and the economy and productivity, economy, and wages for people and with that will ultimately come higher interest rates, so we actually want this…(inaudible). So, organize yourself so you do it.

So I do think having fiscal frameworks put in place as we come into 2021 or in 2021 will be important in the major economies, first point. And do I worry about inflation? Look, in the horizon of normal central bankers or (inaudible) two to three years that horizon for monetary policy, it is unlikely to materialize and to a serious extent, in fact, we need some inflation to come off from where we are, because there is a lot of spare capacity in this economy. You go back to the summer of this year, one third of UK workers are either unemployed or on the furlough scheme, so they were…(inaudible). They only got that down to four and a half percent unemployed and nine percent, or ten percent rather, on furlough so you have fifteen percent idle in the economy when things were picking back up.

So there's a lot of —I can replicate those numbers elsewhere—a lot of spare capacity is still there. That said, the point is to reflate the economy, to pick it up and as you get into the medium term, as a central bank, you want to have that problem. So they've positioned, this is my last point, they have positioned themselves, led by the Fed, that there will be some overshoot of inflation, to make up for the missed inflation. That's the feds new framework, but some, not a lot and that, in my way of thinking, hopefully starts to become an issue, you know, years three, four, five as we come out of this.

FINK: Good. Mark, you worked with Janet Yellen on a paper for the G30. It was about government's policies related to policy and climate policy, investments towards a net zero carbon world. As we move past a post-COVID world and we have a recovery that's full and secure. Tell me about how you see the new green economy evolving, but also tell me, what would you recommend to governments going forward in terms of moving sustainability as a key priority for all governments.

CARNEY: Yeah, so we talked a moment ago about setting the direction for the economy as we come out of this and sustainability is a big portion of that. And Janet and I, along with Philip Hildebrand, your colleague, and Gail Kelly, and Helene Rey did this research project and produced this paper a few months ago. And the core point there was, look, if you give the financial...if we give the financial sector what they need, which is the right information, TCFD type climate disclosure—BlackRock was there at the inception of that, developing that—if we give them the markets they need, the tools to manage these risks they will manage these risks and more positively seize the opportunities towards net zero.

But particularly if governments have credible policy, so if you if you have a sense that countries are serious about moving from where we are today to where we need to get to, because for example, in the UK and Europe, saying internal combustion engines...no new internal combustion engines after 2030 for cars, hydrogen fuel blends in the middle of next decade, a carbon price path that is rising over the course of the next decade, all of those things you know very well from your career, the market, if it's credible, will pull forward those adjustments, you'll invest in the future, not the past. And what we did was to use the history of central banking and the insights from central banking to reinforce this point.

And, of course, Janet, and I'm speaking in her previous capacity not her future capacity, but had been clear about the advantage of carbon pricing, very well understands these dynamics and I think it's important point, the point for a policymaker, and I'll finish on this is look, if you act out, if you're credible, you build that track record, your job gets easier. You know, the economy in 2030 is much easier because the market started to invest now, and a lot of people make a lot of money along the way solving this problem. So then when it really bites, it doesn't. And that's a key point. It's obvious maybe to you know, most of us on this on this discussion. It's not as obvious if you're in the thick of policymaking, which is why we felt it important to get it out there.

FINK: Our experience in 2020, because of COVID, if anything COVID has accelerated finance, bringing these issues forward even faster. The amount of reallocation of capital that we are witnessing has never been greater. It's more than doubled from last year and we think it's going to double next year. And that is going to be the surprise for so many companies as we are seeing this whole vast reallocation of capital, it's happening extraordinarily fast. And that's the marvels of finance bringing things forward, by identifying a problem moving forward.

So my question is, as finance moves us forward though, again, are we seeing enough from the policymakers of government? Are we seeing enough? Are we...you mentioned infrastructure and the need for infrastructure, how can we, in the United States in the UK, and Canada and other countries, how can we bring this all forward? What do we need to do? You mentioned infrastructure earlier, how do you think about the combination of public and private related to bringing this forward faster? And what should we be doing about that? What should members of Council on Foreign Relations do about it?

CARNEY: Yeah, I think the key is looking for the types, of course it's both public and private, but it's the public that unlocks the private, the orders of magnitude will be driven by the private. Let's think of a couple tangible examples. So in the UK, which has one of the largest proportion of power generated by wind, it's actually helped make wind economic, huge opportunities for offshore wind, and actually this is part of the UK government strategy. One of the things needed though, is the interties as the wind comes from offshore, getting it effectively into the grid and efficiently through the grid. That's a common issue in terms of grid stabilization, grid efficiency, so that as renewables build up and more and more part of our power generation, ultimately has to be all of our power generation, you need these public investments, particularly early on, to make it efficient.

Canada, we have issues in terms of interprovincial grid ties, I mean, there's an opportunity in this country to be one hundred percent renewable if we wanted to, so those are examples. Things like, there's very basic infrastructure examples, and this is, you know, it's a fine line between public and private, but think about charging infrastructure for electric vehicles, okay? One of the biggest impediments to more complete adoption of electric vehicles is people worried about running out of their charge. Now, as the life goes on, or they extend the range, then that becomes less of an issue. But it's still an issue for a relatively small amount of money in the big scheme of things relative to carbon debated, and pulling forward an industry of the future, you build up the charging infrastructure in some sort of sharing way.

So there's a series of infrastructure opportunities there, I think, as well, incentives, and again, you calibrate it differently in different environments, but just on the home side, I mentioned retrofits in the UK, it's one of the biggest losses of carbon is just that. I mean, newsflash, homes are drafty in the UK...(inaudible)—I'll tell you they're less drafty in Canada for obvious reasons—and they need to stop this inefficiency so the government is going to take steps there and you provide some balances and incentives, same thing on the commercial side, so there's a series.

Can I make one other point, though, which is, and this goes to a market point, there's a few technologies that kind of need to happen. So about sixty percent of what we need to do is more or less economically efficient already. It's the balance where we need innovation, scale, etc. Think hydrogen, carbon capture, storage, and use. And that's where there is an advantage, both in terms of regulation that encourages it, but also some public investment that goes beyond infrastructure, actually goes towards primary innovation and R&D.

