Corporate Taxes in a Globalized World

Published

Updated

A group of more than one hundred countries has agreed to a historic rewrite of global tax rules. Here’s what to know.

- Experts and politicians say the current global corporate tax rules are not suited for the modern economy and allow multinational companies to avoid paying taxes.

- Some countries have unilaterally imposed new digital taxes, setting off tensions with the United States.

- In October 2021, a group of more than 130 countries reached an agreement on a new model for corporate taxation.

Introduction

A major effort to overhaul the global system of corporate taxation is underway. Many experts and policymakers contend that the current rules are inadequate for an increasingly digital economy, and that they allow multinational companies to shift profits to avoid paying taxes, thereby starving governments of revenue needed for public investments. At issue is both the amount of tax corporations pay, and which countries have the right to tax them.

Some countries have unilaterally imposed new digital service taxes, which Washington has pushed back on, arguing such measures unfairly target U.S. tech firms. Meanwhile, the Joe Biden administration has been pushing for a new global minimum corporate tax in an effort to end the “race to the bottom” of tax-cutting. In October 2021, a group of more than 130 countries reached a compromise on a new model for corporate taxation that includes a 15 percent minimum tax, as well as rules that will redistribute some tax revenue from big multinationals, including U.S. tech giants. The deal marks a historic shift in corporate taxation, but domestic political hurdles remain. At the same time, some critics say the proposed measures don’t go far enough.

How does the current system work?

International taxation is governed by thousands of bilateral tax treaties between countries that began proliferating in the 1920s under the auspices of the League of Nations, the predecessor of the United Nations. Although there is some multilateral cooperation on tax issues, there is no global body with the authority to tax companies, a power that governments generally view as a fundamental sovereign right. Both the UN and the Organization for Economic Cooperation and Development (OECD), a group of mostly advanced economies, provide model tax treaties that are used as the basis for many of the bilateral deals. World Trade Organization (WTO) rules can apply in cases where taxes are found to be subsidizing exports or discriminating against imported goods.

There are two predominant approaches to corporate taxation, known as “worldwide” and “territorial.” Most wealthy countries use a territorial system, under which only corporate profits earned domestically are subject to taxation, with some exceptions. Under a worldwide system, all of a corporation’s profits—domestic and foreign—are subject to tax, though firms are generally credited for taxes already paid to other governments to prevent double taxation. Current treaties generally give taxing rights to a country only if a company has a physical presence there, such as offices or factories, as it is traditionally associated with generating economic value.

The U.S. system, though largely territorial, has elements of both. (Until 2017, it was formally a worldwide system.) Most U.S. companies, many of them small businesses, are known as pass-through entities and are taxed differently than large corporations, which generate the bulk of U.S. business income.

What issues has this created?

The way corporations are taxed matters for two primary reasons, economists say. First, corporate taxes alter incentives and can distort domestic economic behavior in ways that are harmful to growth, such as by discouraging corporate investment. Second, different tax regimes around the world influence the allocation of international investment. The confluence of these two forces has significant implications for countries’ economic competitiveness, as well as their ability to collect taxes to fund government priorities.

Many experts and policymakers argue that current tax rules incentivize profit shifting, in which multinational companies report profits in low-tax countries, such as Bermuda and Ireland, through a variety of legal means, such as by moving their intellectual property (IP) to such countries and then licensing it to other subsidiaries. For tax purposes, the subsidiaries of multinational companies are treated as independent entities that buy and sell goods and services from each other. These intragroup dealings, known as transfer pricing, are supposed to be carried out as if between companies with no relationship to each other, a rule known as the arm’s length principle. However, multinational companies can use transfer pricing [PDF] to report higher costs in high-tax countries, thus reducing their profits and, ultimately, their tax bill.

Economists at the University of California, Berkeley, and the University of Copenhagen have estimated that as much as 40 percent of multinational corporate profits are relocated to so-called tax havens every year, reducing global corporate tax revenues by $200 billion. In addition, corporate tax cuts in one country can incentivize others to follow suit so as not to become less competitive, resulting in what U.S. Treasury Secretary Janet Yellen and other policymakers have decried as a “race to the bottom.” Indeed, corporate tax rates have fallen sharply around the world in recent decades. According to the Tax Foundation, a Washington-based think tank, the average corporate tax rate fell from 46.5 percent in 1980 to 25.9 percent in 2020, a 44 percent reduction.

