- Iran

- Israel-Hamas

-

Topics

FeaturedInternational efforts, such as the Paris Agreement, aim to reduce greenhouse gas emissions. But experts say countries aren’t doing enough to limit dangerous global warming.

-

Regions

FeaturedIntroduction Throughout its decades of independence, Myanmar has struggled with military rule, civil war, poor governance, and widespread poverty. A military coup in February 2021 dashed hopes for…

Backgrounder by Lindsay Maizland January 31, 2022

-

Explainers

FeaturedDuring the 2020 presidential campaign, Joe Biden promised that his administration would make a “historic effort” to reduce long-running racial inequities in health. Tobacco use—the leading cause of p…

Interactive by Olivia Angelino, Thomas J. Bollyky, Elle Ruggiero and Isabella Turilli February 1, 2023 Global Health Program

-

Research & Analysis

Featured

Terrorism and Counterterrorism

Violence around U.S. elections in 2024 could not only destabilize American democracy but also embolden autocrats across the world. Jacob Ware recommends that political leaders take steps to shore up civic trust and remove the opportunity for violence ahead of the 2024 election season.Contingency Planning Memorandum by Jacob Ware April 17, 2024 Center for Preventive Action

-

Communities

Featured

Webinar with Carolyn Kissane and Irina A. Faskianos April 12, 2023

-

Events

FeaturedJohn Kerry discusses his work as U.S. special presidential envoy for climate, the challenges the United States faces, and the Biden administration’s priorities as it continues to address climate chan…

Virtual Event with John F. Kerry and Michael Froman March 1, 2024

- Related Sites

- More

June 3, 2005

EconomicsRoach and Gross could not stay among the most bullish on bonds for very long. From Marc Gilbert’s column today.Gabe Borenstein, managing director of global investments at Investec Holdings Ltd. in N…

December 4, 2005

Financial MarketsThe yen's trajectory at the end of 2005 seems a bit like the dollar's trajectory at the end of 2004. With the yen at 120, companies like Toyota presumably have little incentive to ramp up their US …

August 16, 2007

Financial MarketsThere clearly has been a flight to liquidity recently. T-bill yields have collapsed (See the Econocator). Perhaps because of the Fed. Perhaps because folks are hoarding cash and nothing that pays…

May 7, 2010

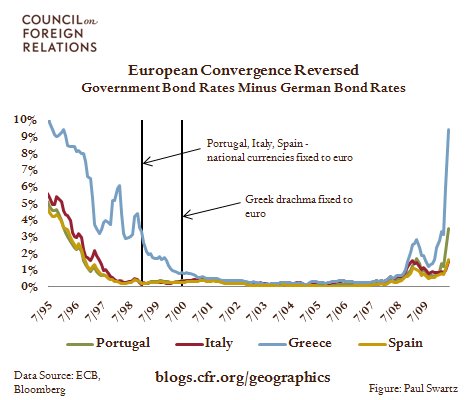

Europe and EurasiaBefore the creation of the euro, European governments borrowed at very different rates. In July 1995, Portugal, Italy, Greece, and Spain all had to pay at least 4% more than Germany on their borrow…

May 13, 2010

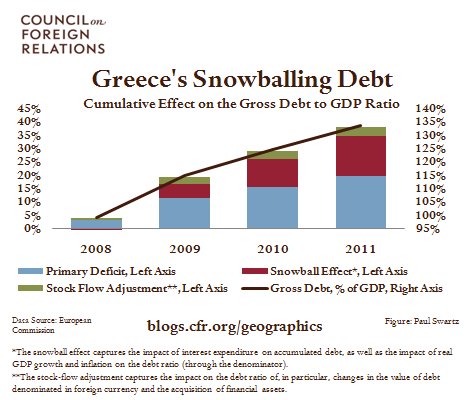

Europe and EurasiaGreece’s 2009 budget deficit was 13.6% of GDP. The primary deficit – the balance before interest – was 8.5% of GDP. The main difference between the total deficit and the primary deficit is the ‘s…

Online Store

Online Store