FINK: Your objective for the COP26 is ensure that every financial decision takes climate and climate change into account, and you're working on a framework and we have different data sources, whether it's TCFD, or SASBE, but how are we going to move this forward faster? How do you see governments are going to get involved in making sure we have, I guess what I'm saying is global standards, global standards that we all operate, and how do we get there and, you know, we are looking for more and more companies to report under SASBE and TCFD. And as we do that, we have more data, but tell me about what the COP26 is going to be doing related to moving that forward together with the private sector.

CARNEY: Yeah, absolutely, and so that's the core objective and I think that core gets to this is about mainstreaming, thinking about climate change, just like you think about credit, you think about climate change, you think about interest rate risk, when you're making a loan and investment, etc. managing risk. In terms of specifically...and at its foundation is disclosure, it's not just about disclosure, but it's foundation is disclosure reporting, and so we've made it clear that we want to get to a position where disclosure is mandatory TCFD-like disclosure is mandatory for public companies so you have consistent and comprehensive application of this. So the private sector has taken this a long way.

As I said earlier, you guys were in there early in the development and endorsement of it. We're up to one hundred and seventy trillion dollars of balance sheet that supports TCFD disclosure, from sovereign wealth funds to asset managers to banks. So that's the market voting with its feet, that's what it wants. Now is the time for the public sector to say, okay, here, we're going to embed this into listing standards, we're going to embed this on stock exchanges, we're going to embed this into reporting standards through the IFRS is one example. In some countries, it's going to be legislated the UK, the Chancellor announced two weeks ago that will be legislated in UK, Europe is moving through its disclosure standard.

And what we need to do and what we're trying to do for COP a) is to get the big countries to move towards mandatory, and then b) make sure it's as consistent as possible—in other words, based off of TCFD—across all those jurisdictions, because, as you well know from international regulation, there's different histories of different structures and adjustments, but you need to get to that sort of three quarters eighty percent commonality. So that you know, if I use BlackRock or Brookfield, we look across the world we can compare, and we know what we're investing in and where the opportunity is and not. I think we're going to get there because the private sector wants this, it's imperative, and now the public sector is listening.

FINK: I would say for the private sector, we need it, and we need to have one common standard. I want to ask one more question before we go into Q&A. And that is, you know, as you talked about some of the governance. In the United States we have a new administration on January 20th, and it appears that maybe this new administration is going to be focused more on multilateralism, in that respect now with COP26 and what you're trying to do, how are you going to be able to navigate this next year with a COP26?

CARNEY: Well, first thing, it's incredibly positive, the engagement of the new administration on these issues, the seriousness with which they take it. And these are individuals, you look at the individuals who've been named or expected to be named, to senior posts, they know these issues, they've helped develop these policies, they think about it, they understand the interaction between policy and markets. And, you know, I can't keep track on exactly who's been named versus who's likely to be named, but you're familiar with I think many of them, if not all of them. So the good thing is this administration will hit the ground running. The U.S. is absolutely essential, is the essential nation on climate issues and so many other things.

And it creates...and it will also reinforce this balance between public policy and the private sector, which is essential. We will not get to net zero without the innovation of the private sector, it needs the right policy framework. So that engagement is crucial, makes it a greater possibility. And I'll go back to something you said at the very start, which is around fragmentation, global fragmentation. And we are in a tough place on global fragmentation, it started on trade, it's there on technology, there are real issues underneath it.

Climate is the one area, and it's not assured, but it's the one area where there can be a global coming together of the major powers. President Xi's commitment of a couple months ago at the General Assembly, virtual General Assembly, to net zero by 2060 is huge, as is Prime Minister Suga's for Japan, and South Korea's. If the Biden administration has made clear its intentions in these regards, it has I should say, then that creates an opportunity to bring it together in the UK and Italy. And I'll remind—this being the CFR, they'll know it—UK, chair of the G7, Italy chair of the G20 in 2021, both of us hosting COP together, we have a chance for alignment. And so if you care about these issues and you want to help shape them, now's the time to be involved.

FINK: I would just ask, as we get governmental alignment, we have alignment within government. And so we have consistency with the banking regulators, the security regulators, that there is a commonality—with labor regulators—that there's a commonality so we in the capital markets, can execute that strategy. But if there's an inconsistency among government within regulatory supervision then it's going to be harder to execute. And so beyond just having governments together under one commonality, but making sure that we have a consistency in Europe, in the United States, throughout the world, that the security regulators, the banking regulators have the same common platform. And so there's not a arbitrage bias between private sector entities and publicly regulated entities.

CARNEY: Can I just add one word on that before we open it up? Because I totally agree on that. And let me just say from a process perspective, how we're trying to do this, which is, okay, TCFD is the gold standard, FSB, G20, (inaudible), but put Bloomberg in charge of private sector comes up with Bloomberg, as in Mike Bloomberg, not Bloomberg the data provider, comes up with the answer, it's gradually built out, now the public sector needs to bring it in. We have similar issues around how...what's the best way to show the extent to which a pool of assets is positioned towards Paris alignment or towards net zero? You know, it's not a blackbox ESG rating. It's not a simple taxonomy of green and brown. And these are issues you think a lot about, what's the gold standard on that? You need the private sector to develop that, but then you need the public sector to broaden it out consistently around.

Third issue, and I'll stop here, which is the market for nature based solutions and carbon offsets, things three hundred million dollars a year at present, it should be one hundred billion dollars a year is where it needs to get to. Our companies are now moving towards net zero led by Microsoft, Unilever, others. And these net zero plans, they need the net in the net zero for a period of time we need a profit market. Who do you go to to design the market, you get the best in the private sector, all the plumbers to design it.

Bill Winters is leading this effort with the Annette Nazareth who you know, well, you know both of them well, they're developing it. We'll need the public sector then to decide, in 2021, whether or not to embrace it and put it in place so that we have a consistent global market. And this last point will be critical for private flows to developing economies as part of it because that's where many of the best opportunities are.

FINK: I agree. Laura, let's open it up for questions.

STAFF: (Give queueing instructions).

We'll take the first question from Jeff Rosensweig.

Q: Yes, I'm a professor from Goizueta Business School at Emory University. I direct the John Robson program for business, public policy, and government so I'm glad to hear the need for public/private aspect. John was the deputy treasury secretary under George H.W. Bush. I'm wondering, in the short run Governor Carney said we need to have fiscal policy kicked in with monetary policy, because we have a great under utilization of labor, then labor should be involved with the retrofitting that could be very labor intensive. But we get out ten or twenty years do either of you see, as artificial intelligence kicks in, will we have a UBI in the U.S. and a universal basic income in continental Europe and in the UK?

