Global Monetary Policy Divergence and the Reemergence of Global Imbalances

Overview

To minimize the risk of greater global imbalances, U.S. policymakers should rethink U.S. fiscal policy and focus on the transatlantic imbalances, not the bilateral trade deficit with China.

BY

- Daniel GrosDirector, Centre for European Policy Studies, European Associate Editor, International Finance; Director, Centre for European Policy Studies, Deputy Director, Centre for European Policy Studies

This Global Governance Working Paper is a new feature of the Council of Councils (CoC), an initiative of the Council on Foreign Relations. Targeting critical global problems where new, creative thinking is needed, the working papers identify principles, rules, or institutional arrangements that can improve international cooperation in addressing long-standing or emerging global problems. The views and recommendations are the opinion of the authors only. They do not necessarily represent a consensus of the CoC members, and they are not the positions of the supporting institutions. The Council on Foreign Relations takes no institutional positions on policy issues and has no affiliation with the U.S. government.

The Challenge

Developed economies are paying remarkably little attention to coordinating their monetary policies. This is an unavoidable consequence of the independence of central banks, which faithfully follow their purely domestic mandates except in times of crisis. As a result, global monetary policies have reached unprecedented levels of divergence. This divergence is set to widen—primarily due to differences in the relative strength of labor markets—while global current account imbalances return. Meanwhile, exchange rates have not reacted as economists expected; the dollar has weakened even as policy rates have increased. Economic tensions will likely become more disruptive the longer global imbalances go uncorrected. Likewise, the global economy will become more vulnerable to shocks. Yet by focusing on bilateral trade imbalances, the United States has mistakenly singled out China when the global imbalances between the United States and the eurozone is the more critical issue. The growing global imbalances are reflected more in the eurozone current account surplus and U.S. fiscal policy than in China’s shrinking surplus.

Monetary Policy Divergence

Economic tensions will become more disruptive the longer global imbalances go uncorrected.

Nations with developed economies increasingly believe that the dangers of the Great Recession and deflation are behind them. This sense of reflation is not based on hard data, however, because core inflation in developed economies has returned to the same level as three or four years ago. For the eurozone, the core harmonized index of consumer prices (the measure of inflation used by the European Central Bank [ECB]) is running at around 1 percent, while inflation in the United States (the core personal consumption expenditures) is increasing at around 1.5–2 percent per annum—the difference in the indexes due mainly to their different treatment of owner-occupied housing. But developed economies have either reached full employment (e.g., the United States and Japan) or are nearing it (e.g., the eurozone), raising economists’ expectations that inflation will pick up. Central banks are therefore exiting or preparing to exit from their unconventional policies such as quantitative easing and negative interest rates. In this regard, at least, monetary policies appear to be converging.

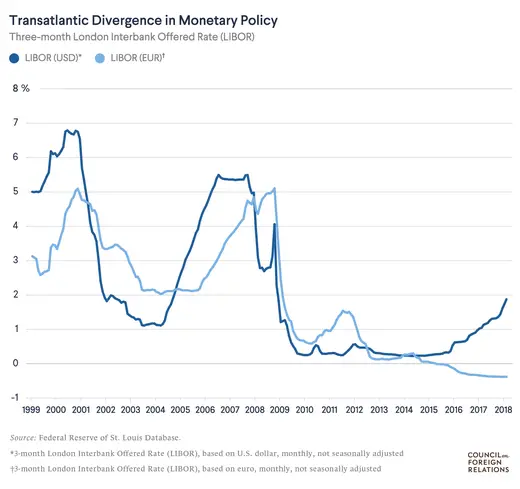

But in reality, the policies are diverging. The economic recovery proceeded at such an uneven pace that the world’s major central banks are now experiencing different phases of the cycle. Central banks in developed economies kept interest rates close to the zero bound for years after the Great Recession. The U.S. Federal Reserve was the first to depart from unconventional policies and return policy rates back to pre-recession levels, in 2017. The policy rates stand now at 1.75 percent in the United States, compared to slightly negative numbers in the eurozone and Japan. The resulting difference in short-term interest rates across the Atlantic has now increased to over 2 full percentage points. The difference is likely to grow as the Federal Reserve keeps increasing rates, whereas the ECB is unlikely to move from its floor for another year (see below). The Bank of Japan is also far from increasing its rates. Moreover, the Federal Reserve is about to reduce its balance sheet, whereas those of the ECB and the Bank of Japan keep expanding, albeit at a somewhat slower pace than before. On the two-year rates, which incorporate expectations of short-term policy moves, the transatlantic difference is close to 3 percent.

