Can Venezuela Resurrect Its Economy?

President Nicolas Maduro has neither the desire nor the capacity to institute the market reforms and debt restructuring needed to revive Venezuela’s sinking economy, says economist Ricardo Hausmann.

By experts and staff

- Published

By

- Sebastian PellejeroCFR Editorial Intern

- Ricardo HausmannProfessor, Harvard University

The misguided policies of President Nicolas Maduro and his predecessor, Hugo Chavez, along with falling oil prices, have destabilized Venezuela’s economy and triggered shortages of vital supplies, says Ricardo Hausmann, a professor at Harvard Kennedy School and a former minister of planning in Venezuela.

Hausmann argues that it will almost certainly take new leadership in Caracas to introduce the market reforms and debt restructuring he says are needed. “A recovery would require a greater availability of foreign exchange, so Venezuela must restructure its debt and ask for international financial assistance,” he says.

Venezuela is experiencing its worst-ever economic crisis. How did it get to this point?

The two causes of the Venezuelan disaster are a full-fledged assault on market mechanisms and a crazy macroeconomic policy.

The assault on market mechanisms by former President Hugo Chavez and his successor, Nicolas Maduro, has undermined society’s capacity to organize itself in order to produce and satisfy consumer needs. Imports are restricted and exchange rate operations are severely regulated. In addition, there is a draconian system of price controls with very heavy penalties for those who violate it. These price controls distort economic incentives and lead to shortages.

Furthermore, there has been a generalized insecurity of property rights: over 1,400 companies and nearly four million hectares of arable land have been expropriated.

Finally there has been a massive process of financial repression, with inflation upwards of 500 percent and a maximum annual interest rate on credit cards of 29 percent. All of that has created a destruction of the market mechanism.

All the policies the regime has announced would worsen the crisis.

The government simultaneously adopted a macroeconomic policy that sextupled the public external debt during its 2004–2013 oil boom; in 2012—when oil averaged $100 per barrel—the state ran a public sector deficit of 17.5 percent of GDP, which means that they were spending as if the price of oil was $200 per barrel. The debt build-up caused Venezuela to lose access to voluntary debt markets in 2013. This was followed in 2014 by declining oil revenues as the price of oil collapsed.

The Maduro regime responded to this situation by stopping payments on imports and then halting imports altogether. That collapse of imports—now down 75 percent relative to 2012—has contributed to a collapse in output and a shortage of supplies. That is what triggered this incredible humanitarian crisis.

How does President Maduro plan to manage shortages and currency instability?

I don’t think that the Maduro regime has a strategy. They have tried to remain current on foreign debt, prioritizing servicing its debt to Wall Street above other policy objectives. They have been trying to issue debt to pay their maturing obligations at fire-sale prices. The last known operation was to Goldman Sachs at an interest rate of 48 percent, demonstrating the government’s willingness to mortgage the future in order to allow the system to live an extra day. Rather than pursue anything significant on the economic policy front, it has focused on eliminating the political power of society by convening an unconstitutional constituent assembly.

Why has Maduro focused on debt repayment?

That is a mystery to most people. It would sound like the policies of a financial elite that prioritizes its own welfare over anybody else’s. In part it is because many well connected Venezuelans own part of the debt. They may also have the perception that if the government were to default or restructure its debt, it would lose legitimacy. In the meantime, people starve. It’s a puzzle; there is no easy explanation for such awkward behavior.

How would default or the restructuring of debt affect the regime?