CARNEY: That's a great question, Jeff. I think... and you've kindly given me the 20 year time horizon, which is which is helpful. It's probably the right time horizon for full application of such a general purpose technology such as artificial intelligence. And by the way that's a faster application than we've seen previously with such sort of transformative technologies. I think one of the one of the things where policy and the private sector can come together is thinking about the extent to which we can apply the technology not purely in a labor displacing, but in a labor augmenting sense.

So how do you take the...I mean, in some respects, it's very been described to me I think, rightly, as a prediction machine. It's a very effective way of making predictions. But the predictions require a certain in a certain qualities of data, certain defined problems. It requires a loop that then is self reinforcing and then it requires judgment on what you do with those predictions and that information. And so, how do we take service tasks, including education, finance, others, and supplement them with AI in a way that, as I say, is augmenting? Of course, it requires skill development, but it's not purely about that.

So it goes actually back to design of the product. And I think the other point is, which does go your point, is that we are in a need to have...there will need to be fairly substantial reallocation of people moving jobs, and there will need to be some support for that. Now, whether it goes all the way to UBI, I think is, you know, it's a big societal choice. And it is also, and I'll stop here, you know, at scale, the scale people talk about it, the actual basic income that is provided, can be provided and afforded, tends to be not basic enough, is the experience. So fiscal constraints, which will reemerge at some point, limit the ability to have something as universal as that, in my judgment.

FINK: I guess I'm supposed to answer that question too for a second. So I'm pretty optimistic about how jobs can be created. I think economists should study the impact of COVID on jobs, because I think this is a real live and very sudden shift in how jobs are lost and how jobs are created. And I think it's a real great example of the resiliency of economies. You know, we've lost millions of jobs, we still have seven plus percent unemployment, those who were furloughed, similar to what Mark was talking about the UK economy, but at the same time, three or four companies that are flourishing right now, without naming them, added over a million jobs.

In Texas today there are more jobs in sustainable energy than there are in hydrocarbon industry. And so we're witnessing, that's much slower, that evolution, but I think that the transformation of jobs in such a short period of time and during the COVID year of 2020, is an example how economies, robust economies can move. And the key is, to me is just as much psychological for so many people, because with AI, with changes of technology, we are going to see big changes in jobs.

And, you know, some industries are going to be growing dramatically in jobs that we're witnessing, and some jobs are going to be eliminated through technology. And the key is making sure that we have the resiliency of an economy to help those...either they may have to move, they may have to change careers in different industries. But we are witnessing a rapid transformation of our economy now, the utilization of zoom, working from home, working remotely, you don't need as much computation people who are helping you commute I mean, these changes in evolution are occurring just in time and I would argue that we could do the same. I'm not sure we have to go totally to a universal type of wage. I'm not an economist to understand that. But I am so impressed on the resiliency of the economy to create jobs. (Inaudible) Mark, anything more than that?

CARNEY: Well, I'll just reinforce that point, which is you look at the—I'm most familiar with the figures for the UK—but you look at the latest lockdown and the mobility statistics for the latest lockdown, and it's about forty percent as severe as the height of the lockdown in the spring, so there's two interpretations of that. One is the negative one, or the cynical one, is Oh, people aren't locking down. That's not the case actually. What is the case is that the adaptation of society in the economy to minimize the risk to have a form of lockdown that still allows children to go to school, the adaptation of restaurants, the restaurants that permanently closed, but now deliver, Deliveroo or Uber Eats—I should probably mention all the potential...anyways—but you know, deliver to the door, that adaptation, adaptation to dental and other services, all of that adaptation in time.

Last point, is that one of the things that we're seeing at least during this period is that most of the reallocation has happened within sector. So you think about how retail is shifted how hospitality shifted, and you're shifting within sectors. Now it's easier, it's not easy, but it's easier to shift within sector for an economy than to go from agriculture to manufacturing or manufacturing to services, those are much more disruptive adjustments. And if this is a precursor of how the economy is going to adapt to technology, again, it's very, it's very positive. I don't want to minimize…you know, there is a lot of hardship, but it is it is a positive indication.

FINK: Ok let’s open up for another question.

STAFF: We'll take the next question from Seema Mody.

Q: Governor Carney, do you think pol...—this is Seema Mody, global markets correspondent at CNBC Business News—do you think policymakers and the market are overlooking the complex effort involved in distribution of a vaccine, keeping it at ultra low temperatures, the role, the massive role of the public and private sector to ensure it doesn't spoil? And how that could potentially delay or prolong the return to normalcy in terms of economic growth and therefore greater reliance on stimulus and fiscal policy?

CARNEY: Yeah, thanks, Seema. And thanks for defining yourself (laughs), this puts me on guard. No, I'll give a direct answer to that, which is that, and as part of what I said at the start, which is I was more confident about the contours of the recovery than the precise timing or numbers around it very much, because of these issues around...of course, it's not vaccines, it's the vaccination that matters. And the rollout, you know, there will be challenges with the rollout. It's never been done on this scale or speed.

And some of the drugs have, as you referenced—some of the drugs, I should underscore—have these requirements. That said, from an overall stance, and first from a market stance, what matters is that over the course, I think the judgment that's been made without being overly precise about which week or quarter, the judgment is that over the course of 2021, there will be widespread vaccination in a number of advanced economies. Very importantly, this happens as well in the merging and developing world, of course. So that's the first thing.

And then looking forward, looking from today as a policymaker, there is more confidence than there might have been three months ago or four months ago about the wisdom of a bridging strategy, trying to bridge from where we are today to that point where you do have vaccinations. So if you can provide the stimulus, or the support, I should underscore this is support, not stimulus, it's there to get us from where we are to where we need to get to, you do. But that said, when I left the scene as a policymaker in the middle of March, the thinking had been that we were bridging to about this period, now. And so it has been extended, there will be more scarring, there will be more adjustment that's necessary. That is, you know, and a lot of tragedies happen along the way so that's difficult. But I think the overall stance remains the same and the strategy's being validated as we speak.