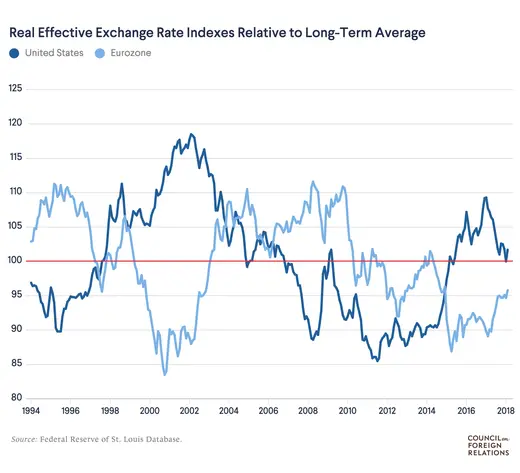

Normally, such a stark divergence in monetary policy would produce similarly divergent exchange rates, with a stronger dollar weakening U.S. exports. However, this has not happened. On the contrary, the dollar has somewhat weakened over the last year. Both the dollar and the euro are close to their longer-term averages in real terms (see below).

Fiscal Policy Divergence

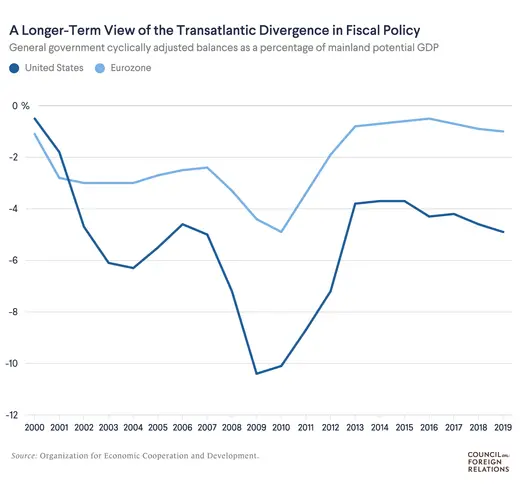

The discrepancies in nations’ fiscal policies might explain how the transatlantic current account imbalances—the measure of trade in goods, services, and some income flows—have widened without any strong exchange rate movement. The U.S. federal government is now projected to run structural deficits between 5 and 6 percent of gross domestic product (GDP) after its recent corporate tax reform. Most of the demand created by these deficits would result in additional imports given that the U.S. economy is running at full capacity. The eurozone, by contrast, is officially on a path to structural balance, with a deficit currently at 1 percent of GDP but with some remaining slack in the economy, suggesting deficit spending does not necessarily result in higher imports.

At a glance, this difference in deficits seems to explain the widening transatlantic divergence in current and trade accounts. However, a closer look at the numbers reveals a more complex picture and shows the practical difficulties of coordinating fiscal policy on a global level.

The chart below shows a widely accepted measure of fiscal policy: the deficit adjusted for the economic cycle (a boom tends to increase revenues, thus improving the deficit even without any action by the government). Discussions within the United States usually emphasize the federal deficit, but international financial institutions tend to focus on the general government deficit, which includes not only the federal government but also local and regional governments as well as social security. This measure (using Organization for Economic Cooperation and Development data) shows that the transatlantic gap already widened fifteen years ago, with the eurozone deficit consistently lower than the U.S. deficit by about 3 percentage points of GDP. Over the last few years, the difference has increased to 4 percentage points of GDP and will likely increase with the U.S. tax reform.

The long-term data thus suggests that the U.S. public sector has a structural problem in bringing its finances under control. This could also explain the long-standing U.S. trade deficits, the root cause of which are not weak exports but strong imports driven by strong domestic demand; imports, in turn, are encouraged by fiscal policy.

The United States should not focus on monetary policy, where the transatlantic divergence has had a limited effect on exchange rates. The usual pattern of monetary policy tightening is not accompanied by the expected real currency appreciation. Moreover, China has ceased to keep its currency down with foreign exchange interventions. It is not surprising that the term “currency manipulator” has largely disappeared from the debate. Limiting global divergence will require the global coordination of fiscal policies. However, fiscal policy is difficult to measure and is no longer considered a macroeconomic tool on both sides of the Atlantic. In the eurozone, the aim is to get debt levels down. In the United States, federal debt continues to increase as bipartisan agreement seems to be possible only on a combination of lower taxes and higher spending.

Recommendations

To minimize the risk of greater global imbalances, U.S. policymakers should rethink U.S. fiscal policy and pay more attention to the transatlantic imbalance—particularly the excess current account imbalance—than to the bilateral trade deficit with China.