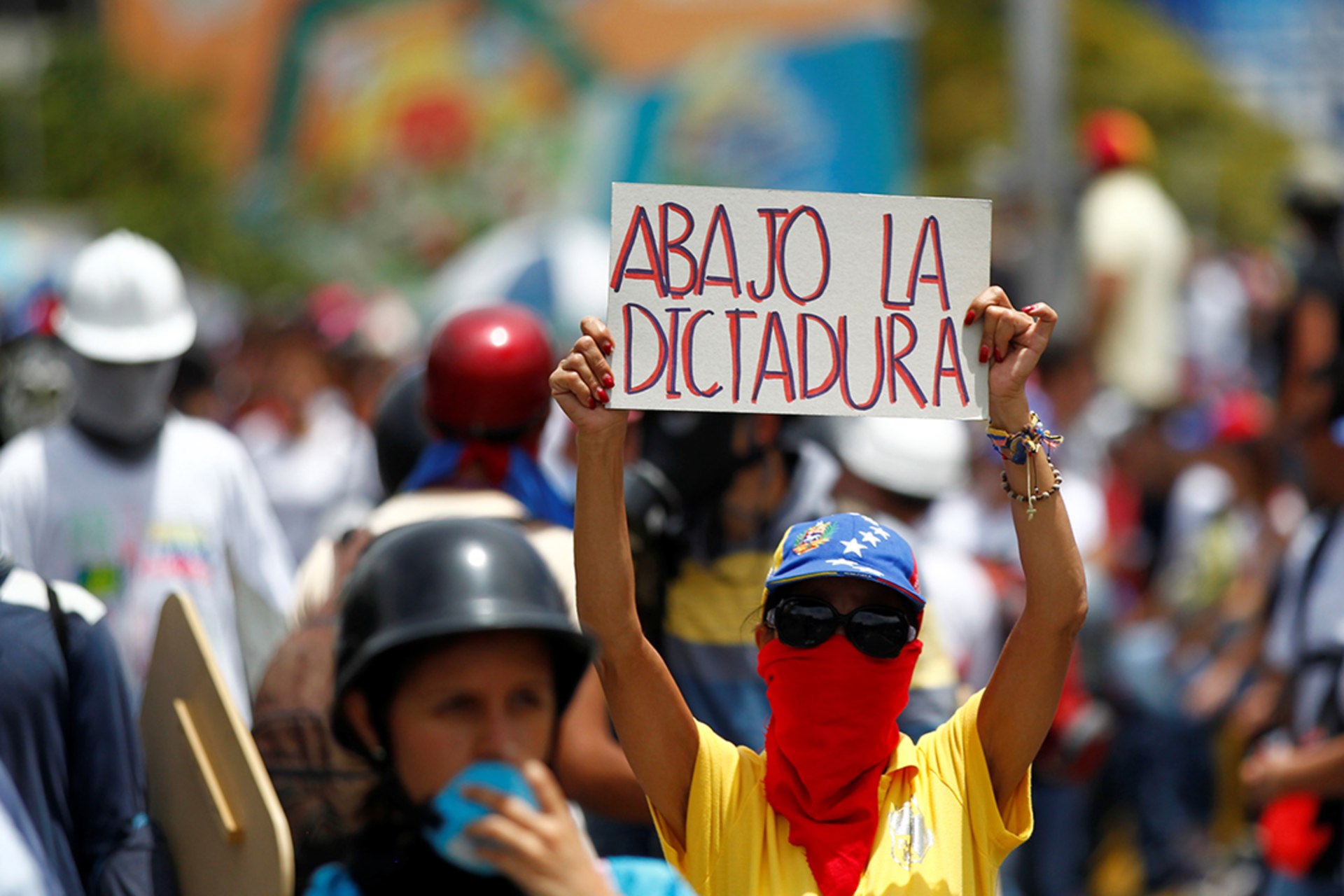

The stability of the regime is compromised by things beyond financial considerations, mainly the fact that it can only hold power by systematically violating the constitution. The constitution empowers the Venezuelan people through their democratically elected institutions. Maduro’s government realizes it can’t live with the elected National Assembly, nor call for elections because it would lose. Instead, it relies on pliant institutions—the armed forces and the Supreme Court—to preserve power. This led to a large majority of Venezuelans finding the situation unacceptable—Maduro’s approval rating has fallen below 20 percent. I would say that beyond anything that would happen on the financial front, it is the people’s outrage that threatens the stability of the regime.

Can the government resolve the crisis?