FINK: Alrighty, want to go to the next question, please?

STAFF: We'll take the next question from Laurie Garrett.

Q: Hi, thank you very much for your wisdom, gentlemen. I'm Laurie Garrett, with MSNBC and Foreign Policy. And my question is, in the very, very short term, what are we going to do about the edges of collapse of public transit systems in nearly every major hard hit city in the world? And how will we bail these out? And is this an opportunity, realistically, to bail out public transit, particularly subway infrastructures and trains, and modernize them, make them more sustainable and improve them in the process?

FINK: Mark?

CARNEY: It's a great question. I think that obviously we're planning, authorities have to be planning for the economy where it will go not where it is at present. And that is, yes, Laurie, you're right, it's very expensive at present and it's going to require some restructuring. There's certain elements that might be brought forward—now, it's very city specific—might be brought forward. So one of the things that, for example, on buses, that I know, in the UK is thought about, has been thought about, but perhaps there's an opportunity, which is that, buses run specific routes, we all know that. There is... well, of course, we have the technology, we have the capacity, we have the ability to, to bus pool, if you will, as opposed to carpool in a sort of Lyft or Uber-ization of public transport. Those are the types of things you could see some authorities looking at.

But I think the general point, look, we're going to return to…my judgment is after a period, we will return to a position where very large numbers of people want to get into city centers are going to be relying on safe and sustainable public transit. And so that the investments will be you know, we need to maintain these systems. And Laurie, if there's an opportunity to modernize them, the step change, it should be taken in those jurisdictions that can afford to do so. But Larry…(inaudible).

FINK: Yeah, let me just respond to that. I would almost link it to the question that Seema asked. I think until you feel safe the utilization of public transportation is going to be limited. And it's going to be a period of time post-vaccinations, when they're freely available. And if the estimates are correct that vaccinations are freely available May, June, July, in the developed countries, it still will not have that psychological impact to people who still feel safe.

You know, I've asked questions of people, how long do you think we're going to be wearing masks post vaccination. And I think those are all interconnected to this whole concept of aggregation and as Mark said, driving the cities, the vibrancy of cities. I believe cities will once again become vibrant and the utilization of public transportation will be strong. Yes, I hope this creates a movement towards modernization of arcane, old transportation systems. Most cities in the world need to do that, but obviously, it's highly expensive, and hopefully that is another mechanism for public/private, that you know, then we have to change your entire financial system of municipal finance, and start relying on other mechanisms of finance.

But as I think I said in the earlier statement, I don't believe all companies are going to have one hundred percent back in offices. I don't believe companies are going to have aggregating one city as their prime office, in any jurisdiction today, whether that is in Asia, or Europe, or North America. And so I do believe the concept of how we aggregate our people, and the need, and what types of people we need in an office all the time, and what type of people can we have working remotely, these are all being decided right now and we're all trying to evolve these decisions.

But I would just speak for BlackRock, most BlackRock employees are working remotely. Many of them are happy working remotely, many of them are happy with that extra savings that they're not paying, you know, commuting costs, and so this is all going to change and evolve. But I do believe once people feel safe, and people feel comfortable again, and that's not top of mind, I think we are slowly but surely going to be able to resolve many of those attitudes and having people coming back to the office.

And I do believe we'll find some form of normalcy, but normalcy in 2022 is not 2019. We're learning from this and we're learning this in many ways, so maybe the city centers are not going to be as vibrant as they were as 2019, but maybe the suburbs are even more vibrant. And so we're seeing a shift in, I would say, societal attitudes and these shifts are not bad, but these shifts mean movement and we all need to adapt with that movement.

Laura, another question.

STAFF: We'll take the next question from Somini Sengupta. And as a reminder, please identify yourself with your affiliation.

Q: Hi, I hope you can hear me.

FINK: Yes, we can hear you, Somini.

STAFF: Excellent. This is Somini Sengupta, I'm a climate reporter from the New York Times and a Council member. Thanks for taking the question. My question is really about when you look at where the COVID economic recovery money is going right now, Governor Carney, how concerned are you about how much of that is going into the gray economy, what you call the economy of the past? And how much of that is going into, you know, helping pivot to a green economy?

CARNEY: Yeah, well I think I could say in terms of the United States, we haven't yet seen that recovery money, we've seen support money. In those economies where we have seen recovery money, recovery budgets, and I'm thinking of the European recovery fund, seven hundred and fifty billion euros, the French budget, the German budgets, both sizable, the early stages of the UK budget, early stages of the Canadian fiscal response.

Let me speak to the European ones and I'll include the UK, the UK was explicitly only about sustainability. The European money, a third of that money is for sustainability. But that actually, in my judgment, that lowballs it because it looks purely at a euro figure relative to the overall spend. And once you put in place the sort of shadow prices, so in other words, regulation on hydrogen fuel blends, phasing out internal combustion engines, expectations of floors on carbon prices, all the things that Janet and I were...Janet Yellen and I were, you know, kind of alluding to in this report, the sort of future path of policy, it is a much higher proportion of the actual spent.

So actually, I think when governments, at least in Europe, Europe and the UK, have had to put money on the table they have pointed this direction. And I'll just refer to, it's early stage, but the Canadian fall update, so called fall update—that's not what it's called, that's UK, anyways—the statement that the finance minister, Freeland, made yesterday, had similar contours to it. And I think this is quite, you know, sensible policy, because as I said earlier, not just because of the need, and you're well aware of Somini, but it actually....the job multipliers on some of this is quite significant and at a time when we're really going to need it.

FINK: I think we have time for one more question, maybe.

STAFF: We'll take the next question from Tom Glocer.

Q: Hi, Mark. Hi, Larry, Tom Glocer, for this purpose I suppose last time I saw Mark was a meeting of the Morgan Stanley board in London so I'll identify with that today. The question I had was, COVID has accelerated many digital transformations and I was wondering whether you thought it might have also accelerated the transition to digital currencies, digital fiat currencies by central banks. And Larry, with Bitcoin tending toward twenty thousand what are you thinking about it as an asset, investable asset class?

CARNEY: Okay, well, that gives us the headline, Larry's answer will give us the headline from this, I'd like to remind everybody of the importance of what we were talking about before he mentions the B- word and, and it dominates, because everything that went before that element is going to be far more determinative of our future.

