Apple’s Exports Aren’t Missing: They Are in Ireland

Goods made in China flow through Ireland before returning to China, and the many other ways tax influences the balance of payments.

Yuqing Xing notes that Apple sells a lot of iPhones in China, at a high mark-up.*

And he also notes, correctly, that Apple’s sales in China don’t really register in the U.S. trade data.

Especially as relatively few of the high value-added components (even the components designed by U.S. companies) are now made in the United States. U.S. semiconductor firms are increasingly fabless, and Corning now makes most of its Gorilla glass in Asia.

So where are Apple’s “missing” exports?

Easy. In the income line of the balance of payments. Probably in Ireland. They account for a big part of the so-called trapped corporate profits offshore waiting around for a tax holiday and that—going forward—are hoping for to a shift to a pure territorial system.

Apple—and Apple here is just the most prominent example of many tech and pharma companies—could structure its affairs so a higher share of its global sales showed up in the U.S. trade data. For example, its California headquarters could charge a royalty to its Chinese sales subsidiary. The royalty would enter into the trade data as a U.S. export of services, and a Chinese import of services. But then Apple would pay U.S. corporate income tax on its global iPhones sales, and, given the opportunities it now has to minimize its global tax bill, it would rather not do so.

We actually know—because of the reporting of the New York Times and the work done by Senator Carl Levin and his staff back when Levin was the Chairman of the Permanent Subcommittee on Investigations—a fair amount about how Apple’s sales in China enter into the global balance of payments.

OK, to be precise, how Apple’s sales used to enter into the balance of payments, as Apple’s tax structure has likely evolved in the past few years.

This is what I have gleaned from these sources over the years.

Apple contracts with Foxconn (Honhai) for a lot of its manufacturing.

In Apple’s case, a lot of the high-end components are manufactured elsewhere in Asia (see this diagram) though in some cases on the basis of U.S. designs, and thus a substantial share of the iPhone’s manufactured valued-added really accrues to Taiwan, Korea, and similar countries.**

But there is no doubt that Honhai does the bulk of its final assembly in China.

However, it does so, technically, in a bonded zone, which is legally offshore.

That matters.

According to the New York Times, the iPhones that Foxconn physically assembles in China are technically sold to Apple’s Irish subsidiary before they legally enter China. That allows Apple Ireland to markup the iPhone’s price before it clears Chinese customs (effectively reducing Apple’s Chinese tax burden). Apple then has to pay value-added tax and any duty China charges at the border.

Why has China agreed to allow phones made physically in China to be exported (in theory) to Ireland before the they are reimported (in theory) to China? Presumably because if China didn’t allow the iPhones to be made in a bonded zone (e.g. offshore), Apple would have a strong tax incentive to do final assembly for the phones that it wants to sell to China outside of China. Assembly costs, I suspect, matter much less than the location of the taxable profit.

The obvious question, then, is how does Apple Ireland (in its various permutations—Apple Operations International, Apple Sales International, and the like)*** acquire the legal rights to sell Apple’s products in China?

And we know a bit about that chain as well, thanks to the Levin Subcommittee hearing.

Apple Sales International historically has gotten the legal rights for Apple’s sales outside of the Americas in return for paying a share—roughly 60 percent—of Apple’s global R&D budget.

That payment, part of a fairly standard cost-sharing agreement, enters into the U.S. balance of payments as a services export.

Back in 2012, Apple’s Irish subsidiaries paid about about $2 billion (see page 29 of the Levin committee report) to Apple as a result of the cost-sharing agreement. Apple’s R&D budget has subsequently increased to about $10 billion, so Apple’s cost sharing agreement would likely require Apple Ireland to pay about $6 billion.

Voila, a rough estimate of the size of the exports (of services) that Apple generates for the United States.

Of course, that sum is small relative to the profit stream on Apple’s global sales, given Apple’s (undoubted) large markup over production costs.

But the resulting profit legally sits with Apple’s Irish global sales subsidiary thanks to the cost-sharing agreement. And Apple’s Irish subsidiary, in turn, was viewed, at least until recently, as American by the Irish tax authorities and as Irish by the American tax authorities and thus it was taxed by neither.

Apple isn’t in Ireland primarily for Ireland’s 12.5 percent corporate tax rate. The goal of many U.S. multinational firms’ tax planning is globally untaxed profits, or something close to it. And Apple, it turns out, doesn’t pay that much tax in Ireland.

In 2016, Apple’s pre-tax earnings were just over $60 billion. Apple’s Irish subsidiaries—or their successors—likely got 60 percent or more of that, so, based on past patterns, Apple likely generated over $35 billion dollars of tax-deferred offshore profit.****

Now technically, these offshore profits are simply tax-deferred—the U.S. retains the right to tax them when they are repatriated back to the United States. Apple just holds on to them in the hope that a tax holiday will eventually pass, and they can be repatriated at a low tax rate.

The combination of $6 billion in estimated exports of services and $35 billion plus in tax-deferred offshore profits, in turn, I think, basically accounts for Apple’s missing exports. It’s all already there, just not in the goods trade data.

Apple’s pre-Levin tax structure was actually unusually simple, as everything flowed through various Irish-but-not-Irish-for Irish tax purposes subsidiaries. Most companies have a more complex structure, with Irish subsidiaries, a Dutch subsidiary and a subsidiary in Bermuda (or someplace similar) that owns their most valuable intellectual property.

For example, the Financial Times has reported that back in 2013 Google swept its Irish sales company’s profits into its Dutch subsidiary, and then swept the profits of its Dutch subsidiary to Bermuda—so it in practice wasn’t paying much tax either in Ireland or the Netherlands. The sums involved have only increased since then.