What people have focused on is changing the regime, rather than lobbying to change the policies of the current regime, because it’s clear that it has neither the ideological desire nor the administrative capacity to address the crisis.

The interesting questions are how the opposition can change the government, and what a new government would have to do.

All the policies the regime has announced would worsen the crisis, such as using the constituent assembly to nationalize the remaining private activities in the oil industry, the only part of the oil industry that is growing as Petroleos de Venezuela (PDVSA)—the state-owned oil and gas company—collapses at double-digit rates. Nothing it is planning to do will address the crisis, so the interesting questions are how the opposition can change the government, and what a new government would have to do to recover Venezuela’s living standards and economy.

What would a new leader have to do?

A recovery strategy would have to involve significant policy reform and the support of the international financial community.

Policy reform will need to reintroduce free market mechanisms so that society can self-organize and start producing again. This includes securing property rights, reunifying exchange rates, price liberalization, and changes in oil policy and other pro-market policies. Venezuela was ranked 187 out of 190 countries in the World Bank’s “Ease of Doing Business” index, beating out only Libya, Eritrea, and Somalia. So there’s a lot of work to be done.

A recovery would require a greater availability of foreign exchange, so Venezuela must restructure its debt and ask for international financial assistance—similar to the recent support for Greece. The current levels of debt are unaffordable: Venezuela holds the largest debt-to-export ratio in the world, along with the highest interest burden. Trying to recover the economy with that burden would be impossible, as this debt overhang would make Venezuela unattractive for new domestic or foreign investment. Venezuela does not have the productive capacity to recover and service this debt at the same time.

How has the Trump administration positioned itself toward Venezuela? What can the United States do to ameliorate the situation?

The United States has demonstrated concern about Venezuela and Maduro’s democratic violations, having said so explicitly at the recent Organization of American States (OAS) special assembly. What the United States would do in the context of a Venezuelan transition to democracy and a market economy is still an open question. I hope the United States will convene foreign actors in support of a strategy such as the one I have outlined, creating a consensus that Venezuela requires policy reform, international financial support, and debt restructuring.

How has the current crisis affected Venezuela’s relationships with other Latin American states?

A failed proposition put forth by five OAS member states condemning Maduro’s democratic charter violations received twenty votes, representing nearly 90 percent of the Latin American population and more than 95 percent of the region’s GDP. This charter places a legal responsibility on OAS member states to collectively defend democracies in the region. The Maduro government is thus almost entirely isolated, relying on the support of Bolivia, Ecuador, Nicaragua, the Dominican Republic, and some islands in the Caribbean.

Regional actors are worried that Venezuela’s humanitarian catastrophe is expressing itself across its borders via massive Venezuelan immigration—northern Brazil and Peru have been overwhelmed by the arrival of Venezuelan nationals, and Venezuela leads in asylum seekers in the United States.

Venezuela is also a public-health concern for the region. The collapse in health care has caused an increase in infectious diseases such as AIDS. Endemic diseases formerly eradicated in Venezuela, such as malaria and diphtheria, have also reappeared.

A collapsing Venezuela also poses a risk for countries in the region because it entails the loss of a relevant trading partner.

Venezuela has played an important role in the Caribbean. How would this change?

Venezuela has a hugely expensive subsidy scheme with Cuba, giving away some one hundred thousand barrels of oil a day. When Venezuela tries to stabilize itself, it will need to revisit that agreement. A country that needs international financial assistance and debt restructuring cannot simultaneously transfer to Cuba almost 10 percent of Cuba’s GDP—these things are incompatible.

Venezuela’s relationship with the rest of the PetroCaribe [oil alliance] needs to be reconceived, with oil producers in the hemisphere—the U.S., Canada, Colombia, Mexico, and Brazil—assuring the energy needs of the Caribbean islands. The Caribbean islands today have incomes per capita that are several times larger than Venezuela’s. Venezuela cannot be solely responsible for assuring their energy needs.

This interview has been edited and condensed.