But seriously, on the digital side, I do think, Tom, you're right in that one of the accelerants of COVID and the experience of the big shift towards a towards online with which we're all familiar, has been to reinforce the importance of further innovation. But the innovations that have happened, further innovations on the payment side, in the end, at the heart of that will be, in my judgment, ultimately a move towards a central bank digital currencies.

Monetary innovations that stick, that have value ultimately are appropriated in through the public sector. One of the things and you're familiar with it, but maybe not everybody is, is that in the...two months ago, let's say, certainly within that timeframe, the Bank of England, the ECB, the Bank of Japan, the Reichsbank, the Swiss National Bank, Bank of Canada, the Fed, all published a very important report on central bank digital currencies—it's one of the last things, I sort of commissioned with Christine Lagarde when I was leaving—it helps lay the groundwork for ultimately having a digital currency at the heart of our financial system and the types of innovation that will come from that will be quite substantial.

So I could have made this shorter and I should stop here and I'll hand to Larry, but the short answer is yes, it has accelerated digital currencies, but also broader payment innovations, which will, you know, make a material difference to the costs of transacting for small, medium sized businesses and ultimately consumers.

FINK: I would just start off and say digital currency is a mechanism to bring down costs quite considerably. And just like companies that do very well because they provide great convenience and price transparency, there's no question digital currency provides that convenience, that simplicity, there's a great need to create it. On the other hand, it needs to be organized, it needs to be governed, it needs to be a component of governmental policy worldwide.

And now related to Bitcoin, one of my important investors was on one of the television shows in the last few days, and he spoke about Bitcoin and to have, you know, one, monetary policy, two and three, COVID. The hits on BlackRock, on our website was three thousand on COVID, three thousand hits on a monetary policy, and six hundred thousand hits on Bitcoin. So what that tells you is Bitcoin has caught the attention in the imagination of many people. Many people are fascinated about it, many people are excited about it.

But it's still untested, it's still a pretty small market relative to other markets. It really, it can be, you know, we see these big giant movements every day, it's a thin market, and so can it evolve into a global market? Possibly, certainly by evidence of the imagined imagination of so many who want to learn about it or interested about it, to me is a very telling sign. Another good example, why understanding big data, like how many hits and all that really is a defining statement.

And so we look at it as something is real. But it's still untested, it still has many...we have to go through many markets to see if it's going to be permanently real or if it's going to be a variant of that sometime in the future. Lastly, because we're running out of time, I would just say, having a digital currency has real impact on the U.S. dollar, because having a digital currency makes the need for the U.S. dollar to be less relevant. So, and I'm not certain… and I'm not talking about for Americans, I'm talking about for international holders of dollar based assets.

The question I would raise and you know, maybe another time Mark and I could talk about it, does it change the need for dollar reserve as a reserve currency, if there was a true digital currency that was that was separated from dollar based assets and other things like that? So many questions need to be answered before I could say is it real and alive, but it certainly has created a lot of imagination, a lot of interest, and it certainly has the potential to evolve into something real. I'll leave it at that.

We ran out of time. I could see it's 12:00 p.m. right now. I want to thank you, Mark, it was fun. It's always nice to have a conversation with Governor Carney. I would also want to remind everybody that there's a second session of the virtual Freidheim Symposium, on the global economic policy after the Coronavirus. It will be tomorrow at the same time. So December 2 at 11:00 a.m. to 12:00 p.m. We urge everybody who's part of this to please listen in. So thank you very much.

CARNEY: Thank you. Thank you, everyone. Thank you, Larry.

END

[TT1]He actually says “…on the global economic”

Panelists will discuss pressing issues facing the global economy as a result of the coronavirus pandemic, including government debt, fiscal policy, and the role of central banks.

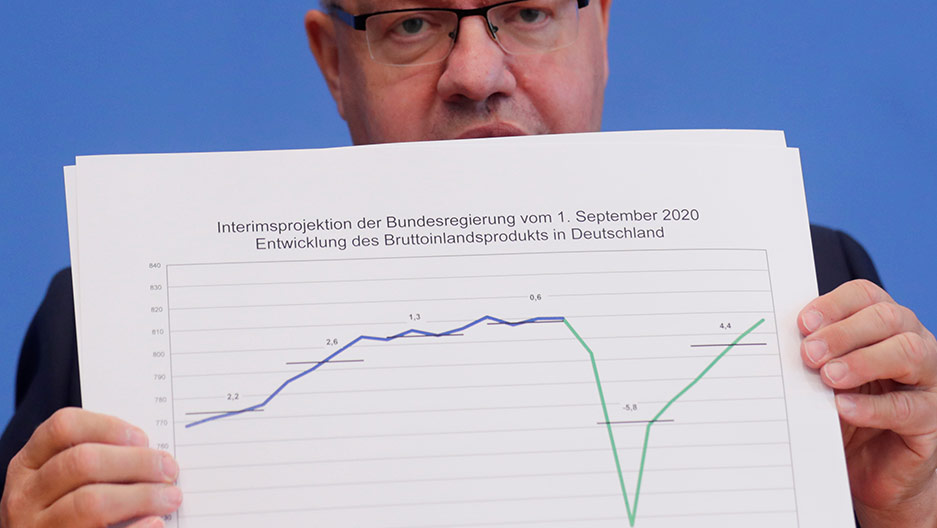

MALLABY: Thanks so much, and welcome everyone to today's CFR virtual Stephen C. Freidheim Symposium on Global Economics. I'm Sebastian Mallaby, the Paul A. Volcker senior fellow for international economics here at CFR, and I'll be presiding over today's discussion. This symposium is presented by the Maurice R. Greenberg Center for Geoeconomic Studies and is made possible through the generous support of Council board member Stephen C. Freidheim. This is actually the second session of this symposium. Some of you may have seen yesterday's session with Mark Carney, and today we're going to be addressing global economic policy after the coronavirus. Of course, COVID-19 has already elicited a big policy debate with unprecedented monetary and fiscal responses and forced choices between public health, public safety, and public liberty. Even in the revised, and a bit rosier assessment, published this week by the Organization for Economic Co-operation and Development (OECD), global output is expected to shrink by 4.4 percent this year, making this the worst recession since the 1930s.

