- Iran

- Israel-Hamas

-

Topics

FeaturedIntroduction Over the last several decades, governments have collectively pledged to slow global warming. But despite intensified diplomacy, the world is already facing the consequences of climate…

-

Regions

FeaturedIntroduction Throughout its decades of independence, Myanmar has struggled with military rule, civil war, poor governance, and widespread poverty. A military coup in February 2021 dashed hopes for…

Backgrounder by Lindsay Maizland January 31, 2022

-

Explainers

FeaturedDuring the 2020 presidential campaign, Joe Biden promised that his administration would make a “historic effort” to reduce long-running racial inequities in health. Tobacco use—the leading cause of p…

Interactive by Olivia Angelino, Thomas J. Bollyky, Elle Ruggiero and Isabella Turilli February 1, 2023 Global Health Program

-

Research & Analysis

Featured

Terrorism and Counterterrorism

Violence around U.S. elections in 2024 could not only destabilize American democracy but also embolden autocrats across the world. Jacob Ware recommends that political leaders take steps to shore up civic trust and remove the opportunity for violence ahead of the 2024 election season.Contingency Planning Memorandum by Jacob Ware April 17, 2024 Center for Preventive Action

-

Communities

Featured

Webinar with Carolyn Kissane and Irina A. Faskianos April 12, 2023 Academic and Higher Education Webinars

-

Events

FeaturedJohn Kerry discusses his work as U.S. special presidential envoy for climate, the challenges the United States faces, and the Biden administration’s priorities as it continues to address climate chan…

Virtual Event with John F. Kerry and Michael Froman March 1, 2024

- Related Sites

- More

October 9, 2019

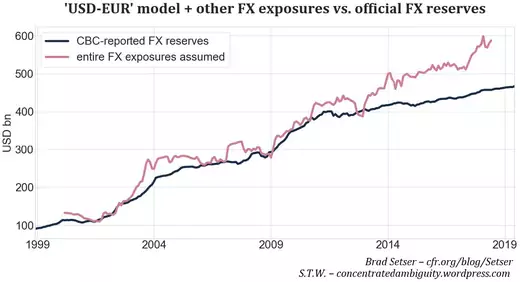

TaiwanBased on the profits and losses disclosed by Taiwan’s central bank, it appears that its true FX exposures exceed its disclosed foreign exchange reserves by USD 130bn, and perhaps by as much as USD 20…

June 4, 2013

Two weeks ago, President Barack Obama gave a wide-ranging speech on U.S. counterterrorism policies. The result has been significant confusion regarding targeted killings, because what was reported in…

May 7, 2012

Defense and SecurityStreaks are made to be broken. After seventeen years on the outside looking in, a Socialist Party candidate has finally returned to the French presidency. François Hollande defeated Nicolas Sarkozy b…

December 4, 2013

IsraelIsraeli columnist Ari Shavit just came out with a new book, My Promised Land, that is receiving tremendous media attention in the United States. I joined Ari and David Remnick, editor of The New York…

January 13, 2006

United StatesStephen "Current accounts almost always don't matter" Jen is intrigued by Ricardo Hausmann and Fredrico Struzenegger's discovery of dark matter. Lots of others are too. Michael Mandel for one. Se…

Online Store

Online Store