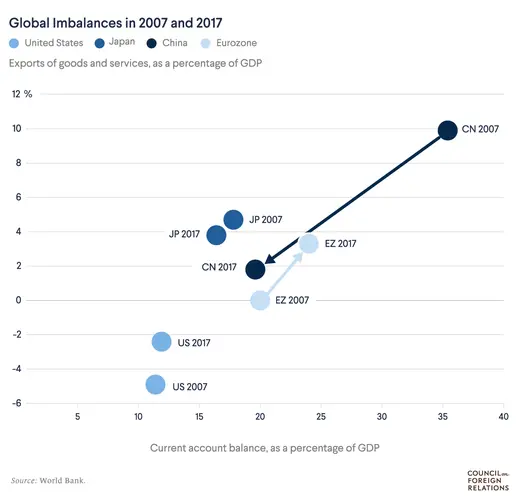

Recognize the importance of current account imbalances over bilateral trade imbalances. In order to reduce global imbalances, the United States should avoid the misleading indicators of bilateral trade balances and look to current account imbalances. The Donald J. Trump administration should focus not on China, given that its current account surplus is about the same as Japan’s, but on the eurozone, which has a much higher current account surplus in current U.S. dollar terms than do China or Japan (see table below). The recent weakness of the euro caused by the renewal of tensions in Italian financial markets risks reinforcing this trend. Unfortunately, while the current account imbalances clearly point to the eurozone, the bilateral trade imbalances between the United States and Europe and the United States and China are of opposite proportions: the bilateral U.S. trade deficit with China is three times larger than that with Europe. Moreover, there are large discrepancies in the data for bilateral trade balances between different sources. Bilateral balances can thus be misleading for several reasons.

Economists tend to focus on the current account, which includes capital income in addition to goods and services. On this measure, China is no longer a central problem for the United States, as its 2017 current account surplus is now smaller than Japan’s (and in the first quarter of 2018, China ran a current account deficit). Global imbalances have become primarily a U.S.-Europe issue, as the U.S. deficit is mirrored in the eurozone surplus.

Stop targeting Chinese trade balances. Trade with China should no longer be the top concern for U.S. policymakers. China has clearly rebalanced away from export-led growth, whereas the eurozone has gone in the opposite direction. European exports have compensated for the weak domestic demand and the current account has moved into surplus. The chart below shows the current account balance and exports as a percentage of GDP for the United States, China, Japan, and the eurozone. China has experienced the largest change, which should be seen as satisfying U.S. demands: the current account surplus shrank from 10 percent to less than 2 percent of GDP, and exports’ share of the economy also shrank by half.

U.S. policymakers should not focus on trade balances, especially not the balance of the trade in goods alone, although the latter seems to be the metric preferred by Trump. For example, in terms of trade in goods (see table above), the U.S. deficit is slightly more than $750 billion (4 percent of U.S. GDP) and both China and the eurozone have large surpluses worth more than 4 percent of their respective GDPs. But even from this perspective, the United States should not focus on China. Trade in services (see table above) shows the relative strength of the United States in this sector. The United States has a surplus of nearly $250 billion, while China is running a deficit on services (mainly tourism) of the same magnitude.

Reduce the federal deficit. Coordination of fiscal policies is critical to limit global imbalances. One of the reasons why the Chinese current account surplus has come down so much is that China’s fiscal policy has driven a surge in domestic infrastructure investment. The eurozone would also benefit from infrastructure investment, but that would have to increase by 40 to 50 percent from the current level of 2.5 percent of GDP to have a noticeable effect on the economy. The European Commission has supported investment with the European Fund for Strategic Investments, a 300-billion-euro initiative, but that has had little effect beyond providing a small subsidy to already existing investment plans.

In particular, U.S. policymakers should follow recommendations from the International Monetary Fund (IMF) to reduce the federal deficit so that it helps reduce public debt. Importantly, the IMF warns that high public debt makes countries vulnerable to a sudden tightening of global financing conditions, which could undermine any response to a future financial shock.

Conclusion

Monetary policy is notoriously difficult to coordinate outside times of crisis. At present, global monetary and fiscal policies are diverging. The United States has large deficits and the Federal Reserve is pursuing a standard tightening cycle, whereas the eurozone and Japan are still pursuing massive asset purchases and negative interest rates. Ordinarily, such divergences would strengthen the dollar. But this has not happened, at least until recently. Even without a strong dollar, global imbalances have widened again, such that the eurozone now has the largest current account surplus.

Given the apparent disconnect between monetary policy and exchange rates, better coordination of monetary policies would achieve little. But U.S. policymakers could help alleviate global imbalances by getting fiscal policy under control and focusing their attention on the transatlantic current account imbalances instead of on the U.S. bilateral trade deficit in goods with China.

This paper has benefited from numerous comments and suggestions from Council of Councils members, in particular Brad Setser and Terrence Mullan.t