The good news, of course, is the rollout of vaccines. And some of you may have heard at yesterday's session, Larry Fink talking about May as a reasonable target for when there might be a full deployment of a vaccine, at least in the rich world. But as our gaze turns to the future, the aftereffects of COVID will present governments with another round of equally tough policy questions—how to manage the public debt, how to respond to the possibly permanent shift to remote working, how to manage the fallout in terms of inequality, and so forth. And our thesis here today is that the responses around the world to these questions will be different. And so we've taken advantage of one of the upsides of remote working to assemble three speakers from different parts of the world with different geographic perspectives.

So from Asia, although she is familiar with Europe and the U.S., we have Keyu Jin, broadcasting live from Beijing, an associate professor at the London School of Economics. From Europe, although she's lived in the U.S. in the past and currently lives partly in Singapore, we have Beatrice Weder di Mauro, who is, among other things, the president at the Centre for Economic Policy Research, which is Europe's premier economic research network. And from the U.S., although, of course, he's a thoroughly global American, we have Vincent Reinhart, chief economist and chief macro strategist at Mellon Bank. So Bea, let's start with you. At the start of the pandemic, the focus of the debate was on the trade-off between saving lives and boosting output. In your view, what countries got it closer to right?

WEDER DI MAURO: You know, Sebastian, one of the amazing experiences of this amazing year, in many ways, has been the so many different ways of tackling the same problem. And let me start with my personal experience. I spent the first half of the year in Singapore and the second half in Switzerland. And already there, you could see very different responses. Whereas I mean, Singapore got the very first wave very well and controlled it, but then in the second wave, it really lost control and had to go for a very big lockdown. Europe, on the other hand, and Switzerland, in particular, actually handled the first wave rather well with unprecedented policy responses. So in a lot of European countries, Switzerland clearly being one, you would not have expected that governments come up with the amount of capital they needed to invest—social capital, political capital, and fiscal capital—to handle the first wave of the pandemic with severe lockdowns and full safety nets, really fully expanding the safety raft.

And then in the second half of the year, where I myself switched the continents, you have now Europe in a very different place. I mean, again, Switzerland is now in the second wave with one of the highest death rates. Europe definitely lost control at some stage. So it's the same country, but in the first wave doing well, and in the second wave not doing well. And on the other hand, you have Singapore, which has, after losing control in the second wave, now really gone all the way to suppression. And it is now in a situation like many other Asian countries, where inside the country it's almost COVID free, but with very high barriers to entry. Essentially, they really don't want to let anything get in—a very, very strong quarantine. So here are two countries that are not only handling it differently but even overtime handling it differently between the first and second waves.

And if I may, one more general remark now on this trade-off that you were mentioning. COVID economics—and you know the Centre for Economic Policy Research (CEPR) has done a lot of COVID economics—COVID economics started with the premise that there is a health/wealth trade-off. And one of the famous charts that came out of that was to say you have to flatten the epidemic curve, and then you steepen the recession curve. That was the illustration of the trade-off. I think what we're learning now is that this is not the right way to think about it. This may be why this trade-off may exist in the transition when you need to go from a high level of cases to a low level of cases, but really, the way to think about it is that you can have two equilibria. You can have a high equilibrium in which you have high cases, high costs on the medical side, and you also will tend to have high costs on the economic side because people just voluntarily lock themselves down to a very large extent, even if the government is not telling them to. And on the other hand, if you have a low level, if you can stabilize a low level, then again, you know, you don't have a trade-off. You have a good medical outcome, and you have a good economic outcome. It's going from high to low where you have the trade-offs. And that's also where a lot of the discussions take place. But I think the real model has to be one in which you have to be looking at two equilibria. Which one will you want to be in?

MALLABY: That's very well put, and it leads to the question I was going to put to Keyu about China. China is clearly the place which moved very aggressively from the bad equilibrium to the good one, and by means of a very tough lockdown, it pretty much eradicated the epidemiological problem, and thereby, stands out in the economic forecasts as the one major economy which is going to experience growth this year. So Keyu, perhaps you could talk a bit about that? What's it like to be in China through this period? And do you believe that it's a model? I mean, some people say, well, China can do that because it's an authoritarian society—could other countries also do that?

JIN: Well, thank you, Sebastian. Yes, I came back in mid-March and just fled Europe to be in China, so I've witnessed the recovery. I just want to make a point that what's special about China is that the epidemic was basically contained in Wuhan—most of the cases were really in Wuhan. It did go out a little bit here and there in China, and of course, to the rest of the world, but there was a severe lockdown that happened right afterward, and it was easier to control for the whole country because it was mainly staying in Wuhan and we basically killed the epidemic. I mean, just as an anecdote, I don't know of anybody, who knows of anybody, who has gotten COVID in China, but I have plenty of friends myself, outside of China, who has gotten COVID, so this is actually real. And regarding the elimination of the uncertainty, you know, compared to other countries, China had very strict border controls and very strictly enforced quarantine measures monitored under surveillance, and that eliminated all this uncertainty. So there were no repeated waves coming back and forth, and of course, that also helped with the resumption of work. So the contrast is very clear.

Now, I think there's a big spectrum if we just look at Asian countries in general. Now, of course, Asian country differs from East Asia to Southeast Asia to ASEAN, and even within this group, it shows that it could be done differently. Some of them, like Vietnam with more centralized leadership, had a severe lockdown, and then, on the other hand, you have Korea, Japan, and many countries in between that were able to do relatively successfully at different points in time, understanding that the number one common factor of success is experience. All these countries have had SARS and H1N1, so they had that organizational capacity and the public health infrastructure to react immediately. And, of course, they have very fast and transparent leadership to act swiftly. And there was a lot of transparent communication with the citizens, including the use of technology. So I think these are all commonalities within Asia, but they did take different approaches. And of course, you have, you know, in China the unprotesting crowd, which is shared in some of these countries, but in countries like Japan, it was less about forcing them to socially distance and wear a mask and more about educating them so that they can volunteer themselves. So these are very different approaches, but China certainly took the most radical one.

