More on:

As Dr. Krugman notes, the Fed’s flow of funds data leaves little doubt that -- at least during the first quarter -- the rise in public borrowing was fully offset by a fall in private borrowing. An updated version of the chart I posted last week comparing government and private borrowing can be found on the website of the Council’s Center for Geoeconomic Studies.

Total US borrowing by the non-financial sector (annualized) was under $1.4 trillion in the first quarter -- down from $1.9 trillion in calendar 2008 and $2.5 trillion in calendar 2007. In the first quarter, Americans borrowed less, at an annualized rate than they did in 2003.

The federal government borrowed over $1.4 trillion - -and if throw in state and local governments, total public borrowing topped $1.55 trillion. That isn’t a small sum. But households were borrowing (they actually paid down their outstanding debt in the first quarter). And modest borrowing by corporations was offset by a fall in borrowing by noncorporate business. Firms and households combined to reduce their borrowing by a bit less than $200 billion ($184.1 billion). To put that in perspective, households and firms borrowed over $2 trillion in 2006. That is an epic fall.

Borrowing less in aggregate translated into borrowing less from the rest of the world. If the flow of funds is right, the current account deficit in the first quarter in the first quarter was under $300 billion dollars ($293 billion according to table F107). $300 billion is closer to 2% of US GDP than 3% of US GDP. The result, obviously, is less need to borrow from the rest of the world -- or to sell equity to foreign investors -- to finance the United States import bill.

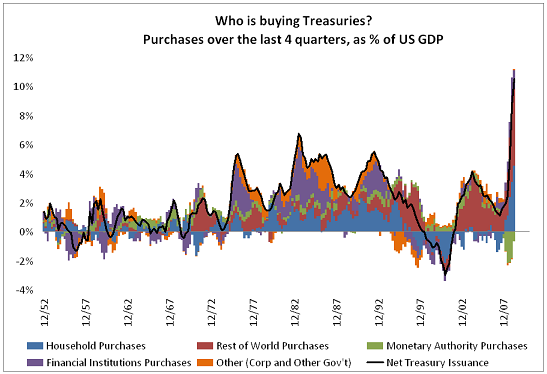

Who bought all the Treasuries the US government has issued in the last four quarters of data (q2 2008 to q1 2009)? Foreign demand for Treasuries -- as we have discussed extensively -- hasn’t disappeared, unlike foreign demand for other kinds of US debt. But foreign demand hasn’t increased at the same pace as the Treasury’s need to place debt. The gap was filled largely by a rise in demand for Treasuries from US households.

Before the crisis, foreign purchases formerly accounted for almost all new Treasury issuance. Over the last 12 months, foreign demand accounted for more like half of total issuance even as foreigners bought a record sum of Treasuries. And from what we know about the second quarter, I don’t think the basic story has changed.

Central bank custodial holdings continue to rise -- just look at the last week’s custodial data. But the world’s central banks are no longer buying up all the debt the Treasury issuing. And Americans are now saving, creating a new pool of funds that needs to be lent out. Moreover, the financial sector isn’t borrowing -- it actually is scaling back -- which means that the household sector is lending less to financial firms, freeing up funds to flow into the Treasury market.*

Obviously, the price that pulls US investors into Treasuries matters greatly. But the basic sources of demand for the huge amount of Treasuries the US is now issuing aren’t really a mystery.

Paul Swartz of the Council did most of the heavy lifting it took to produce the previous graph. To simplify it, we aggregated Treasuries held by mutual funds with Treasuries held directly by households. At the end of 2008. mutual funds were the main buyers of Treasuries. In q1 2009, though, households themselves were the main buyers of Treasuries (see table F100).

And do also check out Paul’s updated charts tracking the evolution of the current US economic cycle -- and how it compares with an average post-war economic cycles as well as the worst (and least bad, if that makes sense) post war slowdowns. They tell an interesting story.

* Total net borrowing (see table F1) fell even more rapidly than borrowing by the non-financial sector, as financial sector borrowing turned deeply negative in the first quarter of 2009. Looking just at "domestic non-financial sector borrowing" in no way understates the fall in total US borrowing.

More on: