Oil Price Volatility: Causes, Effects, and Policy Implications

Insights From a CFR Workshop

BY

- Greenberg Center for Geoeconomic Studies

Overview

Sharp, rapid swings in the price of oil can have outsize effects on companies, economies, and global geopolitics. Oil price spikes can stunt economic growth, for example, and a sudden price plunge can wreak havoc on cash-strapped oil companies. For countries, an oil price roller coaster can blow a hole in government budgets, prompt wholesale economic reform, or alter geopolitical priorities seemingly overnight.

At a workshop in New York, the Maurice R. Greenberg Center for Geoeconomic Studies convened nearly forty current and former government officials, economists, oil-market analysts, political scientists, and investors to explore what drives oil price volatility, what effects it has on both the economy and geopolitics, and what policy options are available to reduce price volatility. The report, which you can download here, summarizes the discussion’s highlights. The report reflects the views of workshop participants alone; CFR takes no position on policy issues.

Framing Questions for the Workshop

Is the United States the New Swing Supplier?

Is Saudi Arabia permanently out of the business of stabilizing world oil markets? If not, under what conditions might we expect it to act, and what might its limits be? How responsive can we expect the United States’ tight oil production to be to imbalances in world markets? Over what sorts of timescales and at what magnitudes can we expect U.S. production to respond? Is the response potential of U.S. supply asymmetric to rises and declines in prices? What effect should this be expected to have on oil price volatility? What, if anything, can we infer from the last eighteen months of oil production and price behavior? What can we learn from the evolution of the post-shale U.S. natural gas market?

How Much Does Speculation Matter?

Some argue that financial speculation plays a role larger than supply and demand fundamentals in driving oil price volatility. What do we know about the influence of derivatives trading on oil price volatility? Past research has often cited a lack of inventory buildups as evidence that financial activity was not having a large impact on oil prices. Should the sustained buildup of inventories over the last eighteen months cause us to revisit any of those conclusions? Has financial reform changed the impact of financial activity on oil price volatility? If so, is the impact permanent or will it evolve further as nonbank entities take on roles once performed by banks? Could we see permanent changes in physical inventory levels? What impact would that have on oil price volatility?

The Economic Consequences of Oil Price Volatility

What are the economic effects of prolonged price volatility (e.g., prices bouncing back and forth between $50 and $100 for several years) on the United States and China? How would such a period influence macroeconomic indicators (e.g., investment, consumption, employment); energy investment (oil, alternatives, and efficiency); government budgets; and monetary policy and dependence of economic outcomes on monetary policy choices?

The Geopolitical Consequences of Oil Price Volatility

To what extent are Chinese policies aimed at hedging against volatile (rather than simply high) oil prices? Potential policies of interest include foreign direct investment in oil, strengthening relationships with oil producers, buildup of strategic reserves, domestic price controls, and efforts to reduce domestic oil use. What spillovers, if any, do these steps have for geopolitics? How might changes in oil price volatility affect Chinese behavior in these areas? Separately, to what extent is U.S. military posture in the Middle East and elsewhere driven by concerns about oil price volatility? How might an increase in oil price volatility affect demands on the U.S. military? How might a reduction in oil price volatility affect demands on the U.S. military? How does price volatility affect the stability of countries whose fiscal health is tied to oil prices (e.g., Saudi Arabia, Russia, or Nigeria, which have high fuel subsidies and/or are major oil exporters)? Can short, volatility-driven periods of low or high prices provoke interstate conflict?

Increasing Supply and Demand as a Response to Oil Price Volatility

Policy analysis that focuses on demand for oil or supply of oil alternatives typically underscores the impact of either on prices. But policy could also, in principle, alter volatility directly by increasing the responsiveness of oil supply and demand. How might demand-side government policies—those that promote electric vehicles, plug-in hybrids, and public transportation—affect elasticity of oil demand? How might government support for oil alternatives, such as biofuels and natural-gas vehicles, affect elasticity of oil demand or of fuel supply? How might government subsidies to oil production, such as intangible drilling costs expensing, percentage depletion, and the manufacturing tax credit, affect elasticity of oil supply?

Using the SPR as a Response to Oil Price Volatility

What are the technical potential and limits to the Strategic Petroleum Reserve (SPR) in reducing volatility? What are the costs and benefits of using the SPR to reduce volatility in response to discrete supply disruptions or in response to more general volatility? Has U.S. vulnerability to volatility changed in a way that points to a larger or smaller SPR? Should U.S. policy on SPR be reoriented to combat oil price volatility beyond supply disruptions? How would other countries fit into such a strategy if it was pursued?t

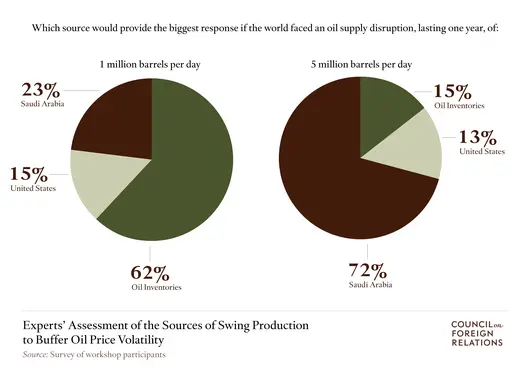

Chart From This Report