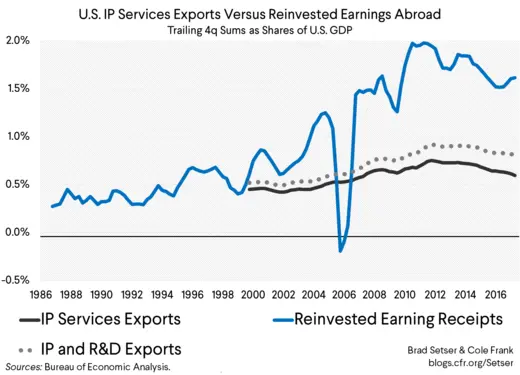

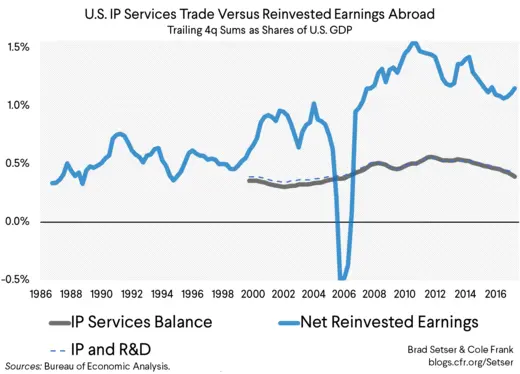

The balance of payments impact of these tax strategies actually isn’t all that hard to find. Relative to U.S. GDP, the surplus on trade in intellectual property (even counting exports of research and development services) has been pretty constant over time. What has really grown by contrast is tax-deferred (e.g. reinvested) offshore profits of U.S. firms.

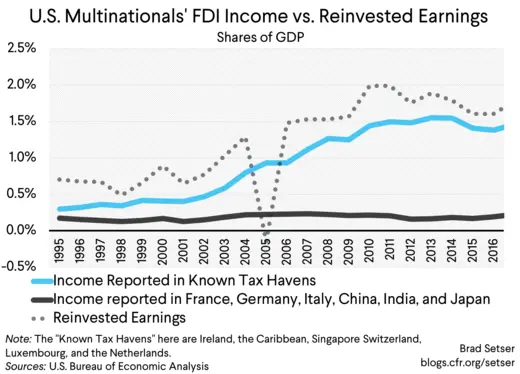

And, broadly speaking, we know the location of these reinvested earnings, as the growth in reinvested earnings over the past 20 or so years correlates with the rise in profits reported in well-known tax centers.

The profits that U.S. firms report in what one would assume are their biggest markets—China, India, Germany, and the like—are remarkably small.

Apple’s missing exports are of course just one example of how tax distorts trade. There are many others: look, for example, at the sources of the U.S. trade deficit in pharmaceuticals.*****

Of course I think this is relevant for the current debate on the incidence of corporate taxation. The size of the profits that U.S. firms report in tax centers gives one indication that a lot of these profits are, in economic terms, rents, and thus any cuts in the tax rate will accrue to the owners of the underlying intellectual property.

And it isn’t yet clear—no doubt on purpose—precisely how the House Republicans’ tax plan will tackle currently untaxed offshore profits. What is clear is that the sums involved are significant: ending the deferral on offshore profits is one of the largest potential base broadeners around (see this and this and this).

* The mark-up is such that, in all probability, Apple could assemble its phones in the U.S. and make substantial use of U.S. components and still turn a profit, though doing so would require substantial upfront investment and a complete reorganization of a host of production chains. See these estimates from MIT’s Technology Review.

** Everyone seems to love the iPhone value-added argument: corporate China says, see, we don’t make any profits, we need to move up the value-chain; corporate Americans often say, look China only assembles the phone, the U.S. still gets all the profit. In a lot of ways, though, the iPhone is no longer representative of the bulk of China’s trade: the aggregate data shows a growing Chinese share of high-end component production, not just Chinese dominance of final assembly.

*** I am not a tax lawyer, but my read of the Senate investigative committee report is that the multiple subsidiaries are needed to get around subpart F of the U.S. tax code (e.g. convert what is economically passive income into something that is considered active income for tax purposes).

**** Apple reports it paid a bit over $8.5 billion in US tax, about $2 billion in foreign tax, and set aside $5 billion against the tax it expects to pay when its offshore profits are repatriated. Apple’s provisioning for its future tax liability on its foreign profits makes it a bit different from some of its peers—Google, for example, didn’t set aside anything. Facebook doesn’t seem to have either.

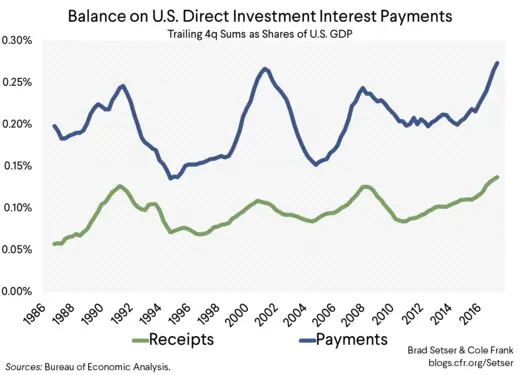

***** Many of the witnesses at the most recent Senate hearing on international tax issues noted, correctly, that foreign firms operating in the U.S. use a range of tax strategies to reduce their reported U.S. profits. This too shows up in the balance of payments—the reported profits of foreign firms operating in the U.S. are low, and a lot of their income is shipped out of the U.S. (for tax purposes) through intercompany loans. While the U.S. runs a massive surplus on “reinvested” earnings, it runs a deficit on intercompany interest payments—though in absolute terms, the tax revenue the U.S. loses on the globally untaxed offshore profits of U.S. firms likely exceeds the tax revenue lost by foreign firms moving profits out of the United States.