MALLABY: Great. So, Vincent, I want to briefly describe to you how I see Britain and ask you to contrast that with the U.S. because there are similarities, but also differences. So here, in Britain, where I've been since January, there is an emerging narrative, which sort of fits with what Bea was saying, that the mistake was not to lock down harder earlier, and therefore you don't get the good equilibrium of a controlled disease and therefore growth. So you get the worst of both worlds, which is that the UK has spent more money on fiscal stimulus than most other rich economies. And it's still going to suffer a much worse growth outcome than other rich economies, and it's also got a worse death per capita outcome, I think, for all countries, but Italy and Spain. And so it really is sort of the worst of all worlds. The U.S. also seems not to have locked down aggressively, of course; that's a state-by-state story, but nonetheless, the growth result has been better in the U.S. than in the UK. And I'm wondering whether you could talk a bit about that and tell us why you think the U.S. growth experience has been so much better than the UK even though the health side of the response looked a bit similar?

REINHART: So, the first point to make is this is all the first draft of history. They'll be writing papers in a hundred years describing the more appropriate models countries could have followed, and just think of how the public reputation of Sweden's path to deal with the pandemic has changed over the last nine months. The U.S. has a decided advantage over the UK—it's a lot bigger. And it is a state-by-state treatment, and therefore we have the advantage of learning locally and then spreading that nationally. We also have the advantage of having more intensive care units and a more disparate delivery of health care, whereas the UK has a single provider. I think, importantly, it's about social attitudes, and in the U.S., distance is an advantage, and it's easier to social distance. The UK is much more population dense, much more reliant on services that will require you getting out of the house. We've got the big-box stores, the big-box supermarkets where you can deal at a distance. It's just harder to do that in a place where you're used to leaving your flat every day to get on with the business of living.

What's interesting about this is I really haven't mentioned the government very much. That's easy in the U.S. because it really was state and local decisions, importantly. In the UK, you can easily fault the Johnson administration for stumbling at the gate and waiting at least ten days too long before starting lockdown. Having an uneven experience, governments can make it worse—the UK experience—but importantly, it's about the population. It's about where you live.

MALLABY: So, therefore, you don't think it's to do with the contrast that some people draw, which is the difference between the policy choice of going for enhanced unemployment benefits, which was the U.S. policy choice, which doesn't freeze people in a connection to a job which may never come back. Whereas the UK, instead of going for enhanced unemployment benefits, went for the furlough policy of maintaining the linkage between workers and companies. You don't think that was a significant differentiator?

REINHART: Well, I do think there are trade-offs there, too. The problem is that unemployment benefits allow you to sever the connection between the employee and the employed, but all too often, an unemployed person loses skills, loses connections in the job market, and drops out or winds up at a lower-wage occupation. And so, I think there are trade-offs. I think more than anything, though, is the service-centric nature of the UK economy. Basically, what happened is that this is the first time the world is wealthy enough to deal with the course of a pandemic, and we did it through mitigation efforts that keep people from the marketplace and from their place of work. If your place of work is intimately connected with you delivering that service, there's going to be a bigger loss.

MALLABY: Okay, so Bea, now that the vaccine rollout is set to begin, and perhaps we would debate, I say May for full deployment quoting Larry Fink from yesterday. You may have a view that it's going to take longer than that. But we agree that it's going to begin, and the debate is how long to extend fiscal support, what kind of support. Can you give us a sense of that debate in Europe and the variety of choices that might emerge?

WEDER DI MAURO: Yes, happy to do so, but if I may, just make a remark on one thing that you asked Keyu earlier. You asked if only governments that are more authoritarian can do the low equilibrium-good outcome. I think, you know, just look at the first wave. I mean, think back to July. In July, the virus was basically suppressed. The number of cases that we had was totally manageable. The problem is then we lost it again. So it's not like, you know, Europe is not able to do it. In fact, it demonstrated it was able to do it. So, that to me is proof that it's nothing to do with government systems, really. It's more, of course, political will and political capital that may now no longer be available to do it again.

But to your question about the support. Yes, I think it's absolutely crucial to start with the question, well, is this a few more months, or is it a few more years? And until relatively recently, we really didn't know an answer to that. If it was essentially totally uncertain how long it would be, then the discussion naturally would lean more towards the concern about the negative impact of too much support. So the discussion about zombie firms, the discussion about keeping people in workplaces that may no longer exist in the future, I can tell you the prime example that I'm hearing here all the time. It's a travel agency. The travel agency was going to go away anyway, and now do you want to support a travel agency? But there are not so many travel agencies left anyway, so it's not representative of the economy and not even of the most affected sectors.

The discussion, however, I see as being very differently answered in countries and let me take an example of Switzerland and Germany now in November. So Germany went for a rather, you know, strongish lockdown and a super generous support package to firms on top of the furlough system, which had already been extended a very long time. Switzerland also has the furlough—the furlough is basically the basis, and I think that's really the difference between Europe and Anglo-Saxon countries. The idea that you can keep your job and that you can go back to your job if it's still there is seen as absolutely essential, not only to support incomes but also for mental health, etcetera. It's part of the social safety net on the side of work. But on the side of capital, the discussion is a bit different. So in Switzerland, for instance, the discussion is very much about how we shouldn't be putting too much money into ventures that may no longer exist later on. Going back to your question, if we are talking about a few months, I think this is not the end of the world in either way. I would rather err on supporting a few too many firms rather than having unnecessary bankruptcies and closures. But this again hinges on the assumption that we are almost through, and I am afraid that there may be a bit too much optimism right now that, you know, by Q1, latest Q2, we are through this.

MALLABY: Okay. China, Keyu, is in a different place because it is in a good equilibrium of having controlled the epidemiology side. And as I understand it, but I'd love you to talk about this some more, the government, the economic policy framework is targeted partly at actually restraining bubbles, restraining real estate price takeoff, allowing some bonds to default even if they're issued by state-linked companies. So it feels as though policy in China has almost, sort of, moved beyond COVID towards the kind of macro stabilization agenda that existed before COVID. Is that right?

JIN: Yes, so I think different countries are in different parts of the cycle. Are you trying to resuscitate an economy, or are you trying to rebuild an economy? And China is currently trying to rebuild an economy. Before getting there, I just want to comment on this interesting observation, which is the different policy approaches to save the economy. So China has focused largely on bolstering the supply side rather than stimulating the demand side, which I think is the first big contrast with the Western economies. Part of the reason is it's not very clear that consumers will be willing to spend when given direct aid. So rather than focusing on households and do these employment benefits and direct payments, China really focused on supporting its corporates, especially small and mid-size companies. And because there are fewer direct channels leading to that, it was done mostly from commercial bank lending rather than fiscal policy.