In the United States, corporate taxation as a percentage of gross domestic product (GDP) has steadily declined since the end of World War II and is one of the lowest rates among those of OECD countries. Some economists argue that lower corporate tax rates encourage investment and business growth; others say they contribute to economic inequality by reducing public spending on education and health care, for example.

The rise of tech companies, particularly giants such as Amazon, Facebook, and Google, has also called into question the model of awarding taxing rights based on physical presence. Tech companies often earn billions of dollars in advertising and other revenue in countries where they have users but no brick-and-mortar operations, and they don’t pay taxes in those countries under the current rules. To counter this, several European countries, as well as India and Turkey, have implemented new “digital services taxes” (DSTs); many other countries and the European Union are considering them. In turn, the United States has threatened to impose tariffs on those countries, arguing that DSTs violate long-standing tax principles and unfairly target U.S. tech companies.

How has the United States tried to address these issues?

Before the 2017 Tax Cuts and Jobs Act (TCJA), the largest U.S. tax reform since the 1980s, the United States’ tax system was an outlier among those of rich countries. At 35 percent, the U.S. federal corporate tax rate was among the highest for OECD members’ rates. (Due to a vast array of tax breaks, many U.S. corporations paid a much lower effective tax rate.)

Under the previous system, U.S. corporations’ foreign profits were subject to tax, but only when the money was repatriated (or brought back to the United States). Many experts said that this incentivized companies to park trillions of dollars in profits overseas to avoid paying U.S. taxes. Others argued that the relatively high U.S. corporate tax rate placed American companies at a competitive disadvantage.

The TCJA attempted to address these issues. The corporate tax rate was lowered to 21 percent, and the United States shifted to a largely territorial system, though some foreign profits are taxed in an effort to reduce profit shifting. The law also offers a deduction for firms that license their IP abroad, a measure aimed at incentivizing companies to keep their know-how in the United States.

The effects of the TCJA are still being studied. Economist Kimberly Clausing, the deputy assistant secretary for tax analysis in the U.S. Treasury Department, has estimated that the provisions on taxing foreign profits could increase the U.S. corporate tax base by up to $30 billion. At the same time, some preliminary research [PDF] indicates that the TCJA has not reduced the amount of U.S. multinational profits booked in tax havens. Former CFR Fellow Brad W. Setser and other experts have written that the TCJA could actually be incentivizing further offshoring of U.S. pharmaceutical production and other manufacturing due to provisions that can lower tax rates as physical assets such as factories and equipment are moved overseas.

President Joe Biden has proposed [PDF] raising the U.S. corporate tax rate from 21 percent to 28 percent to finance trillions of dollars in spending on infrastructure and other major public investments. His plan calls for raising taxes on foreign profits, beefing up the Internal Revenue Service (IRS), and enacting other measures to increase revenue and reduce offshoring. The administration is also pushing for a global corporate minimum tax to further reduce the incentives for profit shifting. “The United States has now changed its fundamental philosophy towards controlling the race rather than trying to win it,” former Treasury Secretary Lawrence H. Summers said at a CFR virtual meeting in April 2021.

What is the rest of the world doing?

In 2013, the OECD and the Group of Twenty (G20) launched a project to minimize corporate tax avoidance, or base erosion and profit shifting (BEPS). That initiative grew into the OECD/G20 Inclusive Framework on BEPS, which now includes 140 countries and jurisdictions.

A primary aim of the BEPS framework is to address taxation in a digital economy, with talks split into two “pillars.” Pillar One is focused on redistributing some tax revenue to countries where big companies sell goods and services without a physical presence, while Pillar Two centers on the establishment of a global corporate minimum tax. In October 2021, nearly all members signed on to a deal that includes a 15 percent minimum tax for companies with more than 750 million euros (roughly $870 million) in annual revenue. The move came after countries reached a framework agreement in July. Estonia, Hungary, and Ireland joined the deal in October after initially resisting due to concerns that higher corporate taxes would cost them foreign investment and jobs.