But on fiscal policy, instead of aiding specific sectors and direct payment schemes, China has focused on infrastructure again. And this was kind of new infrastructure, not only on just public health but also lots of expenditures on digital technology and digital infrastructure. So China is already moving to the next phase of the growth, you know, growth of stimulus, rather than focused on just recovery.

You know, there was a debate in China if we should care more about redistribution of welfare, like a lot of economies in the West, or just focus on production and employment and thus social stability. I think it's difficult to say what works better. I think it depends on the national conditions, especially given that Chinese people have some savings in their household so that they're less in need of these direct payments, but also at what cycle of recovery you're in. And this supporting the production side really helped China's suppliers to resume work, and the supply chain started working again, so the economy's really kind of back in full steam. So that's kind of those differences in approach.

And you're absolutely right, Sebastian, a big lesson learned since 2009—four trillion RMB of fiscal stimulus, which turned to forty trillion yuan, financial liberalization, and of course, a lot of these resources went into the wrong places. Now, the government is very wary about having the repeated era from ten years ago. And, of course, the deleveraging process, maintaining financial stability was the policy priority three years ago, even before the pandemic. So they've now returned to restraining the asset markets, including the housing market, and, kind of, trying to curb these asset bubbles with these highly easy monetary environments, and that is, again, been its focus. But I think within reason, of course, they're willing to tolerate some corporate bond defaults, but financial stability is still very key. And in terms of the state banks, I think China's using this crisis as a springboard to do some of the more fundamental reforms. Now, we've seen in the past, including 2001, joining the WTO, using external pressure to push the solutions for some of these really intractable or very difficult problems in China and reforms. So pushing China towards a more market economy and reducing state-owned enterprise dependence on the government is part of the structural reform that's ongoing.

MALLABY: So Vincent, you know, there is something Keyu just said that gets to the heart of what I want to ask you, which is that once you feel as if the macro is stabilized, demand or output is no longer crashing, the next debate comes, you know, where do you prioritize whatever remaining fiscal effort you still have an appetite for. And yesterday, in the session of the symposium which we had, Mark Carney had this, sort of, catchy phrase. He said, "Policy is going to shift from COVID to capital." And, of course, what he meant by that was a shift from income support, because of COVID and people having this huge income hit, towards capital meaning green investment. But it seems to me, I mean, you know, Mark has a good public policy focus on the green agenda, and hats off to him, but there are competing agendas out there. Some people think we should learn the lesson from COVID that inequality has been further exposed even more than it was before because of the differential hit to different types of workers. Some people think that there's been this acceleration in technology deployment, and because of that tech acceleration, remote working, and so forth, we need to think about a structural shift that might be affecting cities and urban cores. So there's going to be a debate, it seems to me, about what's the priority. Is it actually the green infrastructure that Mark Carney talks about? Is it about inequality? Is it about other structural shifts that we should be addressing? How do you see that debate panning out in the next year or two?

REINHART: Yes, I thought yesterday's remark was an application of Rahm Emanuel's law, which is never let a crisis go to waste. That is, take the opportunity to act to put in all your ambitions for medium and longer-term that may not otherwise have had the chance to be applied. I think that the first thing to note is it's not over yet. Even the optimistic version of the OECD forecast has the world with output below its 2019 level for the next couple of years. That in the World Economic Outlook, the IMF's forecast, most of the G7 takes about three to five years to get back to the prior level of 2019. And there's permanent scarring, and with permanent scarring, there will be harm to balance sheets, and the longer it takes for us to go from rebound to actual recovery, the more scarring there will be. And so, I think, the first order of economic priorities will be dealing with the scarring. You're right; however, there will also be sectoral shifts as a consequence of all this. The cruise industry will not come back to where it was in 2019 for a very long time, and putting resources there doesn't sound like a good public investment. But you do have to help the workers who are just displaced accordingly. So I think, if anything, this is a suggestion for help at the retail level, at the individual level, at the personal and household level, because that's where resources shift.

I'm not confident that in the United States, Washington, D.C. can pick out the winners and losers and say we are transiting to a new economy and, therefore, let's make a capital investment in this place or that place. I'm more confident that a market economy can pick out the winners and losers if we enable the occupants of the market economy that flexibility. And the way you do it is deal with the debt burdens households have incurred, deal with the hole in the educational resume of a generation of kids right now, deal with those things, and let's not go at the industry level. And by the way, we're fighting a war; you generally don't worry about how to pay for the war, during the war. And so, yes, we are definitely going to have to deal with deficits and debt, but we're not going to do it this year or next.

MALLABY: I'm going to go to members for questions in just a moment. But I want to put the last question to Bea, which is really the same question that Keyu and Vincent have been addressing for Asia and the U.S. In Europe, Bea, how do you see this competition of priorities in terms of the next phase of fiscal impetus—green versus inequality versus structural shifts?

WEDER DI MAURO: Well, what is different about Europe and different also to Europe a year ago is that we actually have, in the early summer, reached an agreement between all European member states, and not just Euro area only, to put in place a European fiscal program, a real act of solidarity, of Central European-wide fiscal spending with European issuance of bonds. I mean, all of those things absolutely would have been unthinkable a year ago. So first of all, there was an expression of the fact that the possibility of solidarity exists, that it was able to overcome the north-south debate that had been there for more than ten years. And remember that this pandemic actually started by some fluke of history, or bad luck, again, in the south. So a north-south debate seems to be replayed there, initially, since Italy and Spain were among the most strongly hit, but very quickly, this time, you know, changed, and certainly during the second wave we see that this is no longer the case. But nevertheless, there is a European fiscal program now. There is a next-generation budget of substantial funding, which, as you probably know, is being blocked right now, but not along the traditional north-south, but rather on the east-west, and it's not even all of the east, but on the very different type of discussion about conditionality. But the point is that the idea is to get into this rebuilding phase relatively soon, and there I can echo some of what Keyu was saying. You need to rebuild. There is a need for public investment in public and private partnerships. And you may as well do it in the areas where the biggest needs are, for example, green investment and European-wide Commons is where the money should be flowing, and that's more or less the plan. Therefore, I would put it this way, Europe did a lot of things right last summer. Now it still has to be implemented.