When the OECD talks began, many countries expressed concern that digital companies could make a lot of money in their markets without having a physical operation, says Bob Stack, a managing director at Deloitte who represented the United States at the OECD during the Barack Obama administration. But the United States worried that its dominant tech firms would be the only ones footing the bill under the proposed tax rules, he says. After years of negotiations, the countries agreed that the new Pillar One rules would apply to about one hundred of the world’s biggest companies by revenue, including U.S. tech giants.

Under the new rules, countries where these companies earn money without a physical presence would have the right to collect some taxes; the OECD estimates this will shift taxing rights for about $125 billion in profits each year. In exchange, the expectation is that countries that have imposed DSTs will eliminate them. The EU announced that it will delay its digital tax while the global agreement is finalized. French officials have said that Paris will drop its tax once the new rules are implemented. U.S. tech giants welcomed the deal, saying it would bring stability by replacing the patchwork of DSTs with a single regime.

With the minimum tax, if a subsidiary of a German company in Bermuda, for example, is paying no or little tax, the German government will be able to collect the difference up to 15 percent. “There would be less incentive to try to put income in low-tax jurisdictions,” Stack says. “The difference will get taxed somewhere.” The OECD estimates that the minimum tax will increase global corporate tax revenues by $150 billion. For the Biden administration, Stack argues, the global tax deal is central to the push to raise the U.S. corporate tax rate. Such an increase will be more palatable politically if other countries adopt the new minimum tax.

What happens next?

Even though a new tax agreement has been reached, much work remains: each country has to change its domestic tax laws to comply with the deal, and the OECD is aiming to fully implement it by 2023. In the United States, top Republicans who oppose both foreign DSTs and higher U.S. taxes have signaled their opposition to the plan, contending that it will disproportionately harm U.S. companies. Yellen has said that the minimum tax can be implemented via a legislative procedure known as reconciliation, which requires only a simple-majority vote in the Democratic-controlled Senate. Meanwhile, some Republicans say that the agreement should be considered a treaty, which requires a two-thirds majority in the Senate.

It is a victory for those who seek multilateral solutions. But you have to acknowledge that there’s a long road ahead.

Bob Stack, Managing Director, Deloitte

There are criticisms of the deal. Some experts point out that wealthier countries, where most big multinationals are headquartered, stand to benefit more from the minimum tax, since they will likely receive more of the additional tax revenue. Ronald E. Creamer Jr., head of the tax group for law firm Sullivan & Cromwell, said at a June 2021 CFR meeting: “This is not a Robin Hood kind of proposal. And in fact, it’s sort of a rich-get-richer proposal.” Other experts warn that the proposed minimum tax is too low to discourage profit shifting from developing countries, which tend to have higher tax rates. Some countries could lose more revenue by giving up DSTs than they would gain from the new Pillar One taxing rights. Four countries—Kenya, Nigeria, Pakistan, and Sri Lanka—refused to sign on to the deal.

The deal includes a so-called substance carve-out, which would exempt companies that have employees and physical assets in low-tax countries from paying the full minimum tax, and another carve-out that would exempt financial services, oil and gas, and mining companies from the rules regarding physical presence. Some experts warn that the substance carve-out in particular could incentivize different patterns of profit shifting, potentially resulting in a “tax haven reshuffle.” “It is a victory for those who seek multilateral solutions,” Stack says of the deal. “But you have to acknowledge that there’s a long road ahead.”

Recommended Resources

The Wall Street Journal breaks down the major elements of the global corporate tax deal.

The Brookings Institution’s and the Urban Institute’s Tax Policy Center explains how a U.S. multinational firm pays taxes on foreign earnings in this briefing book.

Economist Kimberly Clausing, deputy assistant secretary for tax analysis in the U.S. Treasury Department, examines profit shifting before and after the 2017 Tax Cuts and Jobs Act.

Economist Gabriel Zucman of the University of California, Berkeley, calls for a 25 percent U.S. corporate minimum tax in this New York Times op-ed.t

Colophon

Staff Writers

- Anshu Siripurapu

Additional Reporting

James McBride and Jonathan Masters contributed to this Backgrounder. Will Merrow helped create the graphics.

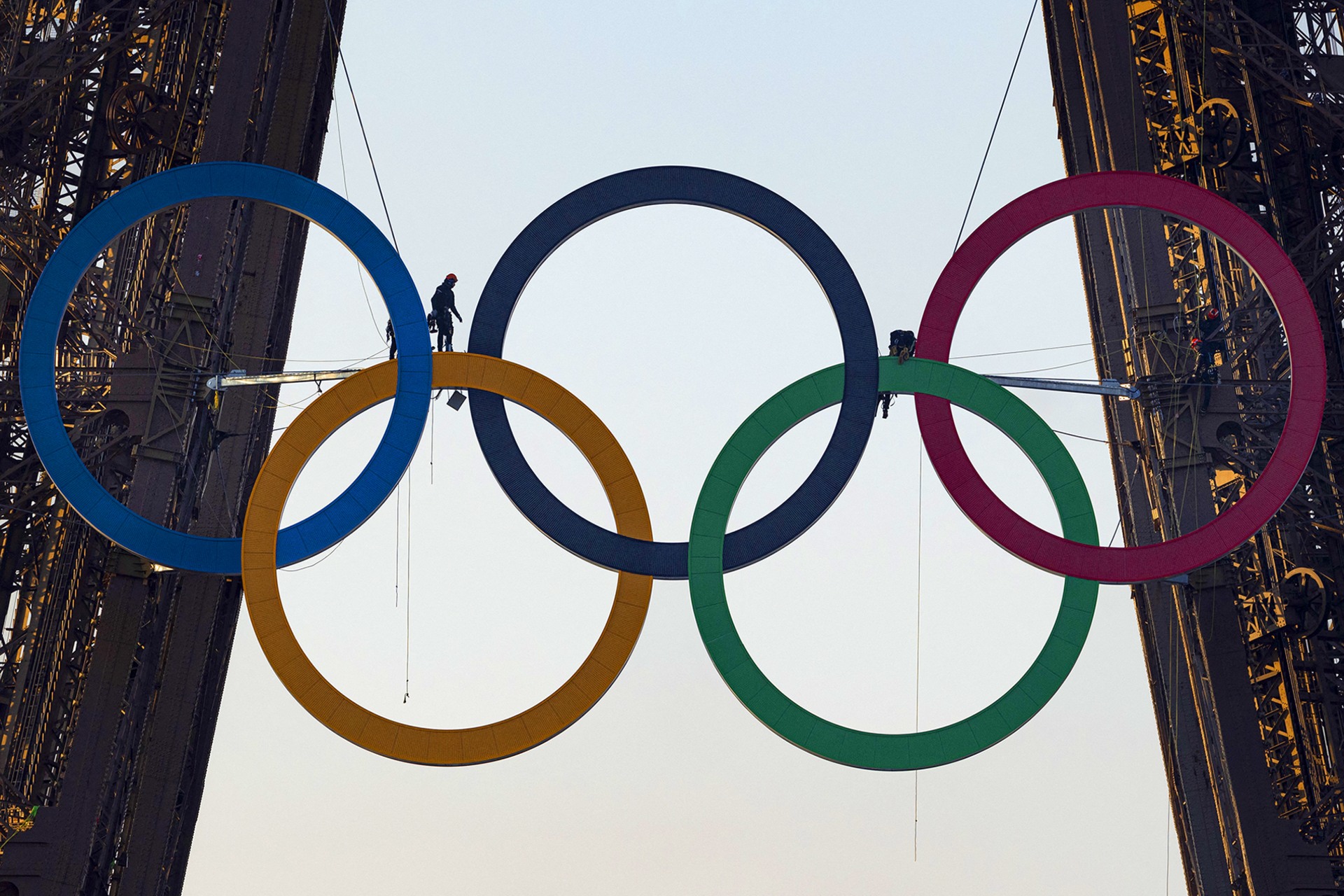

Header image by Henry Nicholls/Reuters.